Bulls Celebrated

Jerome Powell gave a nod to the market and bulls celebrated as they held rates steady but suggested three cuts in 2024. Bond yields plunged as did the dollar on the FOMC decision spiking commodity prices, real estate, and utilities. As parabolic as the indexes appear the celebration could continue today with an ECB rate decision pending. We will also look for bullish or bearish inspiration in the Jobless Claims, Retail Sales, and a handful of notable earnings including the very parabolic Costco at record highs. Plan carefully with indexes so extended in the short term a profit-taking wave could begin at any time.

Asian markets traded mostly higher with only the Shanghai and Nikkei exchanges seeing modest declines. European market trade is decidedly bullish across the board this morning as they wait on ECV and Bank of England rate decisions. U.S. Futures want to keep the party going this morning pointing to another gap up open ahead of earnings and economic reports.

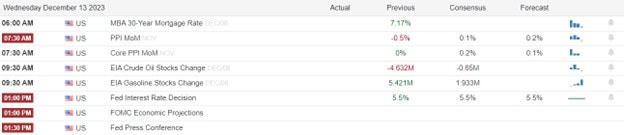

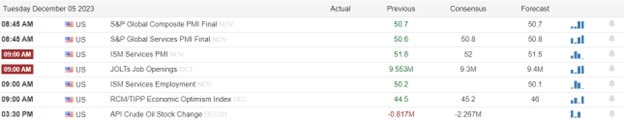

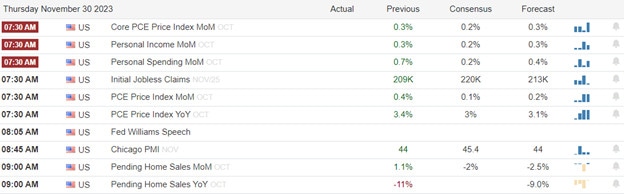

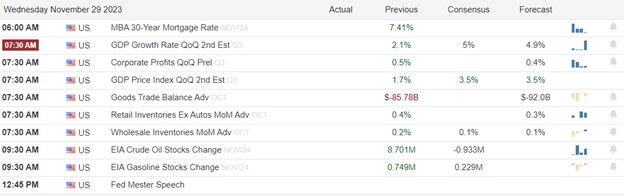

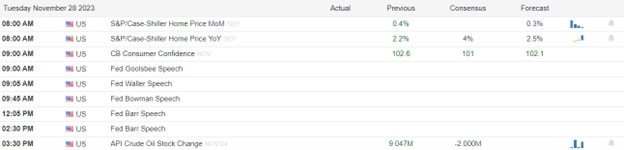

Economic Calendar

Earnings Calendar

Notable reports for Thursday COST, JBL, & LEN.

News & Technicals’

The Federal Reserve (Fed) decided to keep its key interest rate unchanged on Wednesday, for the third time in a row and signaled that it will lower its rate in 2024 and beyond. The Fed said that the inflation rate has moderated and the economy has remained stable, and therefore it was appropriate to maintain the benchmark overnight borrowing rate in a range of 5.25%-5.5%. The Fed also projected that it will cut its rate at least three times in 2024, by 0.25% each time. This is less than what the market expects, which is four rate cuts, but more than what the Fed had previously suggested. The Fed’s outlook reflects its balance between supporting the economic recovery and controlling the inflationary pressures.

Treasury yields dropped to their lowest levels in months on Thursday, as investors reacted to the Federal Reserve’s guidance on the future of interest rates. The Fed said on Wednesday that it will keep its interest rate unchanged for now, but signaled that it will start cutting its rate in 2024 and beyond. The Fed’s outlook reflected its balance between supporting the economic recovery and controlling the inflationary pressures. The market responded by lowering the yields on the 10-year and the 2-year Treasury bonds, which are influenced by the Fed’s policy. The 10-year yield fell below 4% for the first time since August, while the 2-year yield declined by more than 14 basis points. The yields had already fallen sharply on Wednesday, after the Fed’s announcement. The lower yields indicate that investors are expecting lower interest rates and slower economic growth in the future.

Adobe’s quarterly earnings for the fourth fiscal quarter beat the market’s forecasts, but its outlook for fiscal 2024 fell short of the projections. The software company said that it is waiting for a verdict from the U.S. Department of Justice on its proposed purchase of Figma, a design platform.

Jerome Powell spoke and the bulls celebrated moving stocks sharply higher into parabolic new record highs. The Fed decided to keep policy rates unchanged while lowering its forecasts for inflation and policy rates in 2024. Bond yields moved sharply lower as did the dollar which spiked precious metals and other commodities. The Russell 2000 Index outshined on the day, gaining over 3%, however, continues to lag way behind the other indexes despite the nearly 14% increase in a month. The sectors that performed well were the utilities and real estate sectors, which are sensitive to interest rates, both increasing by over 3%. Today the ECB will make its rate decision along with Jobless Claims, Retail Sales, Import/Export Prices, Business Inventories, and Natural Gas reports supplying bullish or bearish inspiration. There is also a handful of notable earnings to keep traders guessing. Although the celebration is likely to continue in the short term keep in mind a substantial market pullback should be expected in the near future so plan carefully.

Trade Wisely,

Doug