The Options Chain Demystified Posted 4-9-17

The Options Chain Demystified. Use It With Confidence!

At first glance, an options chain with all blinking, flashing and fast moving numbers is intimidating. What does it all mean? How do you make sense of what appears quite chaotic? Which one is the right one to choose? These are all valid questions that immediately come to mind for new options traders. By the time you finish this article, you will find that the options chain is a very efficient tool. Not only is it easy to understand but provides a wealth of valuable information.

At first glance, an options chain with all blinking, flashing and fast moving numbers is intimidating. What does it all mean? How do you make sense of what appears quite chaotic? Which one is the right one to choose? These are all valid questions that immediately come to mind for new options traders. By the time you finish this article, you will find that the options chain is a very efficient tool. Not only is it easy to understand but provides a wealth of valuable information.

By the time you finish this article, you will find that the options chain is a very efficient tool. Not only is it easy to understand but provides a wealth of valuable information.

What is an Options Chain

The options chain is a matrix (chain) of available contracts listed for a given security. Searching through an entire list of all the options available for a given security could be a daunting task. To solve that problem an options chain groups the contacts into a series based on the expiration dates. As an example, the July XYZ option contract series will have have the same date of expiry.

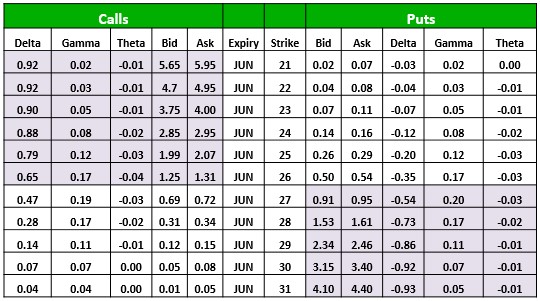

Within a given expiration series price quotes are displayed for each of the available Strike Prices. There are stock and ETF’s that have contracts available in $1.00 increments. While others only provide contracts in increments in $2.50, $5.00 and even $10. It should go without say that the trader must focus on the details of each contract to avoid making mistakes that could prove very costly!

The Option Strike Price is most commonly listed down the middle of the overall option chain. Grouped to the left of the strike price you will find the Call Option Contracts. Conversely, you will find Put Option Contracts displayed to the right of the strike price. Below is a representation of the typical options chain layout.

Although this configuration of is very common, not all brokers display option chains in the same manner. Each trader is highly encouraged to check with your broker and acquaint yourself with the tools and resources that they proved. It’s of critical importance to know how to use the tools properly and efficiently. In the heat of the moment is not the time to learn how to use your trading tools!

Bid/Ask Spread

Each listed options contract has two prices. The Bid Price and the Ask Price. The Ask Price is the price you will pay to purchase the option contract. The Bid Price is what you will receive if you sell the option contract. The difference between the Bid Price and Ask Price is called the Bid/Ask Spread and in the options world is referred to a Slippage.

For the stock trader, the Bid/Ask spread is negligible, often as small as one penny. However, for the options trader, the Bid/Ask spread can be significant and an important consideration for all positions. Heavily traded options contracts such as found in the SPY ETF often have small bid/ask spreads of just a few cents. Options with large bid/ask spreads can often provide a warning of insufficient volume that a wise trader should.

Visualize Moneyness Using The Options Chain

Using the options chain above the stock XYZ is currently trading at $26.50 a share. Looking at the 26 Strike Call, you will notice it is highlighted or shaded in with a different color. In fact, every strike price lower than 26 has been shaded in to signify that they are In-The-Money (ITM) contracts. For example, with the XYZ stock currently trading at $26.50 then the 26 Strike contract is ITM by $.050. The 25 Strike is ITM by $1.50. Furthermore, the 26 Strike contract has an Intrinsic Value of $0.50 and an Extrinsic Value of $0.81.

All of the Call option contracts higher than 26 are Out-Of-The-Money (OTM). The OTM Call options have $0.00 Intrinsic Value and $1.31 of Extrinsic Value. You will learn more about Intrinsic and Extrinsic values when you study the Option Greeks.

Conversely, on the Put side of the Options Chain, you will find that the 27 Strike contracts and higher are ITM having both Intrinsic and Extrinsic Value. The Put contracts Strikes 26 and below are OTM having only Extrinsic value. OTM has zero Intrinsic value.

Slippage

The term Slippage describes the effect of the bid/ask spread on the trade. For example, let’s assume we want to buy a JUN 25 Call option because we think the stock is about ready to move up in price. (See the options chain provided above.) The Bid Price for the JUN 25 Call is quoted at $1.99 and the Ask Price $2.07. Buying a single contract costs $207 (excluding commissions), however, if we immediately sell the contract we would only receive $199 (bid price). Thus, creating a slippage loss of $8.00. In this example the slippage is relatively small, however, Bid/Ask spreads can be substantially larger. It’s imperative the trader identify the cost and evaluate how it may affect the overall trade decision.

The term Slippage describes the effect of the bid/ask spread on the trade. For example, let’s assume we want to buy a JUN 25 Call option because we think the stock is about ready to move up in price. (See the options chain provided above.) The Bid Price for the JUN 25 Call is quoted at $1.99 and the Ask Price $2.07. Buying a single contract costs $207 (excluding commissions), however, if we immediately sell the contract we would only receive $199 (bid price). Thus, creating a slippage loss of $8.00. In this example the slippage is relatively small, however, Bid/Ask spreads can be substantially larger. It’s imperative the trader identify the cost and evaluate how it may affect the overall trade decision.

Most noteworthy is that your brokerage account will immediately display a loss in your account on a filled position. In this example, the slippage is only $0.08 per share but still a consideration in the overall position. It is not uncommon to find very large bid/ask spreads. It is incumbent on the options trader to evaluate the slippage cost of all contracts

Starting off in a new position with a loss is far from ideal, so it is vital to evaluate the bid/ask spread before making any new trade decision. Look before you leap because the mistake of unknowingly entering a new position with an excessively large bid/ask spread can be a costly lesson.

Mid Price

The Mid-Price describes the middle price between the Bid and the Ask. Although not listed on the options chain it is commonly used by options traders. If the Bid/Ask Spread is wide, traders will often try to negotiate a better price by submitting an order at the Mid-Price.

More Than Just a Price Quote

Many brokerage firms nowadays offer options chains that allow customization to the user needs. They have the ability to display data pertinent to the options trader along with the price quotes. These tools can be  invaluable to the trader helping them identify the best contract for their strategy. They also help in avoiding option contracts that don’t meet the trader’s rules. For example, an option contract may not have enough volume or open interest (contracts held) to fit the trader’s requirements.

invaluable to the trader helping them identify the best contract for their strategy. They also help in avoiding option contracts that don’t meet the trader’s rules. For example, an option contract may not have enough volume or open interest (contracts held) to fit the trader’s requirements.

Contacting your broker to learn about the tools available to you is highly recommended. It may require a little extra time learning to efficiently use the tools but in the long run, it’s time well spent.

I wish you great success!

[button_2 color=”green” align=”center” href=”https://hitandruncandlesticks.com/right-way-options/”]Explore What We Have To Offer[/button_2]