Rising infection rates and concerns of more economic impacts, brought out the bears yesterday, breaking the psychological support of the 50-day average in the DIA, SPY, and QQQ. Although the market seems certain government stimulus will eventually happen, Congress’s inability to reach a deal before the election puts tremendous pressure on earnings performance. Will earnings be enough amid so much future uncertainty?

Asian markets traded mixed but mostly lower overnight. European markets trade cautiously mixed this morning as the monitor earnings and the surging virus numbers. Here in the U.S, ahead of a big day of earnings and economic news, the bulls are trying to put on a brave face pointing to a gap up open that may prove to recover the 50-day average in the SPY and QQQ. Expect another day of news-driven price volatility.

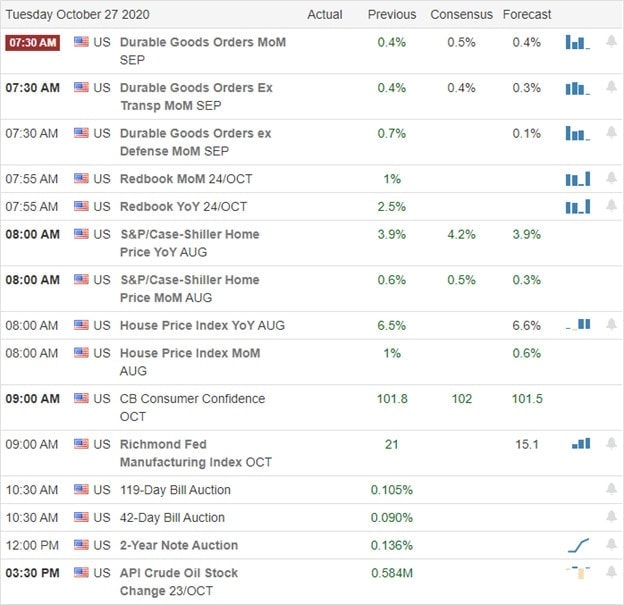

Economic Calendar

Earnings Calendar

We have more than 90 companies reporting as 4th quarter earnings ramp up on the Tuesday earnings calendar. Notable reports include, MSFT, MMM, AMD, AFL, AKAM, SAN, BP, CAT, CNC, CYH, GLW, CROX, DENN, ECL, LLY, FEYE, FSLR, BEN, HOG, IVZ, JBLU, LH, MKTX, MRK, NVS, RTX, QSR, SPGI, SHW, SSTK, SWK, & XRX.

News & Technicals’

Rising virus infections and no sign of stimulus from Congress brought out the bears yesterday, creating significant technical damage to the index charts. Today we have a big round of earnings reports that include market movers such as MSFT, AMD, and CAT. Still, as infection rates hit new records, the uncertainty may continue to weigh heavily even if earnings results come in bullishly. The WHO yesterday said gaining control of this new virus surge may require significant sacrifice, and hinting more restrictions may be on the horizon. U.S. Treasury yields are moving lower this morning as market participants are increasingly concerned about the viral upsurge and its potential economic impacts. The Senate confirmed Amy Coney Barrett to the Supreme Court yesterday and blocked an attempt to extend the voting deadline in Wisconsin, a central battleground state in the presidential election.

With the DIA, SPY, and QQQ all closing the day below their 50-day averages, the index charts’ technical damage is starting to become a significant concern. However, as earrings roll out this morning, the bulls are trying to put on a brave face pointing to a gap up open that may suggest a defense of this critical psychological level on the SPY and QQQ this morning. The question to be answered, can earrings overcome the concerns and the possible economic impacts of COVID in the absence of governmental stimulus? One thing we can count on is that price volatility and sensitivity to news will continue to challenge even the most adept traders trying to navigate the uncertain path forward.

Trade Wisely,

Doug

Comments are closed.