The urgency of corporate buybacks as we near the beginning of the blackout period was not quite enough to recover the early selling with only the IWM managing to close the day in the green. The rest of this week’s jobs data will be the center of attention as we head toward the market-moving Employment Situation report Friday morning. Today we will begin with the JOLTS report and a handful of notable earnings to provide bullish or bearish inspiration. However, Moody’s credit downgrade highlighting the weakening economic conditions in China could start the day with some bearish activity so plan your risk carefully.

Overnight Asian markets have had a rough session selling off across the board after a credit downgrade adding the economic concerns in China. However, European markets trade with modest gains and losses as Ericsson surges while Nokia plunges. Ahead of earnings and economic reports U.S. Futures point to bearish open.

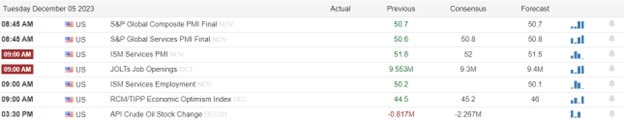

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AZO, AVAV, CRMT, ASAN, BOX, CNM, PLAY, FERG, GIII, MDB, PHR, S, SIG, SFIX, TOL, & YEXT.

News & Technicals’

Moody’s, a global credit rating agency, has lowered its outlook on China’s government credit ratings from stable to negative, citing concerns over the country’s fiscal, economic, and institutional strength. Moody’s said that China’s government may have to provide more support and bailouts for local governments and state-owned enterprises that are facing financial difficulties, which could weaken China’s fiscal position and increase its debt burden. Moody’s also said that China’s economic growth may slow down further due to structural challenges and external pressures and that China’s institutional capacity may not be able to cope with the rising complexity and risks of its economy. Moody’s maintained China’s long-term rating on its sovereign bonds at “A1”, which is the fifth-highest level in its scale, but warned that it could downgrade it in the future if China’s fiscal, economic, and institutional situation deteriorates.

Some experts believe that the Fed is lagging behind the market expectations and needs to cut interest rates sooner rather than later. Paul Gambles, managing partner at MBMG Group, said that the Fed is behind the curve and that traders are anticipating a 25-basis-point cut as early as March 2024. David Roche, a veteran investor and president of Independent Strategy, said that he is “almost certain that the Fed is done raising rates” and that inflation will not go back to 2% anymore. These views suggest that the Fed may have to adjust its policy stance and communication in response to the changing economic and financial conditions.

Banque Pictet, a major Swiss bank that provides private banking services, has admitted that it helped U.S. taxpayers and others evade taxes by hiding over $5.6 billion from the IRS. The bank has reached an agreement with the U.S. prosecutors to pay about $122.9 million in restitution and penalties and to cooperate with the ongoing investigation. In exchange, the Justice Department will defer the prosecution of the bank for three years and then drop a criminal charge of conspiracy to defraud the IRS, if the bank complies with the terms of the deal. The bank is one of the several Swiss banks that have been accused of facilitating tax evasion by U.S. clients, and the latest to settle with the U.S. authorities.

The S&P 500 ended its five-week winning streak on Monday, with most of the indexes closing lower despite the energy of the corporate buybacks. The best-performing sector was real estate, while sectors that rely on growth, such as information technology and communication services, lagged. Small-cap stocks gained nearly 1% today adding to their more than 3% increase last week. Today’s market movement may reflect some profit-taking in areas like large-cap technology that have driven the market higher in the recent rally. The bulls and bears will look for inspiration in several reports on the labor market, starting with the JOLTS report today. There will also be a dozen or so notable earnings reports that have the potential to inspire price action. The Moody’s credit downgrade of China could make the bears a bit more aggressive so it may be wise to take some profits or raise stoploss orders to protect your capital.

Trade Wisely,

Doug

Comments are closed.