Another Increase in Bonds

Heading into Wednesday’s market open, U.S. stock futures traded lower, influenced by another increase in bonds yields raising interest rates. The benchmark 10-year Treasury note yield rose by 3 basis points to 4.23%, a level not seen since July. This rise is attributed to robust economic data and concerns over the deficit, despite a half-point rate cut by the Federal Reserve in September. Traders are increasingly worried that central bank policymakers might be less inclined to reduce rates in the near future.

European markets traded flat as investors concentrated on corporate earnings reports and U.S. Treasury yields. Despite Deutsche Bank surpassing profit expectations for the three months ending in September, its shares fell by 3%. In contrast, Roche’s shares increased by 0.7%, Heineken rose by 2.3%, Volvo Cars climbed by 1%, and Swedbank saw a significant rise of 6%. However, AkzoNobel’s shares dropped by

Asia-Pacific markets experienced a mixed performance. Tokyo Metro’s shares surged dramatically, soaring by as much as 47% during the day and closing 45% higher. However, Japan’s Nikkei 225 index fell by 0.8%. In contrast, South Korea’s Kospi climbed 1.12%, Australia’s S&P/ASX 200 edged up by 0.13%, and Hong Kong’s Hang Seng index increased by 1.33%. Meanwhile, Singapore’s core consumer price index, which excludes private transport and accommodation, rose by 2.8% in September compared to the previous year, surpassing the Reuters poll forecast of 2.7%. The overall consumer inflation in Singapore also rose by 2% year-on-year, slightly above the expected 1.9%.

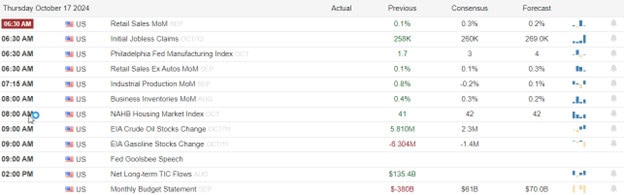

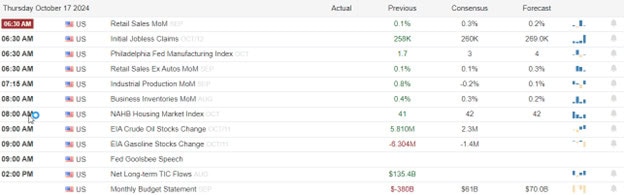

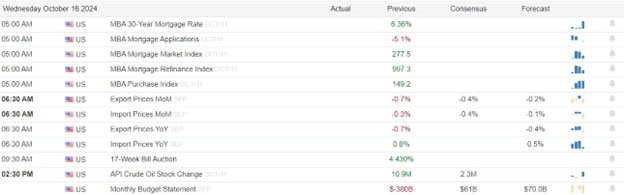

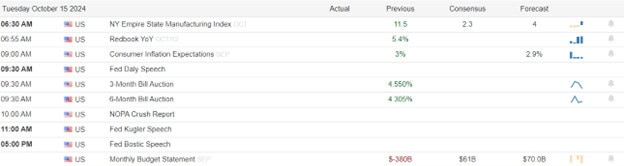

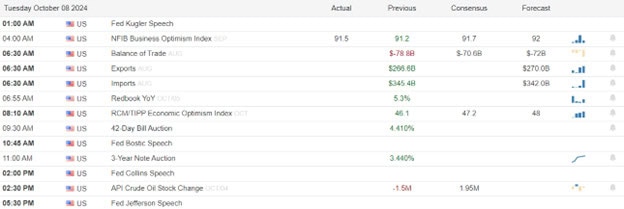

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include APH, T, AVY, BA, CME, KO, CSTM, EVR, GEV, GD, HCSG, HLT, KBR, LII, LAD, COOP, EDU, NEE, NEP, NTRS, ODFL, PRG, PB, ROP, SF, TMHC, TDY, TMO, TRU, TNL, UNF, UCB, VRT, WAB, WSO, & WGO. After the bell reports include ALGN AMP, ASGN, CACI, CP, CLS, CHDN, CYH, CLB, EGP, EQC, EPRT, GL, GSHD, GGG, GBX, IBM, ICLR, PI, KALU, KNX, LVS, LC, MAT, MXL, MC, MOH, MSA, MEN, ORLY, OII, CASH, PTEN, PEGA, QS, RJF, ROL, SLM, SEIC, NOW, SLP, SSB, STC, TMUS, TER, TSLA, TYL, URI, VLTO, VKTX, WCN, WSBC, WU, WHR, & WH.

News & Technicals’

McDonald’s shares fell by approximately 7% in after-hours trading on Tuesday following a CDC report linking an E. coli outbreak to the chain’s Quarter Pounder burgers. The outbreak has resulted in 10 hospitalizations and one death. Preliminary findings from the ongoing investigation suggest that the illnesses may be connected to slivered onions used in the Quarter Pounder. In response, McDonald’s has stated that it is taking “swift and decisive action” to address the outbreak in affected states.

Starbucks has released its preliminary results for the fiscal fourth quarter, revealing a continued decline in same-store sales for the third consecutive quarter, driven by a 10% drop in traffic to its North American stores. In response to these challenges, the company has suspended its outlook for fiscal 2025. To reassure investors and provide some stability, Starbucks has raised its quarterly dividend as part of its efforts to turn the business around.

Amazon is discontinuing its same-day delivery service, Amazon Today, which facilitated deliveries from mall and brick-and-mortar retailers. The company has halted any new development of the service and will begin winding it down. Selected retail partners can continue fulfilling orders through January 24, 2025. As part of this transition, a small number of employees will be laid off and provided with severance, while others will be reassigned to different positions within Amazon.

The International Monetary Fund (IMF) has issued a warning about the worsening state of China’s property market, which has led to a reduction in the country’s growth outlook. The IMF emphasized that the contraction in China’s property sector poses significant downside risks to the global economic outlook. Last week, China reported a third-quarter GDP growth of 4.6%, slightly above the 4.5% forecasted by economists polled by Reuters. However, in a report published on Tuesday, the IMF lowered its growth forecast for China to 4.8% for this year, down by 0.2 percentage points from its July projection.

The market will be trying to focus on earnings inspiration today with a huge increase in reports. However, another increase in bond yields could keep that excitement in check. The bad news in MCD and SBUX have created a nasty overnight whipsaw down so plan carefully as price volatility is likely to increase over the next several weeks as earnings numbers increase.

Trade Wisely,

Doug