The indexes struggled to find momentum on Monday suffering from post-holiday anemic volume which is pretty typical as traders extend vacations and travel home. With a GDP reading on Wednesday and the Core PCE numbers on Thursday, it is possible the light volume chop could continue today. However, we have some earnings and economic reports today that may well inspire the bulls or bears so be prepared for just about anything in this short-term very extended condition.

Asian markets closed mixed overnight with modest gains and losses trying to shake off the growing real estate crisis in China. However, European markets trade in the red across the board this morning with modest losses as momentum stalls. Ahead of earnings and economic data, the U.S. futures suggest a flat to slightly bearish lean but that could quickly improve or get worse depending on the reaction to pending data.

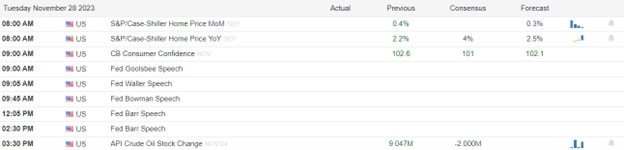

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AZEK, BMO, CRWD, HPE, INTU, LESL, NTAP, PDD, SPLK, & WDAY.

News & Technicals’

Some regional banks in the U.S. are facing the risk of being acquired by their more profitable rivals, according to a report by KBW, a financial services research firm. KBW analysts said that Comerica, Zions, and First Horizon are among the banks that might be targeted for takeover, as they have lower returns and weaker growth prospects than their peers. On the other hand, larger banks with strong returns, such as Huntington, Fifth Third, M&T, and Regions Financial, are well-positioned to expand their market share and scale by buying smaller banks. KBW analysts also said that two other banks, Western Alliance and Webster Financial, could also consider selling themselves, as they have attractive franchises and valuations. The report said that the consolidation in the regional banking sector is likely to continue, as the banks face competitive pressures, regulatory challenges, and technological changes.

Wells Fargo Securities has released its 2024 stock market forecast, and it is not very optimistic. The firm’s head of equity strategy, Chris Harvey, predicts that the S&P 500 will end 2024 at 4,575, which is only 75 points higher than its closing level on Monday. Harvey expects the stock market to face a lot of volatility and uncertainty in the first half of 2024, as the economic growth and the Federal Reserve’s policy will be in a dilemma. He said that if the economy grows faster, the Fed will not ease its monetary policy, and if the economy slows down, the earnings will be lower, and the Fed will eventually cut its interest rate. He said that the second half of 2024 will be better, but the first half will be “really, really sloppy.” Harvey’s forecast is based on his analysis of the economic, earnings, valuation, sentiment, and technical factors that affect the stock market. He also shared his views on the sector and style preferences, as well as the risks and opportunities for investors.

The European tech sector has faced a significant drop in funding in 2023, according to a report by Atomico, a venture capital firm. The report, titled “State of European Tech”, showed that the total funding for European tech companies backed by venture capital is expected to decline by 45% in 2023, compared to 2022. The report attributed the decline to the reduced inflow of institutional capital from the U.S. and Asia, which had boosted the European tech market in 2020 and 2021, but retreated in the last year due to the macroeconomic uncertainties. The report also highlighted the bright spot of artificial intelligence, which attracted 11 mega funding rounds of $100 million or more in 2023, showing the strong potential and innovation of the European AI sector. The report also covered other aspects of the European tech ecosystem, such as talent, diversity, regulation, and social impact. You can read the full report here.

The indexes ended the day with modest losses on Monday, suffering from anemic volume which is pretty normal after a holiday shutdown. Today we have a bit more inspiration for the bulls and bears on the economic calendar and several notable earnings that have the potential to be market-moving as they are in the tech sector. However, the T2122 indicator continues to signal a short-term over-bought condition so guard yourself from getting caught up in the fear of missing out and chasing already extended stocks. That said the bulls remain in control and the so-called magnificent seven seem to have the ability to lift three of the indexes without the help of other stocks so it would be unwise to ignore the bullish enthusiasm.

Trade Wisely,

Doug

Comments are closed.