Today we face a big day of earnings news that has been a mixed bag of results so far this quarter. Couple that with the uncertainty of stimulus, rising virus impacts, election meddling by Iran, and Russia expect extreme sensitivity to the news cycle and the significant price volatility to continue. The DIA, SPY, and QQQ are quickly approaching their 50-day averages, and one has to wonder if they can hold as support without a stimulus deal. If we head into the weekend still waiting on a deal, don’t be too surprised to see the bears become more aggressive.

Asian markets closed mixed but mostly lower overnight as the IMF downgrades economic growth forecasts amid rapidly rising infection rates worldwide. European markets are flat this morning as they continue to monitor U.S. stimulus talks and earnings results. U.S. futures point to a slightly bearish open at this time, but with a big day of earrings and Jobless Claims numbers, anything is possible by the open. Plan your risk carefully and be prepared for news-driven whipsaws and full reversals.

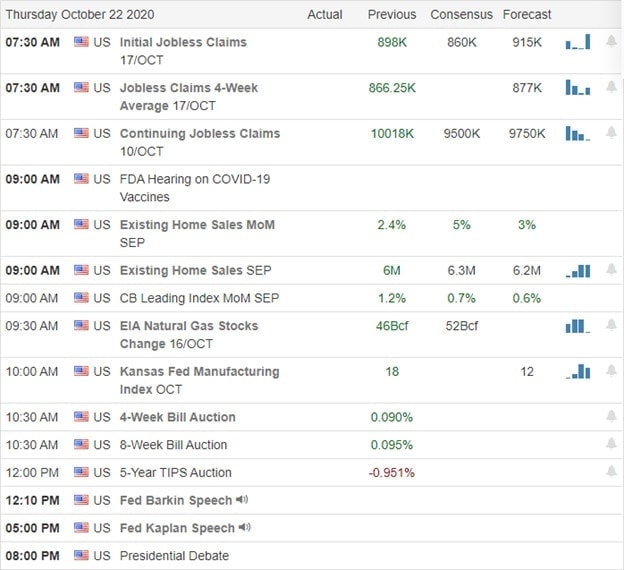

Economic Calendar

Earnings Calendar

We have our busiest day of the week on the Thursday earnings calendar, with 80 verified quarterly reports. Notable reports include ALK, AB, AAL, AEP, T, BJRI, SAM, CTXS, KO, DOW, EHTH, FITB, FCX, GPC, HBAN, INTC, KMB, LLNW, MTB, MAT, NOC, NUE, PBCT, PHM, DGX, RHI, STX, SIRI, LUV, TSCO, UNP, VLO, VRSN, GWW, & WST.

News & Technicals’

Wednesday was another day of struggle as the market waits for a decision on stimulus negotiations. The bulls controlled the positive morning gaps that quickly ran out of steam allowing the bears access and leaving behind tremendous uncertainty in the candle patterns. With the DOW, SPY, and QQQ drawing near their 50-day averages, a test of this key technical levels seems likely unless news of a stimulus deal occurs soon. Although there is a palpable uncertainty in the market, the index charts’ technical damage is minimal, with lower highs as the primary concern. However, that damage could become critical if the 50-day moving averages are unable to hold as support. Earnings thus far have shown a mixed bag of results, and with today being the biggest round of reports so far this season, we should expect an extra dose of price volatility as a result. As the election draws near, the FBI says both Iran and Russia have obtained U.S. voter registration data to influence the outcome. A cybersecurity firm confirmed that a hacker is trying to sell info on 148 million U.S. voters. Despite the issues, please get out and vote! The oil industry is now warning of significant layoffs in the coming weeks as rising virus infection rates substantially impact the sector. I can only imagine the damage and helplessness business must feel as the infection and death rate numbers increase and the worry of more restrictions on the horizon.

Overnight futures were quite bearish, but this morning they have bounced off the lows, trying to put on a brave face ahead of a slew of earnings and economic news that includes the latest reading on Jobless Claims. With so much uncertainty swirling about, expect a considerable price sensitivity to stimulus and virus news. If there is still no deal as we head into the weekend, I would not be surprised to see the bears become more aggressive. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.