Stock Options – Your Options Trading Success Starts Here!

Trading stock options may be a little scary at first due to their level of complexity. However, options trading  provides many benefits well worth the additional learning curve they may require. Most people think the power of options comes from the “leverage” they provide. In truth, the real power of options is in their versatility. Depending on the strategy used the trader can construct positions that are conservative to those used for pure speculation. The birth of options came from the need to manage the risk of significant positions. Learning effective hedging strategies alone is well worth the effort required to educate yourself on these valuable tools.

provides many benefits well worth the additional learning curve they may require. Most people think the power of options comes from the “leverage” they provide. In truth, the real power of options is in their versatility. Depending on the strategy used the trader can construct positions that are conservative to those used for pure speculation. The birth of options came from the need to manage the risk of significant positions. Learning effective hedging strategies alone is well worth the effort required to educate yourself on these valuable tools.

What is a Stock Option?

So, What is a Stock Option? Simply stated options are contracts between one Buyer and one Seller. The Buyer of the contract is known as the Holder while the Seller is called the Writer. Option contracts are standardized into 100 share lots and based upon the underlying equity. The terms of the contract include the Strike Price, Expiration Date, and of course the Underlying Stock upon which it the contract is structured.

Strike Price

The price which the contract writer (seller) is obligated to accept as payment for the purchase of the underlying stock is called the strike price. The holder (buyer) has the right to buy the underlying stock at the strike price, however, is not obligated to do so.

Expiration Date

One indisputable fact about options contracts is that all of them will expire. It’s critical, for the options trader to know the expiration dates as they vary depending on the instrument used. For  example, Monthly options are the most widely used contracts. The last trading day for a monthly option contract is the 3rd Friday of the month, yet it technically does not expire until Saturday. A Weekly options contract will expire the Saturday just eight days after issue while a Quarterly option expires at the end of quarter no matter what day of the week.

example, Monthly options are the most widely used contracts. The last trading day for a monthly option contract is the 3rd Friday of the month, yet it technically does not expire until Saturday. A Weekly options contract will expire the Saturday just eight days after issue while a Quarterly option expires at the end of quarter no matter what day of the week.

If the price of the stock, is below the strike price at expiration the contract is (out-of-the-money), and the option contract is worthless. Therefore, if the stock is above the strike price at expiry, the option is (in-the-money). The Options Clearing House will transfer the stock of an In-The-Money Option, to the holder at the listed strike price.

Rights and Obligations

An option contract Buyer acquires the right but not the obligation to buy the underlying stock at the Strike Price before the expiration of the contract. Thus, the Buyer has the right to buy the underlying stock but may choose to sell the option contract collecting a profit or stopping a loss. It’s important to note that the buyer’s rights to exercise the contract are only valid if the value of the underlying stock is greater than the strike price before expiration. The seller of the contract has an obligation to fulfill the terms of the contract at expiration or upon the buyer’s order to exercise. However, the seller can buy back the contract to take a profit or stop a loss before expiration or exercise.

Option Types

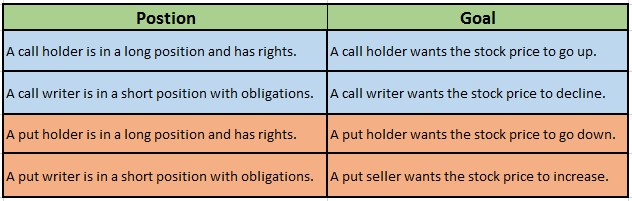

There are call options and put options for each strike price. Call options are often thought of as a long instrument while Put options are considered short instruments, yet the opposite may be true. Holders of calls or puts are in long positions. Therefore, option writers are in short positions. The table below may be helpful in sorting out the details.

Premium

All stock options have a premium associated with them. Options writers collect a premium as compensation for the risk of carrying the obligation of the rights conferred to the buyer.

Moneyness

Moneyness is the term describing the relationship between the Strike Price of an option and the current Trading Price of the underlying equity. In options trading, you will commonly hear phrases such as In-The-Money, Out-Of-The-Money, and At-The-Money or see their respective abbreviations ITM, OTM, and ATM.

Moneyness is the term describing the relationship between the Strike Price of an option and the current Trading Price of the underlying equity. In options trading, you will commonly hear phrases such as In-The-Money, Out-Of-The-Money, and At-The-Money or see their respective abbreviations ITM, OTM, and ATM.

In-The-Money

A call option would be ITM when the strike price is below the current trading price of the underlying equity. For Example; a 30 strike, call option contract would be ITM if the current stock price is $30.01 or higher.

A put option would be ITM when the strike price is above the current trading price of the underplaying equity. For Example; a 40 strike, put option contract would be ITM if the current stock price is $39.99 or lower.

Out-Of-The-Money

A call option would be OTM when the strike price is above the current trading price of the underlying equity. For Example; a 25 strike, call option contract would be OTM if the current stock price is $24.99 or lower.

A put option would be OTM when the strike price is below the current trading price of the underplaying equity. For Example; a 50 strike, put option contract would be OTM if the current stock price is $50.01 or higher.

At-The-Money

As an equity price moves up and down at some point in time, it will be equal to the strike price. Thus, and ATM call or put would be equal to the current price of the underlying equity.

When an underlying equity is close but not exactly equal to the strike price of an option you will often hear, they referred to as near-the-money or close-to-the-money.

Intrinsic Value

The Intrinsic Value of a call option is the underlying stock’s current price minus the strike price. If the resulting difference is a negative number, then the intrinsic value is given as zero.

The Intrinsic Value of a put option is the strike price minus the underlying stock’s current price. If the resulting difference is a negative number, then the intrinsic value is given as a zero.

Extrinsic Value

Extrinsic value is the cost of time. The expression, “time is money,” is very true when it comes to option prices. As time passes extrinsic value diminishes until it reaches zero at the expiration of the contract. One of the challenges of options trading is this effect of time decay. Not only do you need to be right on direction but it’s also necessary to be correct on the trade timing.

Successful Options Trading

Learning option terminology and the mechanics of their construction is the first to becoming a successful options trader. At Right Way Options we believe a good education Key to trading success. We back up that belief with 10 hours of live options and stock training every week. If you would like to learn more, please visit our website and come back regularly for more valuable trading information.

[button_1 text=”Visit%20Our%20Benefits%20Page” text_size=”32″ text_color=”#000000″ text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”Y” text_shadow_vertical=”1″ text_shadow_horizontal=”0″ text_shadow_color=”#ffff00″ text_shadow_blur=”0″ styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_shine=”Y” styling_gradient_start_color=”#ffff00″ styling_gradient_end_color=”#ffa035″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”https://hitandruncandlesticks.com/right-way-options/”/]

Comments are closed.