Focused on Nvidia

U.S. stock futures retreat slightly on Wednesday, with investors’ attention focused on Nvidia. The Dow Jones Industrial Average futures saw a modest decrease, dipping by 36 points, which translates to a 0.1% drop. The S&P 500 and Nasdaq 100 similarly edged down by 0.1%.

European markets experienced a bearish start on Wednesday. The pan-European Stoxx 600 index declined by 0.36% as of 10:18 a.m. London time, mirroring a broader trend of apprehension as most major bourses and sectors saw red. The automotive sector was particularly hard hit, dropping by 1.83%, while oil and gas stocks also saw a significant decrease of 1.04%.

Asia-Pacific stocks were mostly lower on Wednesday. Mainland China emerged as the outlier, with its stocks climbing against the regional downtrend. This divergence came on the heels of fresh economic data from Japan. Japan’s Nikkei 225 index fell by 0.85% to 38,617.1. South Korea’s Kospi index barely moved, edging down by 0.03% to 2,723.46, and Hong Kong’s Hang Seng index dipped by 0.2% as trading wrapped up.

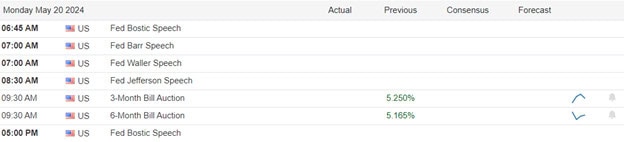

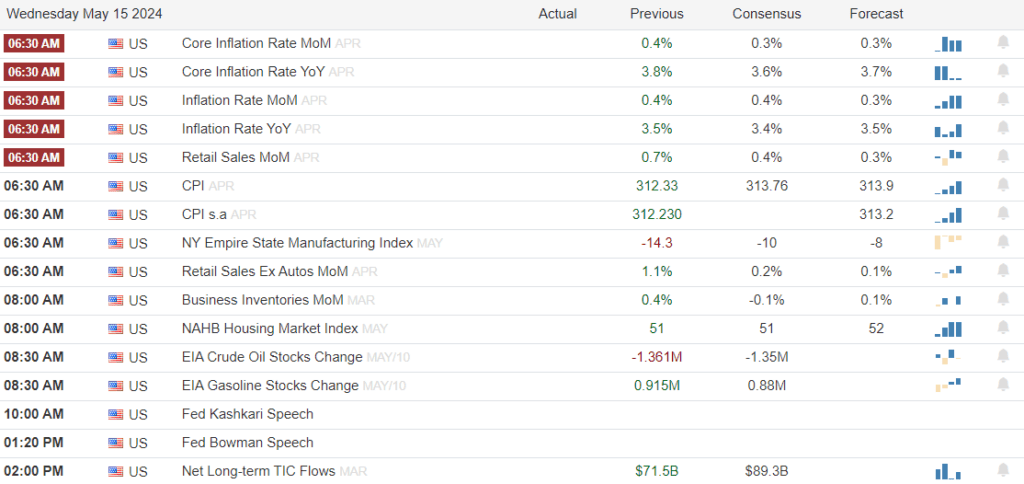

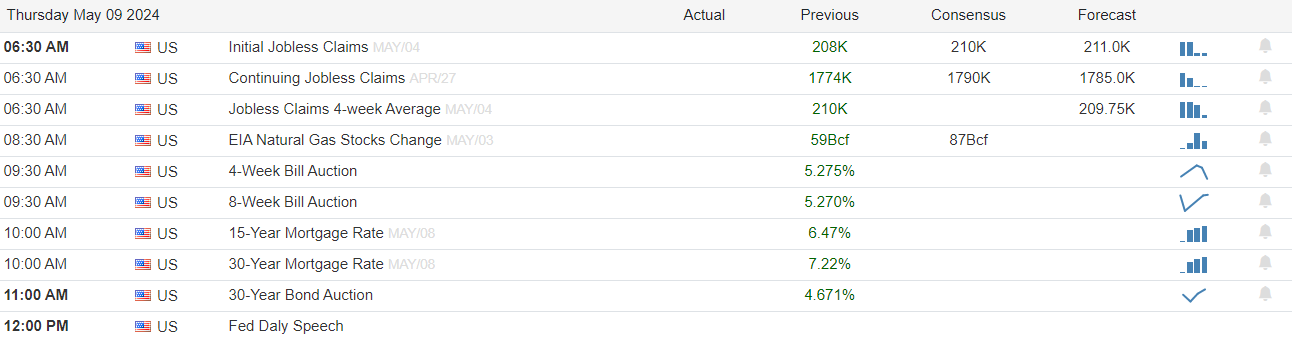

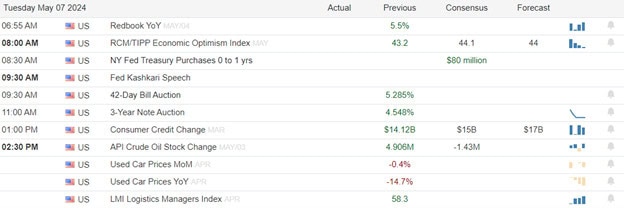

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include ADI, BRC, LPG, DY, GDS, KC, TGT, WOOF, PLAB, TJX, VIPS, & WSM. After the bell include NVDA, ENS, RAMP, SNOW, SQM, SNPS, VFC, & ZUO.

News & Technicals’

The Biden administration announced a significant step towards alleviating the financial strain of education debt on Wednesday, committing to the forgiveness of $7.7 billion in student loans. This sweeping measure will benefit over 160,000 borrowers, marking a substantial move in the government’s ongoing efforts to address the student debt crisis. The decision stems from the U.S. Department of Education’s recent enhancements to its income-driven repayment schemes and the Public Service Loan Forgiveness program. These improvements are designed to provide much-needed relief to borrowers, ensuring a more manageable repayment process and a clearer path towards financial freedom for those weighed down by educational loans.

