After the worst day of selling since June, the market faces a data deluge with several tech giants rounding out the day after the bell. Should they report well, may finally get some relief heading into the weekend. Should they disappoint or guide lower like MSFT, Friday could be a painful day heading into the uncertainty of the weekend. With infection rates surging over 80,000 yesterday here in the U.S. and news that France and Germany are going into nationwide lockdowns, fear of a double-dip recession is growing fast. Plan your risk carefully!

Asian markets closed mixed but mostly lower overnight in reaction to the Wall Street Plunge. European markets are choppy this morning, hovering around the flatline with an ECB decision in focus. Ahead of a massive day of earnings and economic data, U.S. futures are trying to hold on to some positive numbers. Hold on tight and prepare for another day of challenging news-driven volatility.

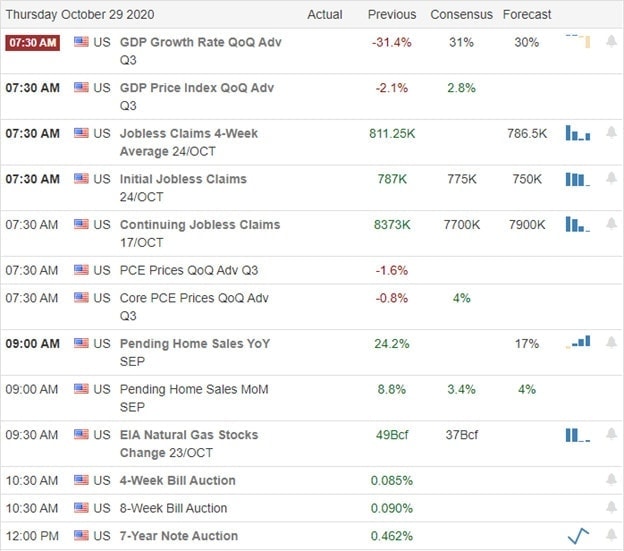

Economic Calendar

Earnings Calendar

Thursday is the biggest day on the earnings calendar this week, with more than 250 companies fessing up to quarterly results. Notable reports include GOOGL, AMZN, AAPL, FB, FLWX, AOS, ANN, ATVI, AMT, BUD, APO, CAR, BAX, BWA, CAKE, CHD, CMCSA, COP, CS, DVA, DVN, DLR, DNKN, FTNT, GLPI, LMUN, IP, K, KDP, KHC, KTOS, LPSN, LTC, MTX, MPW, MGM, TAP, NOK, OHI, OSTK, PENN, PCG, RL, RDS.A, SNY, SHAK, SHOP, SO, SPOT, SBUX, STNE, TROW, TPR, TWTR, X, VRTX, WU, WWE, XYL, YU< & ZEN.

News & Technicals’

After the biggest day of selloff since June, U.S. Futures point to a modest bounce this morning. Today will be a massive day of data with our most important day of earrings reports since the beginning of the 4th quarter earnings season. The big tech market-moving reports AMZN, AAPL, FB & GOOGL occur after the bell, which means anything is possible Friday morning, so plan your risk carefully heading into the close. Treasury yields are moving slightly lower this morning ahead of the 3rd quarter GDP economic growth figures at 8:30 AM Eastern. If that’s not enough data to digest, we will also get the latest reading on the weekly Jobless Claims. Concerns continue to grow for the possibility of a double-dip recession, and France and Germany initiate nationwide lockdowns to combat surging infection rates. Daily infection number topped 80,000 here in the U.S. yesterday. With just 5-days to the Presidential election, the market uncertainty as to what comes next as the index chart technical damage grows. If the big tech firms perform well this afternoon, the market could get a little relief. However, if any of them fall short of spectacular results such as MSFT, the path into the weekend could be lead by the bears.

With the DIA now so close to its 200-day average, it would seem a test of that level is very likely in the days ahead. Of course, everything could quickly reverse if a stimulus deal is agreed upon, but the evidence is now pointing to 2021 for that to occur. Stay focused and flexible, and always remember that cash is a position often underutilized in such troubled times.

Trade Wisely,

Doug

Comments are closed.