Retail Sales

As stats reopen their economies, consumers were out in force shopping according to the retail sales number. Although they remain sharply lower year over year, the bulls produced a massive gap at the open that proved to be very volatile are the coronavirus brings new China restrictions. Here in the US, governor’s remove restrictions on restaurants and health clubs, several states reported a record number of infections yesterday. The VIX remains elevated as the market continues to rally, creating extreme price volatility intraday to challenge even the most adept day trader skills.

Asian markets closed mixed but mostly higher as the IMF warns of an unprecedented crisis. European markets have fluctuated this morning but currently point to modest gains across the board as US Futures once again suggest a substantial gap up open. Stay focused on price action and remain very flexible with such high price action volatility.

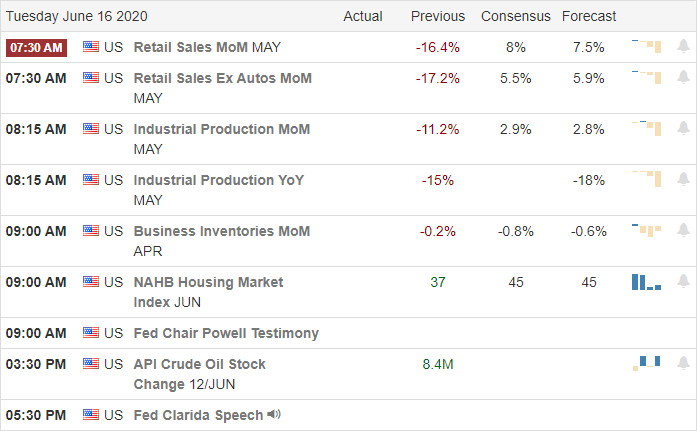

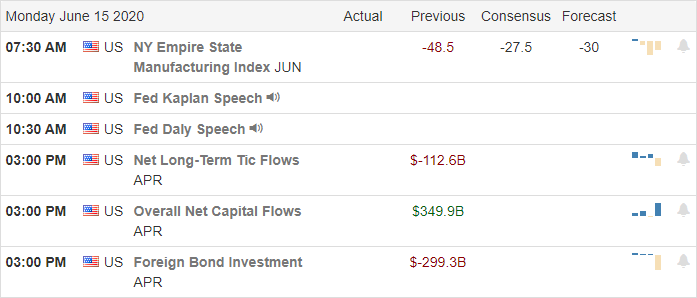

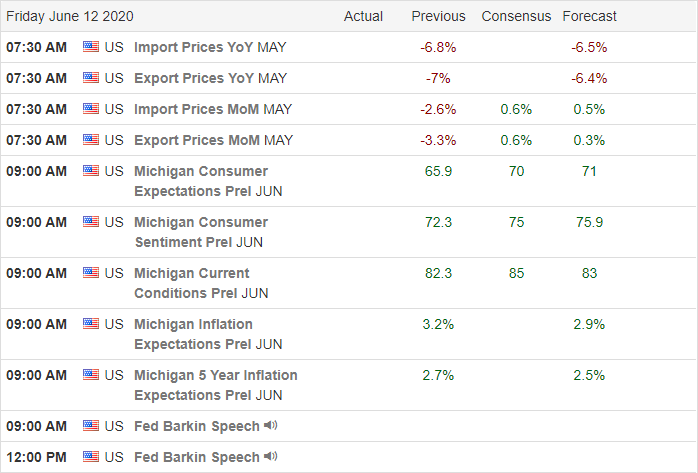

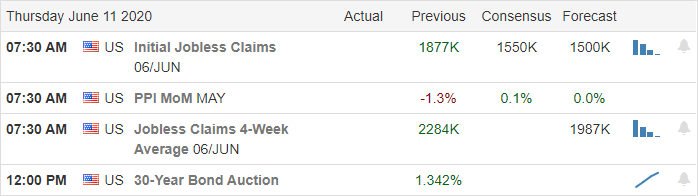

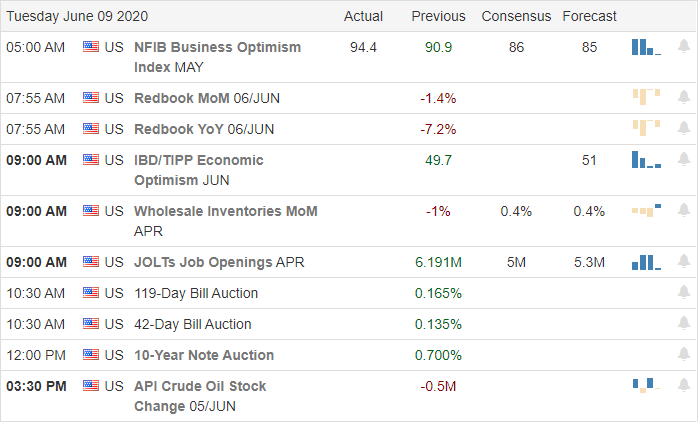

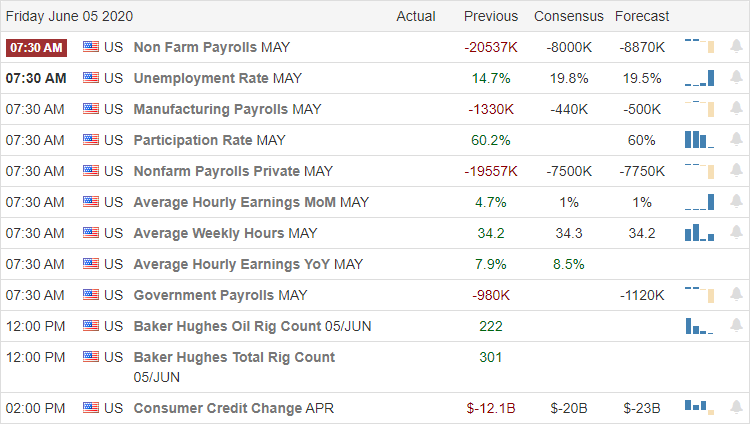

