Uncertainty Dominates Price Action

After a will day of volatility where the Dow whipsawed more than 650 points closed the day lower as fear and uncertainty dominate the price action. Though indexes appear very oversold in the short-term futures indicate another substantial gap lower this morning with the CDC announcing our first community spread incident of the virus. As much as we all want some selling relief the conditions suggest this could get much worse before it gets better. Anticipating a bounce with a buy the dip mentality could prove very dangerous in the days ahead.

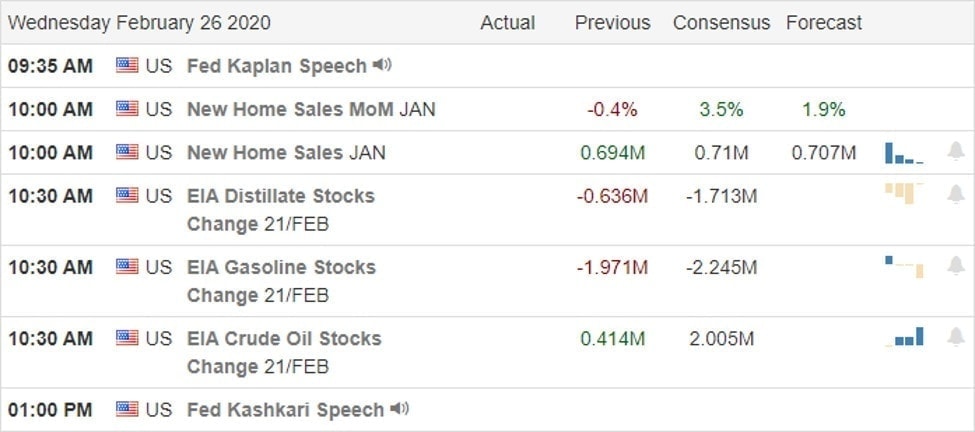

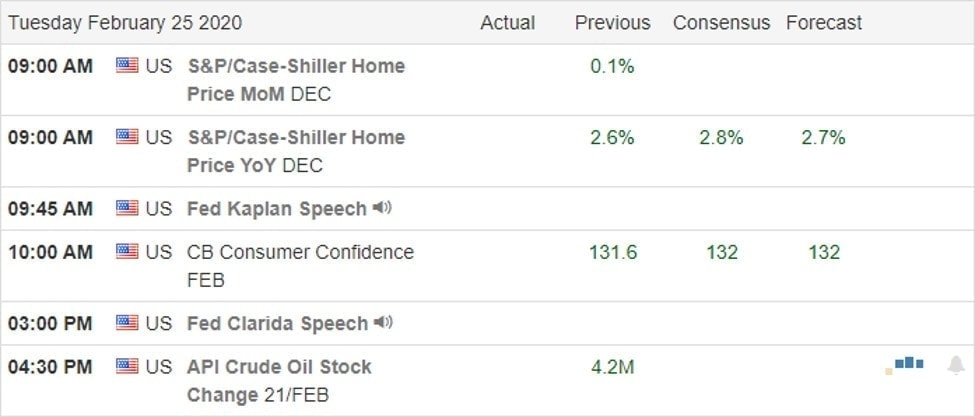

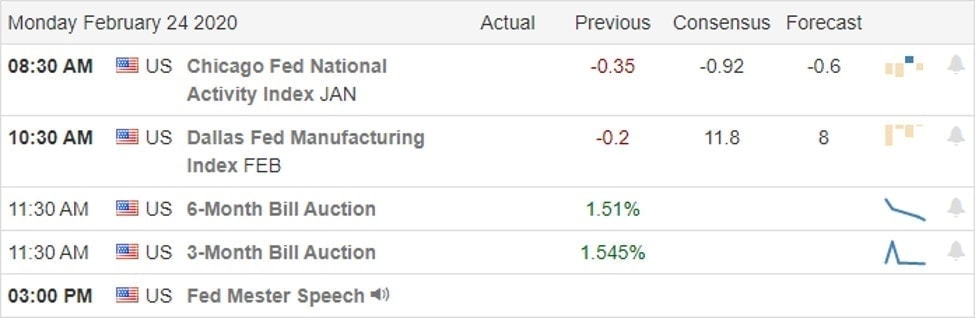

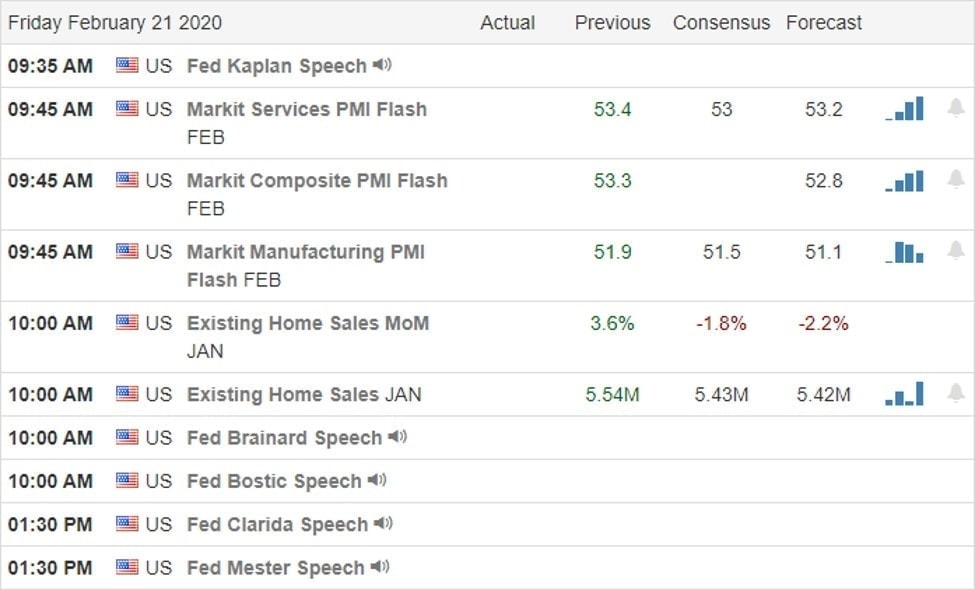

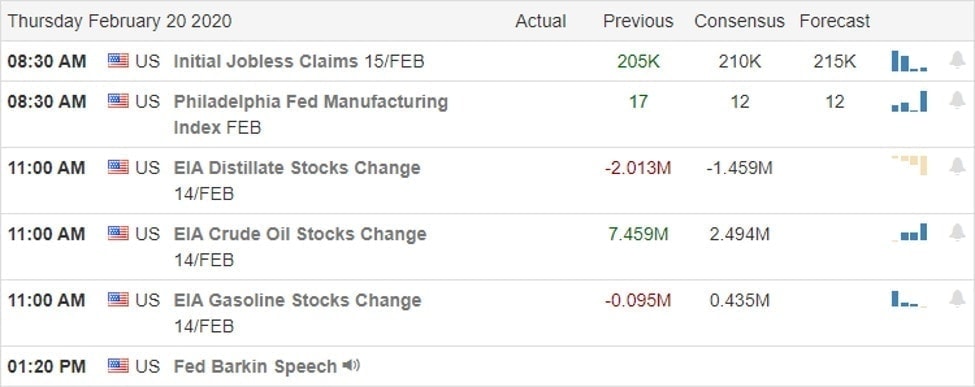

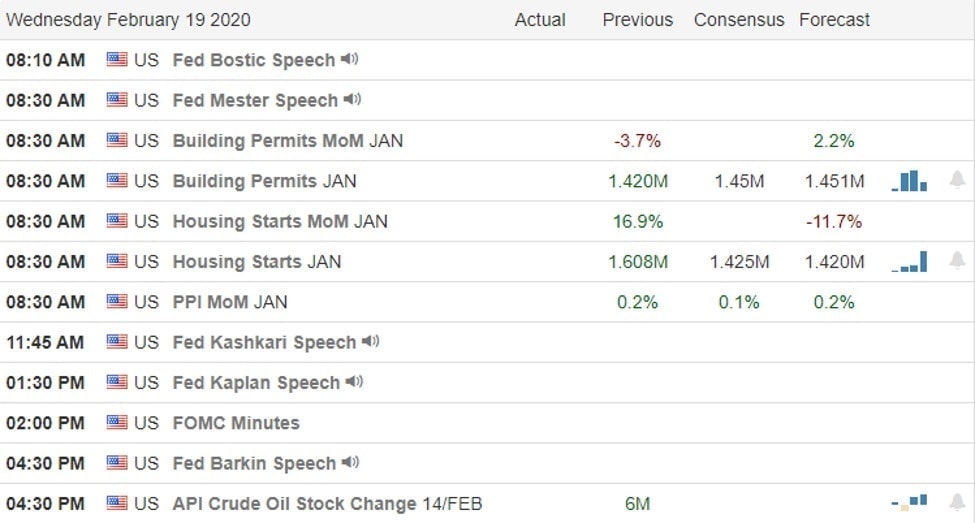

