All Eyes on the Presidential Election

Stock futures edged higher on Monday as investors with all eyes on the presidential election and the potential volatility it may bring. Nvidia shares climbed 2% in premarket trading following the announcement by S&P Dow Jones Indices that the chipmaker would replace Intel in the 30-stock Dow. Meanwhile, Wall Street is on edge ahead of the Federal Reserve’s latest rate decision, expected on Thursday, with traders pricing in a 96% chance of a rate cut.

European markets saw an uptick on Monday following a sluggish start. Sectors such as oil and gas, autos, and banks each gained approximately 0.7%, while tech stocks experienced a slight decline of 0.2%. The rise in crude oil prices by over 2% provided a boost to oil stocks. Burberry’s shares surged by around 5% after reports emerged that Moncler might be considering a bid for the British luxury brand. Meanwhile, investors are keenly watching developments related to the upcoming U.S. presidential election.

Asia-Pacific markets experienced a positive trend as investors geared up for a busy week ahead. South Korea’s blue-chip Kospi led the gains with a 1.83% rise, while Hong Kong’s Hang Seng index saw a modest increase of 0.27%. Australia’s S&P/ASX 200 closed 0.56%, and the Taiwan Weighted Index advanced by 0.81%. Notably, Japan’s markets were closed for a holiday. Investors are also closely watching Australia, where the central bank is expected to announce its interest rate decision on Tuesday, with the Reserve Bank of Australia likely to maintain the official cash rate at 4.35%.

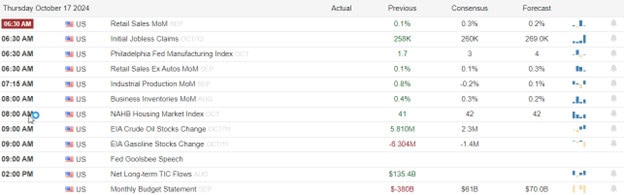

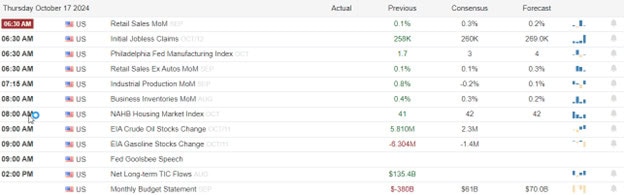

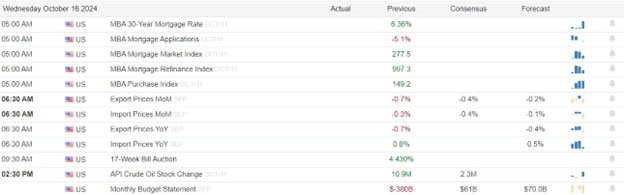

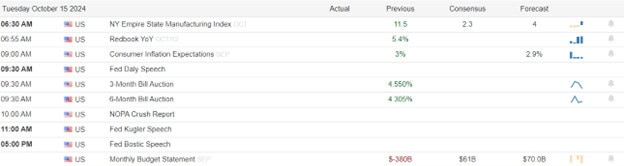

Economic Calendar

Earnings Calendar

Notable reports for Friday before the bell include AMG, BCRX, BNTX, CC, CHH, CAN, CEG, DOCN, ENTG, FIS, FOXA, BEN, FRPT, FTDR, IART, KNF, KRYS, MAR, MSSC, NYT, OMI, PEG, RVTY, TPG, TRS, TGI, YUMC, & ZTS.

After the bell reports include EGHT, ADUS, AOSL, ATUS, AIG, ANDE, AHH, AZAB, AVB, BCC, BFAM, BWXT, CDNA, CE, CRUX, CLF, CRBG, CWK, FANG, DEI, ELME, EQH, WTRG, EVER, ES,, FN, FWRD, GKOS, GT, GXO, HPK, HIMS, HOLX, HMN, HHH, HUN, ICHR, ILMN, INSP, INTA, LSCC, MQ, MTG, NVTS, NXPI, OGS, OTTR, PLMR, PLTR, PRAA, PRIM, QNST, O, RRX, RHP, SANM, ST, SLAB, SLF, TDC, BWIN, TBI, VVX, VRTX, VNOM, VNO, VOYA, WOW, & WYNN.

News & Technicals’

Berkshire Hathaway’s cash reserves surged to a record $325.2 billion by the end of September, up from $276.9 billion in the second quarter, as revealed in its recent earnings report. Despite this increase, the company did not repurchase any shares during this period, continuing a trend of reduced buyback activity seen earlier in the year. This slowdown in repurchases coincided with Berkshire shares outperforming the broader market and reaching record highs. In the second quarter, Berkshire had repurchased only $345 million worth of stock, a significant drop from the $2 billion bought back in each of the previous two quarters. The company maintains that it will repurchase shares when Chairman Warren Buffett believes the price is below Berkshire’s intrinsic value, conservatively determined.

Nvidia shares rose by 2% in premarket trading after S&P Dow Jones Indices announced late Friday that the chipmaker would replace Intel in the 30-stock Dow, effective at the end of the week. This change reflects Nvidia’s impressive performance, with its stock up 173% year to date, driven by its strong position in the artificial intelligence sector. In contrast, Intel has struggled, losing more than half of its value over the same period as it falls behind in the AI race.

Tuesday’s election results could significantly influence the stock market’s performance for the remainder of the year. According to the latest NBC News poll, the race between former President Donald Trump and Vice President Kamala Harris is “deadlocked.” However, the market’s reaction may depend more on which party gains control of Congress. A divided control of the U.S. House of Representatives and Senate would likely maintain the status quo. In contrast, a sweep by either Republicans or Democrats, likely accompanied by a White House victory for the same party, could lead to new spending initiatives or a tax overhaul.

The bulls are trying to put on brave faces this morning but all eyes on the presidential election and the uncertainty that can create we could easily see very choppy light volume price action. We should also plan carefully the risk of election day when we have in the past seen some very big price swings setting up market gaps and reversals overnight. Besides that we have a busy week of earnings and an FOMC decision coming Thursday afternoon.

Trade Wisely,

Doug