Gap it down, whip it hard, chopping up traders accounts in the process as politicians continue to kick around the stimulus football. Almost lost in the background noise of this political silliness, joblessness is rising, and new virus infections top 60k in a single day. Toss in earnings season, and we have the perfect climate for continued wild price volatility as an emotional market awaits the next news report to fuel the next whipsaw.

Asian markets closed mixed but mostly higher amid rising virus fears. European markets are currently rebounding from early losses now green across the board. Recovering from overnight lows, the US Futures point to modest opening gains ahead of earnings and economic reports that include Retail Sales numbers. What comes next is anyone’s guess.

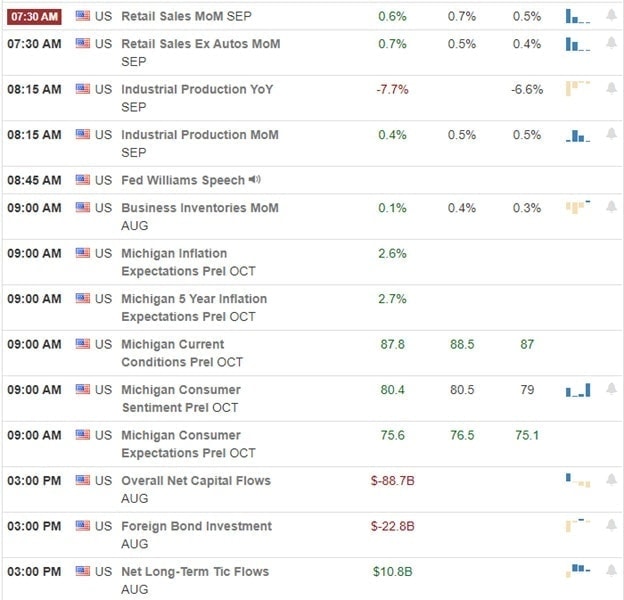

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have 20 companies reporting quarterly results. Notable reports include ALLY, BK, CFG, JBHT, KSU, SLB, STT, & VFC.

News & Technicals’

Stimulus uncertainty and rising infection concerns brought out the bears Thursday morning, punishing those holding long positions. With news reports, the President was willing to increase his 1.8 Trillion offer spurred a rally to punish any short traders. This morning, we hear that even though the White House is ready to support a bigger package, the Senate may not be willing to pass such a massive spending package. Can we get off this political merry-go-round? Please! While stimulus wrangling continues to whip the market around jobless claims, increased substantially, and new coronavirus infections topped 60,000 yesterday. Stimulus or not, the economic damage to the economy is real and makes me wonder how much longer we can ignore its impacts.

Though the rally back yesterday was substantial, it will only look like a knee jerk reaction unless the price action can follow-though breaking the short term downtrends and recovering lost price supports. Continue to expect extreme market sensitivity to the Washington spin cycle and the growing headwinds of rising infection rates heading into this weekend.

Trade Wisely,

Doug

Comments are closed.