Could this be the perfect storm of market uncertainty? Election, new record infection rates, an earnings deluge, and a big week of economic data lining up to provide the potential for incredible price volatility. An environment best suited for very adept day traders that quickly react to morning gaps, whipsaw, and news-driven intra-day reversals. All other traders will find it difficult to impossible trade with an edge as the market reacts. Consider the risk carefully, and always remember protecting your capital is one of a trader’s primary jobs.

Asian markets traded mixed overnight as virus infections surge, and oil prices fall. European markets trade in the red this morning, with the DAX down more than 2%. U.S. futures point to a nasty gap down at the open ahead of earnings data and the latest reading on New Home Sales. Prepare for a wild week of uncertainty.

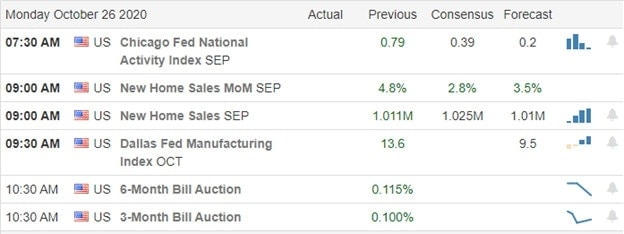

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 30 verified companies stepping up to report quarterly results. Notable reports include AGNC, ACC, BYD, CAJ, CINF, FFIV, HAS, NOV, OMF, PKG, & TWLO.

News & Technicals

With the election just one week away and a severe rise in pandemic infections, U.S. futures reflect the incredible uncertainty. With infection rates hitting a new record high, hospitalizations are rapidly increasing, and the death rates rise once again, determining any company’s market value amid all the impacts is near to impossible. That said, traders should expect wild price volatility to continue with extreme sensitivity to the news cycle. One bright light is the hope for a vaccine to combat the virus that could be available by early December but for small businesses, just barely holding that is little solace. Current market conditions favor the experienced day trader, and swing traders will find it very difficult to trade with an edge. Remember that just because the market is open does not mean you have to risk your hard-earned capital. One of the trader’s primary jobs, forgotten during uncertain markets, is to protect your money. Keep that in mind as you plan your risk forward.

Besides the election and pandemic, the market faces an earnings deluge and a big week of market-moving economic reports pouring rocket fuel to potential volatility. Expect large moring gaps, news-driven whipsaws, and intra-day reversals as the market tries to price such incredible uncertainty. Of course, we can’t forget the possibility that Congress could at any time announce a stimulus package. Plan your risk wisely.

Trade Wisely,

Doug

Comments are closed.