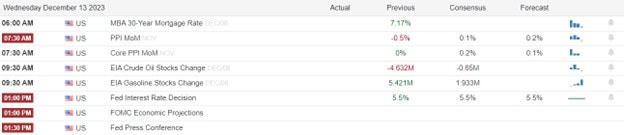

After an ever so slightly higher CPI reading the indexes melted higher on lower-than-average volume in a relentless pursuit of record highs. Interesting oil prices continued to fall on demand worries from a weakening consumer yet that has not translated into any other market sector. Things that make you say Hmmm? Today will be focused on the interpretation of Jerome Powell’s comments as Dovish or Hawkish with PPI, Petroleum Status, and a handful of earnings tossed in to add price volatility. With the market convinced the Fed will soon pivot big moves are possible if that sentiment is confirmed or denied so plan your risk carefully.

During the night Asian markets traded mixed but mostly lower as they monitor the FOMC decision. However, European markets trade cautiously bullish across the board ahead of the pending data. U.S. futures at the time of this report point to a higher open convinced the Fed will soon pivot from its inflation-fighting stance. We will find out at 2:30 PM Eastern as Jerome Powell takes the microphone.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday ABM, ADBE, CGNT, NDSN, PLAB, & REVG.

News & Technicals’

The European Central Bank (ECB) is planning to reduce its balance sheet, which has grown significantly due to its bond-buying program to support the economy during the pandemic. The ECB’s balance sheet is currently over 8 trillion euros or about 75% of the eurozone’s GDP. The ECB wants to shrink its balance sheet gradually and carefully, to avoid disrupting the financial markets and the economic recovery. However, the markets are expecting the ECB to cut its interest rates next year, as inflation has fallen below the ECB’s target of 2%. Inflation dropped to 2.4% in November, and core inflation, which excludes volatile items such as food and energy, also declined. Money markets are betting on almost 150 basis points of rate cuts in 2022, which would lower the ECB’s key deposit rate from its record high of 4%. The ECB has raised its deposit rate 10 times since July 2022, when it became positive for the first time since 2011. The ECB faces a delicate balance between shrinking its balance sheet and easing its monetary policy, as it tries to achieve its inflation goal and support the eurozone’s growth.

The Bank of England (BoE) is likely to keep its interest rates unchanged on Thursday, as economists disagree on whether the BoE will need to cut rates in 2024. The market is almost certain that the BoE will not change its policy stance this week, based on the LSEG data, as the economic indicators since the BoE’s last meeting have been mixed. The real GDP growth was zero in the third quarter, which matched the BoE’s forecast, but the inflation and wage growth were lower than expected, and the domestic demand was weak. Barclays predicts that the BoE’s Monetary Policy Committee (MPC) will have a divided vote in favor of a hold, but will maintain a hawkish tone as it challenges the market’s expectation of “premature” rate cuts. The BoE faces a difficult balance between supporting the economic recovery and controlling the inflationary pressures.

The Federal Reserve (Fed) is expected to announce a policy shift on Wednesday, as it wraps up its last meeting of the year. The Fed is likely to signal that it will stop raising its interest rate, which it has done four times this year, and start preparing for the next phase of its monetary policy. The Fed will also release its updated forecasts on economic growth, inflation, and unemployment, which will reflect the impact of the pandemic, the fiscal stimulus, and the supply chain issues. The Fed Chair Jerome Powell will also hold his regular press conference, where he will explain the Fed’s decision and outlook. The market is anticipating that the Fed will start cutting its rate in May 2024, and continue to do so throughout the year, as the economy slows down and inflation eases. However, the Wall Street analysts and economists expect the Fed to be more careful and gradual in its rate cuts, as it balances the risks and uncertainties in the economy.

Stocks melted higher on lower-than-average volume after the November CPI inflation report, which came in just slightly higher than the market’s expectations. The rally was broad-based, with growth sectors, such as information technology, doing well along with cyclical sectors, such as materials and financials. The energy sector was a clear laggard, as the market worried about consumer demand which interestingly has not translated into any other consumer area. Today we have a handful of notable earnings but the market focus will be on the PPI, figures, Petroleum Status, and the FOMC decision and future projections. No one is expecting a rate increase but the market will likely react to how the Dovish or Hawkish Jerome Powell comments are interpreted during the 2:30 PM Eastern press conference. Anything is possible so plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.