Scrutinized Nvidia’s Earnings

Futures tied to the Nasdaq-100 declined as investors scrutinized Nvidia’s earnings report. Despite Nvidia surpassing third-quarter expectations and providing robust guidance, its shares dropped 3% in premarket trading. This reaction highlights the heightened expectations surrounding Nvidia, as noted by Aswath Damodaran, a finance professor at New York University’s Stern School of Business. He remarked on CNBC’s “Closing Bell: Overtime” that Nvidia not only needs to exceed analyst estimates but must do so by a significant margin, around 10%, to satisfy market anticipations.

European stocks flattened out due to weak global market sentiment. British sports retailer JD Sports saw its shares plummet over 14% in early trading after cautioning that its annual profits would likely hit the lower end of its forecast. Conversely, Zurich Insurance shares climbed 2% following the announcement of a new three-year plan. The overall market sentiment was further dampened by investor reactions to the crucial earnings report from artificial intelligence leader Nvidia.

Asia-Pacific markets experienced a downturn as investors closely monitored tech shares and developments surrounding Indian stocks linked to billionaire Gautam Adani. The chair of Adani Group, along with others, faced an indictment in a New York federal court over a significant bribery and fraud scheme. This news contributed to a decline in several key indices: India’s Nifty 50 dropped by 0.72%, Japan’s Nikkei 225 fell by 0.85%, and Hong Kong’s Hang Seng index decreased by 0.32%. In contrast, mainland China’s CSI300 saw a slight gain of 0.09%. Meanwhile, markets in South Korea and Australia ended the day marginally lower.

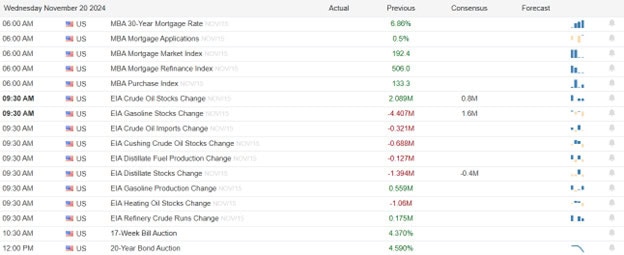

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include AKTR, BJ, BEKE, DE, SCVL, VSTS, & WMG. After the bell reports include CPRT, ESTC, GAP, INTU, ROST, & UGI.

News & Technicals’

Ukraine reported that Russia launched an intercontinental ballistic missile (ICBM) overnight, targeting Dnipro city in the central east of the country. If confirmed, this would mark the first use of such a missile by Moscow in the ongoing conflict. Although the range of an ICBM seems excessive for a strike against Ukraine, these missiles are typically designed to carry nuclear warheads. The deployment of an ICBM would underscore Russia’s nuclear capabilities and signal a potential escalation in the conflict. The attack resulted in injuries to two individuals and caused damage to an industrial facility and a rehabilitation center for people with disabilities, according to local officials.

Gautam Adani, one of the world’s wealthiest individuals, was indicted in a New York federal court on charges related to an alleged bribery and fraud scheme. A spokesperson for Adani Group dismissed the allegations from the U.S. Department of Justice and the U.S. Securities and Exchange Commission against directors of Adani Green Energy as “baseless and denied.” Following the indictment, shares of companies within India’s Adani Group plummeted, with Adani Green Energy — the company at the heart of the allegations — experiencing a significant drop of 17.9%.

Chinese tech giant Baidu reported a 3% year-over-year decline in third-quarter revenue, totaling $4.78 billion for the quarter ending September 30. Despite this drop, the company exceeded market expectations, driven by growth in its AI cloud segment. Net income for the period increased by 14%, reaching $1.09 billion. However, Baidu’s U.S.-traded shares fell nearly 4% in premarket trading following the release of these results.

The Department of Justice is urging a federal judge to mandate that Google divest its Chrome internet browser as a remedy in the ongoing antitrust case. According to the filing, this action is intended to “permanently stop Google’s control of this critical search access point.” This push follows an August ruling by a U.S. judge that determined Google holds a monopoly in the search market. The proposed divestiture of Chrome aims to address and mitigate the competitive harms identified in the case.

Although NVDA was down during the night the US futures this morning have decided it was good enough to push for a gap up open. Keep in mind the rest of the world seems to have a slightly different opinion. Today we will look for clues to inspire the bulls or the bears in earnings and economic data while keeping an eye on the rising geopolitical tensions. The bond yields continue to a concern as well the oil prices rising sharply today due to the escalating conflict.

Trade Wisely,

Doug