Tech Giants

Darn good earnings from the big tech giants after the bell have not received their typically very bullish response as election and rising infection rates across the county weigh on investor’s minds. Futures markets are trying to rally off the overnight lows this morning, but there is a palpable uncertainty as we head into the weekend. Technically speaking, the indexes are in a short-term oversold condition, but it may not be easy to inspire a bullish defense of these price levels. Continue to expect substantial price volatility driven by news events.

Asian markets closed in the red across the board overnight, with APPL suppliers selling off strongly in reaction to the iPhone sales decline. European markets trade around the flat-line this morning as they grapple with new virus related lockdowns and uncertain outcome of the U.S. elections. Facing just over 100 earrings reports and a reading on Personal Income futures, markets are trying to rally off of overnight lows but at this time point to a gap down open. Plan your risk carefully, heading into the uncertainty of the weekend.

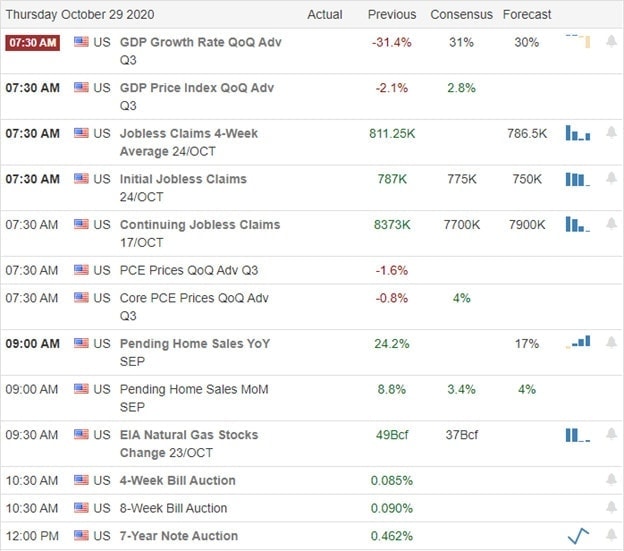

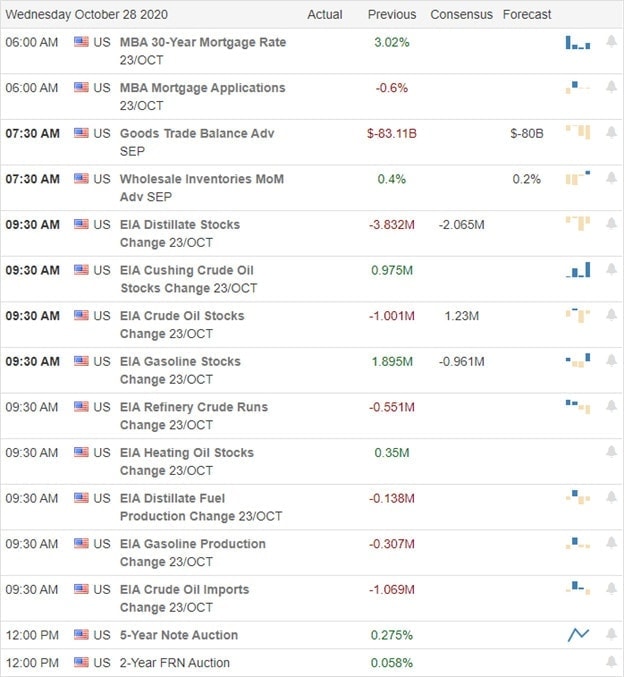

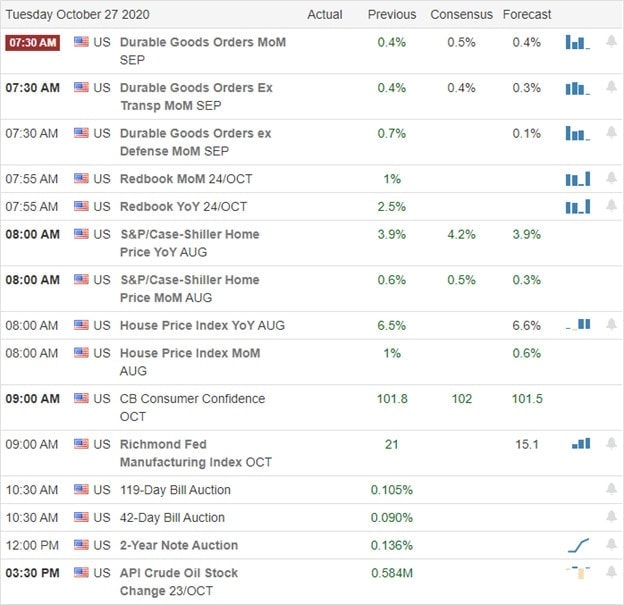

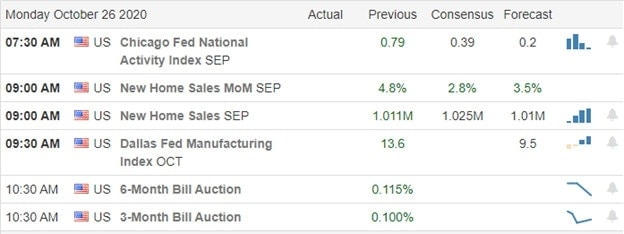

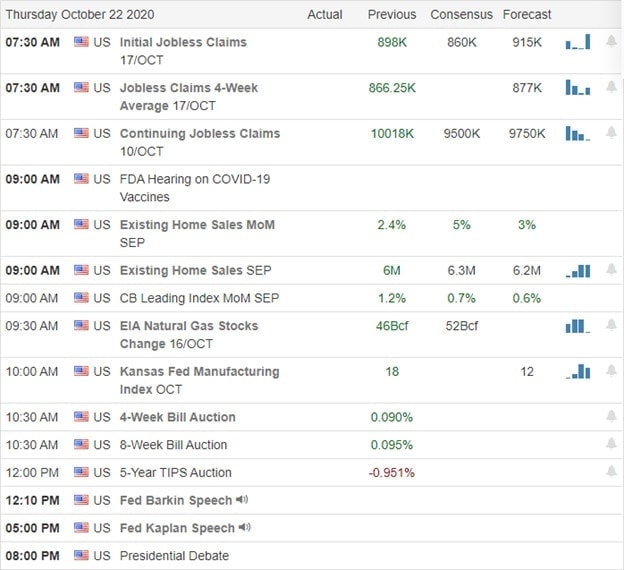

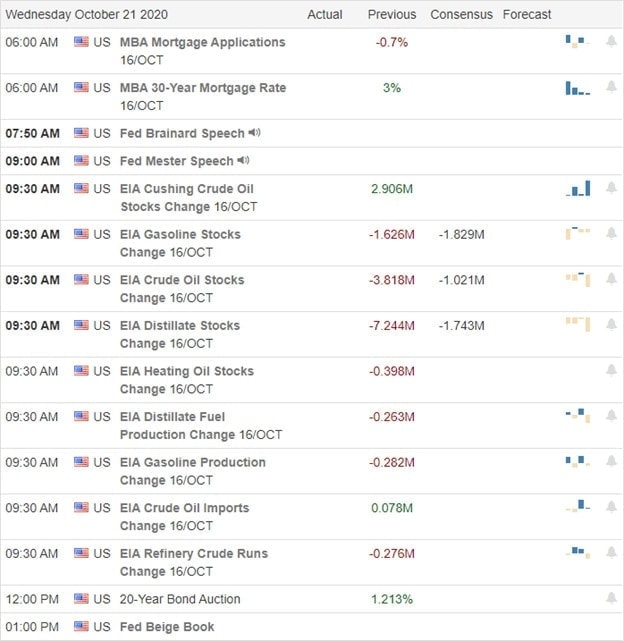

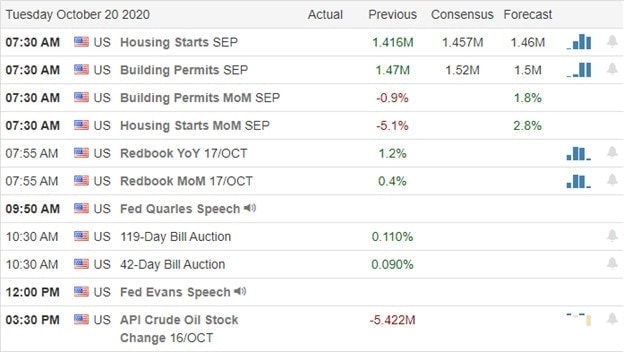

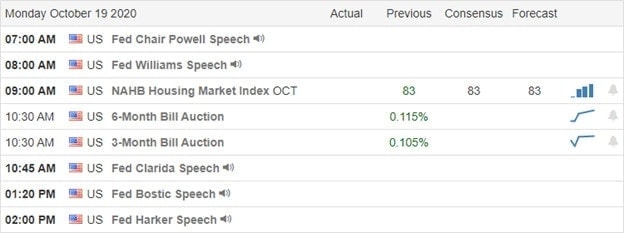

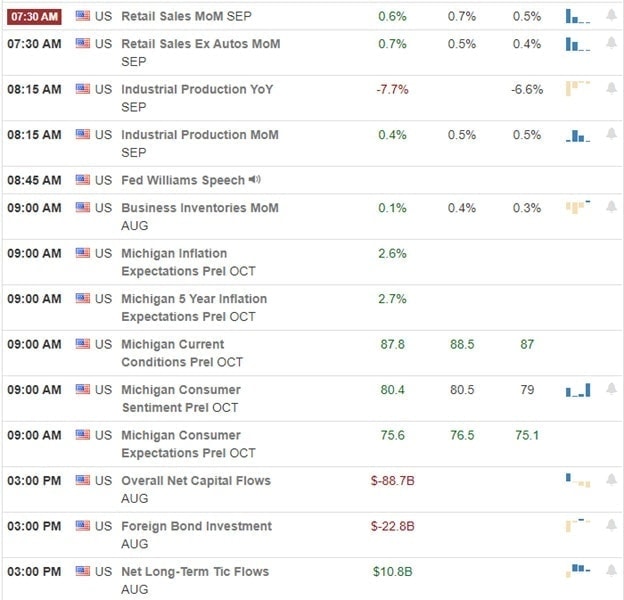

Economic Calendar

Earnings Calendar

We get a little break on earnings reports this Friday, with just over 100 companies reporting quarterly results. Notable reports include CVX, ABBV, MO, BAH, CHTR, CL, FTS, GT, HON, LHX, MMP, NWL, NVO, PSX, PBI, RUTH, SJR, USS, WPC, & WY.

News and Technicals’

Although the big techs reported strong earnings after the bell yesterday, it appears it was not enough to overcome election and virus uncertainty. Euro Zone topped GDP forecasts for the 3rd quarter, but new lockdowns in France and Germany have raised double-dip recession worries. With the presidential election in its final days and polling numbers beginning to tighten, we should continue to expect significant price volatility as the market tries to price the possible outcome. We can see this uncertainty in the treasury yields as they continue to slide south this morning.

Technically speaking, the small relief rally we experienced yesterday was nice but fell significantly short of boosting bullish confidence. Futures markets trading in the red all night but this morning lifting slightly off the overnight lows. Keep an eye on the DIA 200-day average. If the bulls defend this vital support, perhaps the process of repairing the technical damage in the charts can begin. However, if the bears pile on heading into the weekend, breaking this level, the DIA could drag the other indexes lower and threatening a test of their 200-day averages. With so much swirling uncertainty, it would not be a surprise if investors cut risk heading into the weekend, so stay focused and protect your capital.

Trade Wisley,

Doug