The U.S. Department of Energy is strategically timing the release of gasoline reserves to coincide with the summer season, aiming to optimize the effect on fuel prices during a period of high demand. This initiative will see gasoline being distributed via a competitive bidding process, targeting retailers and terminals as the primary recipients. The backdrop to this move is a significant 19% rally in gasoline futures over the current year, propelled by escalating crude oil prices. This surge is largely attributed to OPEC’s production cuts and the looming anxiety over potential conflict escalation in the Middle East, factors that have injected volatility into the energy markets and heightened concerns over energy security and pricing stability.

In the United Kingdom, the inflation rate took a downward turn in April, settling at 2.3%, as reported by the Office for National Statistics on Wednesday. This figure inches closer to the Bank of England’s target rate, signaling a potential easing of the cost-of-living pressures. Despite this, the actual inflation rate fell short of the anticipated forecasts. Meanwhile, the core inflation rate, which strips out volatile components such as energy, food, alcohol, and tobacco, also saw a reduction, dropping to 3.9% from March’s 4.2%. This decline in core inflation suggests a softening in the underlying inflationary trends, providing a glimmer of hope for a more stable economic environment in the coming months.

The current discourse on inflation in the U.S. is marked by a sense of uncertainty among Federal Reserve officials, according to Julian Howard of GAM, as reported by CNBC. Despite recent data, policymakers continue to express concerns that inflation rates are persistently high and have not decreased as much as anticipated. This has led to a cautious stance on adjusting interest rates, with officials advocating for patience. Howard’s remarks underscore the inherent challenges in forecasting inflation, suggesting that even those at the helm of monetary policy are grappling with understanding the full scope and trajectory of inflationary trends.

Although Target numbers disappointed this morning the market will be heavily focused on Nvidia hoping the tech giant can keep the tech rally going. With a few more notable earnings and economic reports that include the FOMC minutes plan for an extra dose of price volatility.

Trade Wisely,

Doug