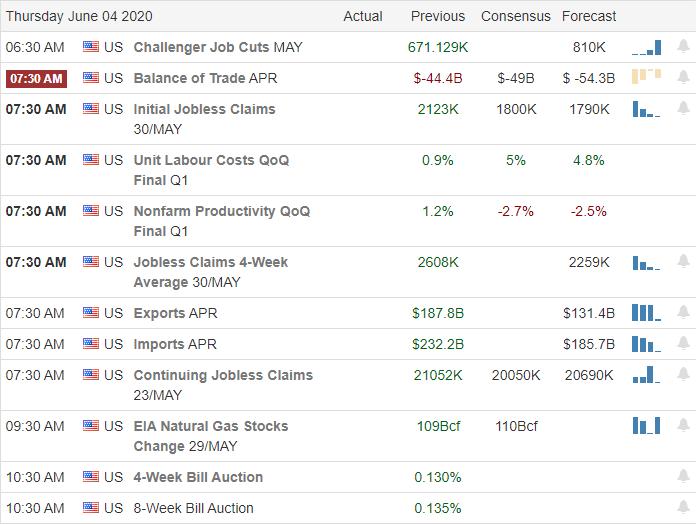

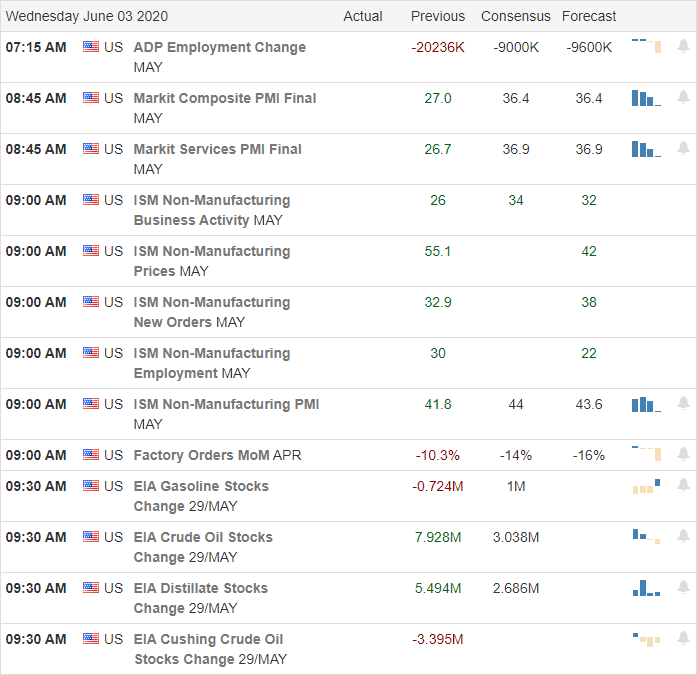

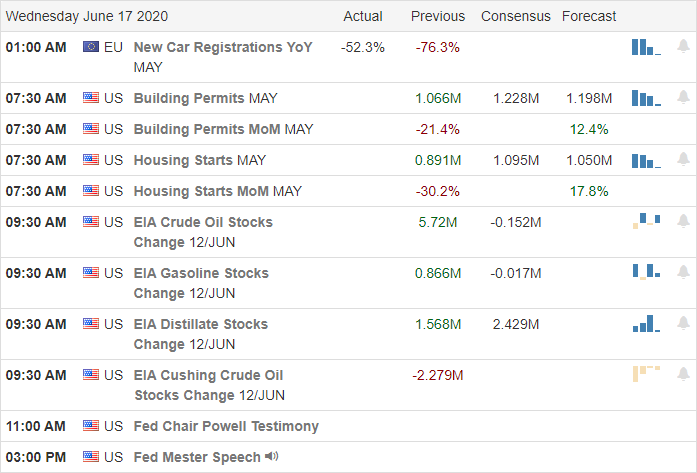

Economic Calendar

Earnings Calendar

On the Hump Day earnings calendar, we have a light day with 12 companies stepping up to report quarterly reports. Looking through the list, I only see one marginally notable report from ABM.

Technically Speaking

Fueled by much better than expected retail sales, the already bullish futures lept higher at the open. Though consumers returned to shopping with a vengeance raising hope of the recovery, the year over year numbers still needs a lot of improvement. News that China is implementing another round of restrictions with a resurgence of coronavirus cane close to reversing the bullish intraday, but the bulls charged back in before the close of day. Although the reopening of the economy has the bulls out in force, it is coming at a high cost, with several states reporting a record number of COVID-19 infections and hospitalizations yesterday. Should this trend continue, it will make a recovery very challenging for all struggling retail business. However, there was positive news of a treatment that, in a preliminary test, shows signs of improving the survivability of those hospitalized.

At the close yesterday, the DIA recovered and held just above its 200-day average while IWM remains challenged by this key resistance. The SPY closed well above its 200-day, attempting to test the island reversal pattern created on the June 11th gap down. The QQQ remains by far the most resilient of indexes lead by the internet giants, AAPL, AMZN, MSFT, GOOG & FB. The T2122 indicator is once again signaling a short-term extended condition with the Dow recovering more than 1400 points in just 2-days of trading. Although the VIX has pulled back the last couple of days, it remains very elevated closing above a 33 handle as the extreme price volatility continues to keep the danger level high. The enormous overnight reversal gaps and the rapid intraday price swings have made the market particularly dangerous for retail traders. They are either forced to hold and pray, suffering whatever the market hands out, stand on the sidelines, or attempt day trading the extreme volatility. Its no surprise there is another gap expected this morning, but what comes next in Coronaland is anyone’s guess.

Trade Wisely,

Doug