Meta Disappoints

Meta’s recent quarterly report has cast a shadow of concern over the upcoming earnings releases of other tech giants, particularly Microsoft and Alphabet, which are expected to announce their earnings after the market closes on Thursday The apprehension stems from Meta’s shares tumbling by 17% in after-hours trading, despite the company beating revenue and earnings-per-share. This reaction is attributed to Meta’s forward-looking statements, which indicated higher-than-anticipated spending, especially in AI and the. The market’s response to Meta’s report could be a bellwether for how investors might react to the financial disclosures of Microsoft and Alphabet, with particular attention being paid to their guidance and investment strategies.

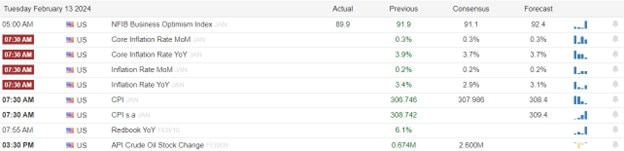

In addition to corporate earnings, traders are also bracing for the release of key economic data. The U.S. Bureau of Economic Analysis is scheduled to publish the first-quarter GDP reading at 8:30 a.m. ET on Thursday, with Dow Jones economists predicting a 2.4%. Concurrently, the latest weekly jobless claims data will be released, providing further insight into the labor market’s health. These economic indicators are crucial as they will influence the Federal Reserve’s monetary policy decisions. Currently, the Fed funds futures market is signaling the possibility of an interest rate cut at the September Fed meeting, as per the CME FedWatch Tool. This anticipation of a policy shift reflects the market’s expectations that the central bank may pivot in response to evolving economic conditions.

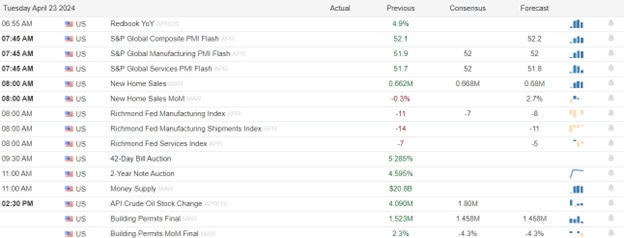

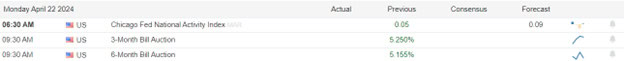

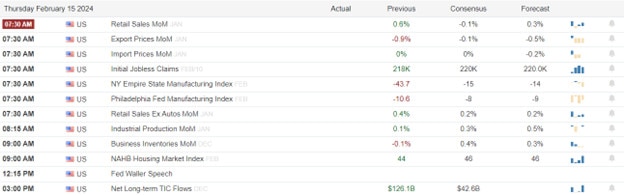

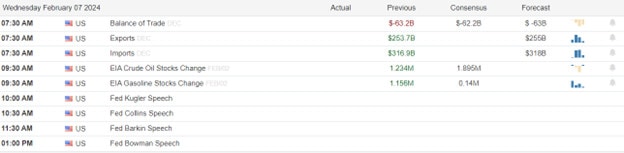

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell AOS, ADT, ALLE, MO, AAL, AIT, ARCH, ABG, AZN, BMY, BC, CWT, CARR, CAT, CBZ, CHKP, CMS, CNX, CMCSA, CFR, DOV, DTE, XPRO, FCN, GWW, HOG, HTZ, HES, HON, IMAX, IIIN, ITGR, IP, KDP, KEX, LH, LKFN, LAZ, MRK, MBLY, NDAQ, NEM, NOC, OSK, PCG, POOL, RS, RCL, SPGI, SAGE, SNY, SAH, SBSI, LUV, STM, FTI, TXT, TSCO, TW, TRU, TPH, UNP, VLO, VC, WST, WEX, WTW, WNS, & XEL. Thursday after the bell includes MSFT, GOOG, AB, APPF, ATR, AJG, TEAM, AVB, SAM, BYD, COF, CSL, CWST, CINF, COLM, CUBE, DXCM, EMN, EXPO, FICO, FHI, FFBC, FE, GLPI, GILD, HIG, DOC, HUBG, INTC, JUNP, KLAC, LHK, MHK, NRDS, OLN, PECO, PFG, PTCT, RMD, RHI, ROKU, SKX, SKYW, SNAP, SPCS, TDOC, TEX, TMUS, VRSN, WDC, WY, WSFS.

News & Technicals’

In a significant legal development, a Russian court has ruled in favor of VTB Bank, a state-controlled lender, in its legal battle to recover $439.5 million from JPMorgan Chase. The U.S. bank had reportedly frozen these funds following the invasion of Ukraine. The court’s decision mandates the confiscation of JPMorgan’s funds held within Russian jurisdiction, as well as its tangible and intangible assets, which notably include the bank’s equity in a Russian subsidiary. This ruling comes on the heels of VTB’s lawsuit filed in a St. Petersburg arbitration court, which sought restitution for the funds frozen by the U.S. financial institution. VTB’s legal move was partly driven by JPMorgan’s announcement of its planned withdrawal from the Russian market, prompting the state-run bank to seek judicial intervention to reclaim the blocked capital.

The Japanese yen has experienced a notable depreciation of 4.2% since the Bank of Japan’s (BOJ) meeting in March, a trend exacerbated by the strengthening of the U.S. dollar this weakness is partly attributed to the persistent inflation in the United States, which has led Federal Reserve Chair Jerome Powell to hint that rate cuts may not be on the horizon for the next few months]. Analysts are calling for decisive measures to bolster the yen, yet there is widespread skepticism that such actions will emerge from the upcoming BOJ meeting on FridayThe market’s anticipation of continued low-interest rates in Japan, contrasted with the U.S.’s higher rates, has put additional downward pressure on the yen, leaving investors and policymakers alike watching for any potential shifts in the BOJ’s stance that could impact the currency’s trajectory.

During Meta’s recent quarterly earnings call, CEO Mark Zuckerberg emphasized the company’s commitment to long-term investments in artificial intelligence (AI) and the metaverse, a strategy that appeared to unsettle investors. Despite the potential of these emerging technologies to revolutionize digital interaction and business models, the immediate market reaction was negative, with Meta’s shares plunging by up to 19% in after-hours trading. Zuckerberg acknowledged the market’s response, noting that such volatility is not uncommon for Meta during periods of significant product development and innovation. His comments suggest a focus on future growth and transformation, even as current shareholders grapple with the implications of these ambitious projects on short-term financial performance.

The Meta disappointment makes today’s reports a significant moment for the tech industry as both Apple and Alphabet are set to report their earnings after the market closes. This event is highly anticipated by investors and market analysts alike, as the financial performance of these tech giants often serves as an indicator of the sector’s overall health and future direction. The results will be closely scrutinized for insights into consumer demand, advertising revenue trends, and the companies’ ability to navigate the current economic landscape. With the global economy facing various challenges, the outcomes of these reports could have substantial implications for market sentiment and tech stock valuations moving forward. Expect significant volatility, whipsaws. Anything is possible!

Trade Wisely,

Doug