As coronavirus numbers surge, wild-eyed speculation of stimulus continues to drive indexes toward record territory. With Speaker Pelosi issuing a 48-hour deadline to get a deal passed before the election, expect extreme price sensitivity on the stimulus news cycle. Substantial whipsaws and full intraday reversals are possible as both sides of the aisle battle for position through the news. There is a lot at stake as we push company valuations to perfection and beyond, even as our economy faces rising joblessness and new business impacts due to the rising infection rates.

Asian markets surged during the night as China reports their economy grew by 4.9%. European markets are flat cautiously monitoring US Stimulus talks and Brexit uncertainty. US Futures point to a Dow gap of nearly 200 points ahead of earnings, Jerome Powell comments, and the latest reading on the Housing Market Index. Buckle up for another week of challenging price volatility.

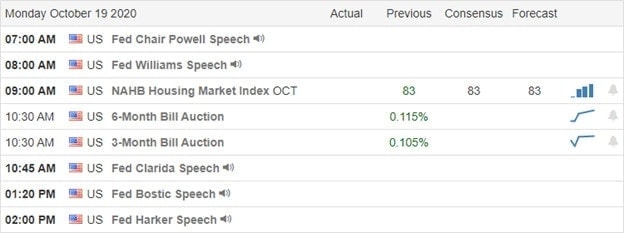

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 20 verified reports as the 4th quarter earnings volatility begins to ramp up. Notable reports include ADC, FNB, HAL, IBM, LLI, PPG, STLD, & ZION.

News & Technicals’

Speaker Pelosi drew a line in the sand this weekend, giving the White House just 48 hours to reach an agreement on a stimulus package so that it can be passed before the election. Reports suggest the Pelosi and Munchin will continue negotiations today, but it’s still unclear if the Senate has the willingness to give the deficit spending bill nearing a 2 trillion dollars. China released numbers saying its economy grew 4.9% in the third quarter lifting Asian markets overnight. Unfortunately, as coronavirus infections accelerate, new restrictions and lockdown measures increase the economic uncertainty looking forward. Worldwide cases of the virus topped 40 million, with more than 90K new cases reported in the US over the weekend. The IMF downgraded the outlook for the Middle East and Central Asian economic recovery, with oil prices expected to suffer next year due to virus-driven demand impacts.

That said, US Futures are surging this morning as hopefulness of a stimulus deal outweighs virus concerns. The T2122 is once again suggesting that we are in an extremely overbought condition as wild-eyed speculation pushes the indexes toward record territory. As we gap up once again in anticipation, remember to watch for the possibility of a pop and drop pattern. Traders will have to stay on their toes as news sensitivity around stimulus could be extreme should negotiations fail. With the VIX continuing to hold above 25 handles, anything is possible, so plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.