Potentially Challenging Month

U.S. stock futures declined on Tuesday as traders prepare for a potentially challenging month following a strong yet volatile August. Investors are eagerly awaiting the first major economic report of the month, which will be released on Friday when the U.S. government publishes the August jobs report. Additionally, Wall Street faces seasonal headwinds, as September has historically been the worst month for the S&P 500 over the past decade.

European stocks saw a slight decline on Tuesday, extending a tepid start to September trading. According to data from the British Retail Consortium, total sales in August increased by 1% year-on-year. This growth was driven primarily by food sales, which rose by 2.9% annually over the three months leading up to August. In contrast, non-food sales experienced a 1.7% decline.

Asia-Pacific markets experienced a downturn on Tuesday, with most indices showing declines. Notably, South Korea’s headline inflation for August eased to 2% from 2.6%, marking its lowest year-on-year level since March 2021. Meanwhile, Mainland China’s CSI 300 index hover near a seven-month low, according to futures data.

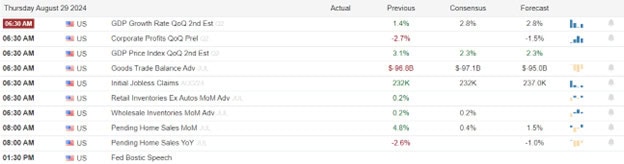

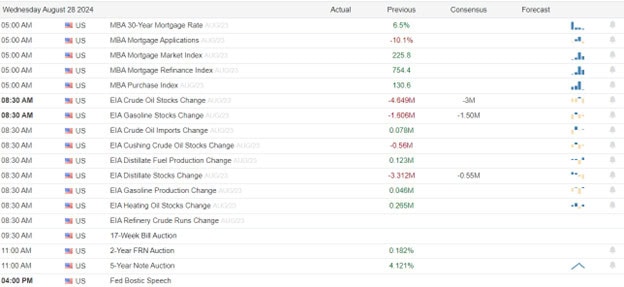

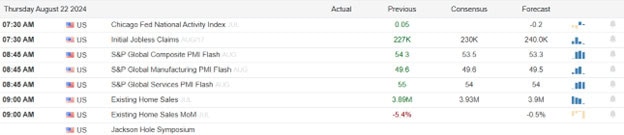

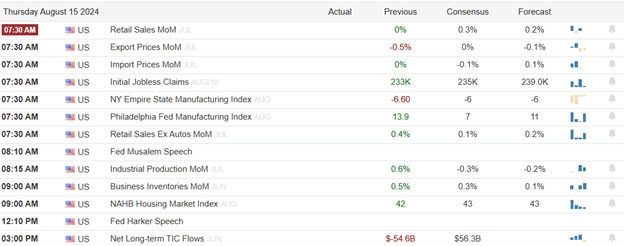

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include MOMO. After the bell include GTLB, PD, & ZS.

News & Technicals’

German carmaker Volkswagen issued a warning that it may no longer be able to avoid plant closures in the country, citing the need for significant cost-cutting measures to “future-proof” the company. Volkswagen announced its decision to terminate its employment protection agreement, a job security program in place since 1994, to facilitate “urgently needed structural adjustments.” VW brand CEO Thomas Schäfer emphasized the gravity of the situation, stating that it is “extremely tense and cannot be resolved through simple cost-cutting measures.”

Russia has signaled potential changes to its official nuclear weapons policy in response to ongoing incursions by Ukraine into the Kursk border region. Deputy Foreign Minister Sergei Ryabkov announced on Sunday that Russia is revising its nuclear doctrine, which outlines the conditions under which nuclear weapons may be deployed. This shift is attributed to what Russia perceives as the West’s escalating involvement in the conflict in Ukraine. The adjustments to the nuclear doctrine reflect the heightened tensions and the evolving dynamics of the war.

Brazil’s telecommunications regulator, Anatel, has threatened sanctions against Elon Musk’s satellite internet firm, Starlink, amid escalating tensions over Brazil’s decision to block Musk’s social media company, X. Artur Coimbra, a commissioner at Anatel, stated that Starlink is the only company refusing to comply with the court order to block X. This public confrontation highlights the growing friction between Brazil and Musk, as regulatory authorities push for adherence to legal decisions while Musk’s companies resist compliance.

Huawei is set to hold a product launch event on September 10 at 2:30 p.m. Beijing time, just hours after Apple’s iPhone 16 unveiling. While the specifics of Huawei’s new product remain unclear, Richard Yu, the company’s consumer and automotive technology executive, has described it as an “epoch-making product.” Huawei’s resurgence in the Chinese market has posed a significant challenge to Apple, which lost its position among the top five smartphone vendors in China during the second quarter.

Although the current bullishness appears unstoppable keep in mind that September is a potentially challenging month historically. Plan on corporate buybacks to dwindle my mid-month with about 50% of companies slipping into their blackout period according to Goldman. Until then continue to ride the bullish wave but consider raising stops and watch carefully for a pullback in this extended condition.

Trade Wisely,

Doug