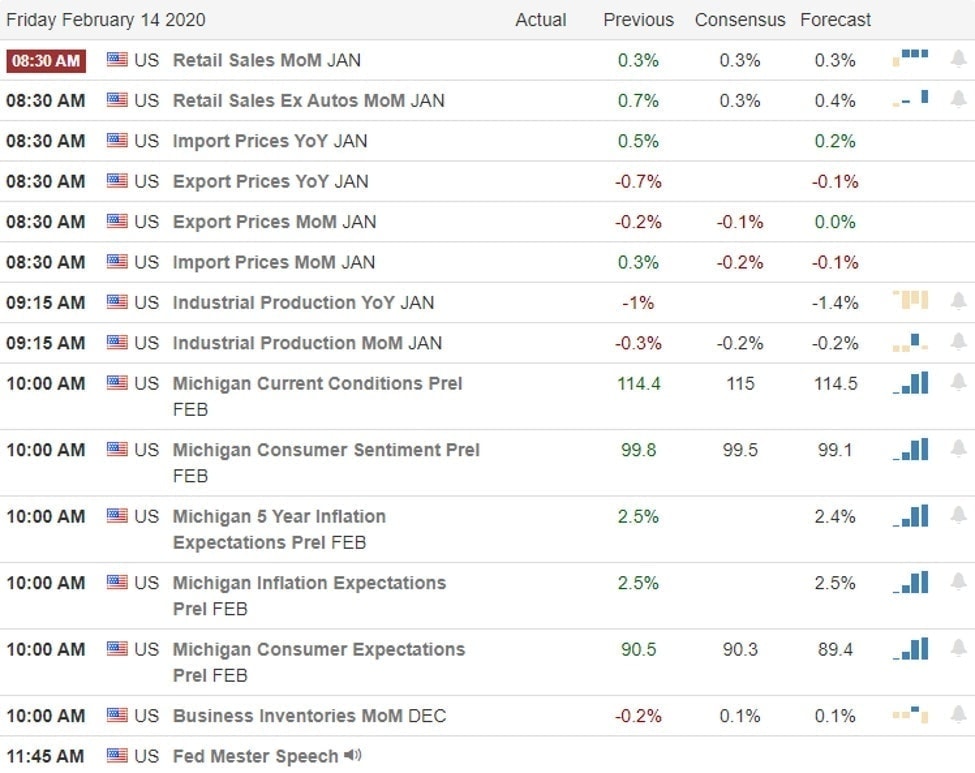

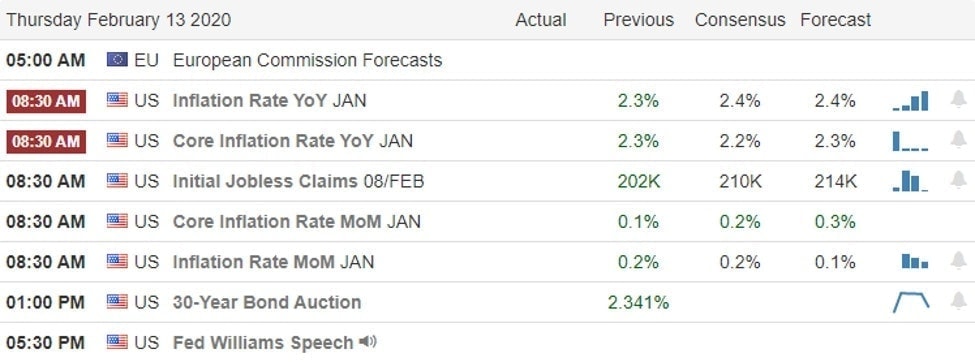

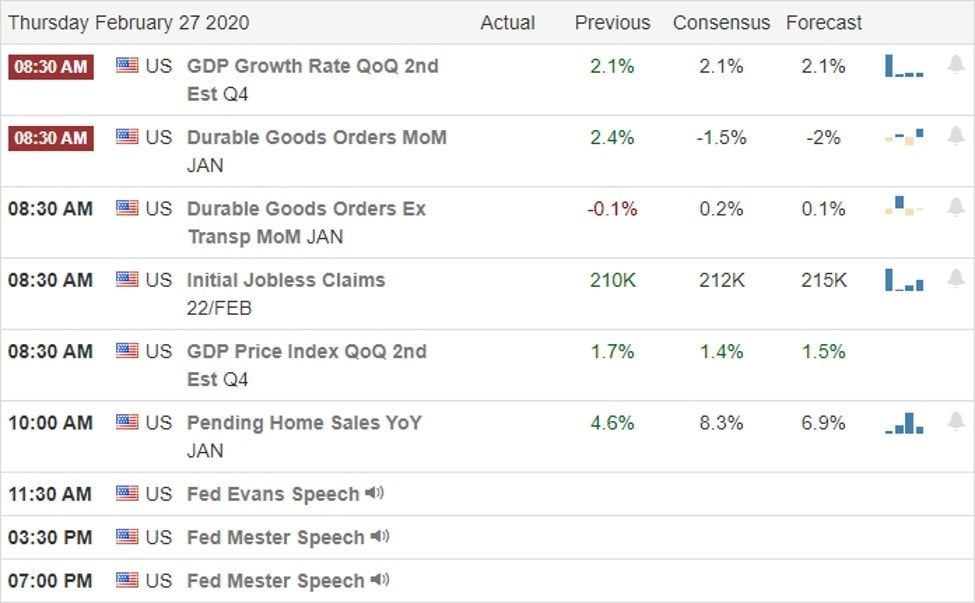

Asian markets closed mixed overnight with Japan sinking 2% with the South Korean central bank holding rates unchanged. European markets are decidedly bearish this morning declining more than 2% with the outbreak continuing to spread. Ahead of our biggest day of earnings reports and a busy economic calendar US Future point to Dow gap down of more than 350 points. Expect fast price action, news-driven reversals and intra-day whipsaws to continue as we head into the weekend.

On the Calendar

On the Thursday earnings calendar is the biggest day of reports this week with more than 325 companies fessing up. Notable reports include AMC, BUD, ADSK, BIDU, BBY, BYND, CROX, CRON, DELL, DISCA, EOG, EQT, FLIR, FRO, GCI, GNC, IQ, JCP, JD, KDP, MAIN, MYL, NLSN, NRG, PRGO, RRC, SRE, SWCH, TTD, TD, VMW, WDAY.

Action Plan

Yesterday’s 650 point whipsaw in the Dow shows the market stress as it struggles to come to grips with the virus impacts. The CDC announced that a woman in California tested positive for the virus and is now the first community spread case in the US. The news reports on the spread of the virus around the world are becoming increasingly grim as health agencies struggle to inhibit the expansion. Companies continue to warn of substantial financial impacts and uncertain markets continue to fall. Where this ends is anyone’s guess but for now price volatility will continue to make trading very challenging and traders should prepare for the fact this could get a lot worse before it gets better.

Technically speaking indexes are oversold but in this situation market fears could continue to drive the markets lower. I suspect we could soon experience more drawdowns with mutual fund redemptions and 401 plan holders shifting to money markets to protect their capital. The cascading effect can trap traders trying to buy the dip attempting to anticipate an oversold bounce or relief rally. It will take a significant time for the daily charts to recover to the point that bullish patterns can appear. With the high volatility this is a Day Traders market. Swing and position traders will find this to be very challenging and dangerous. Remember that cash is positon and just because the market is open you should not be compelled to trade it until conditions improve. Protect your Capital!

Trade Wisely

Doug