Will they or won’t they agree on a stimulus deal remains the big question of the day? Emotions are high on the subject that could have dramatic effects on the short-term market direction. If Pelosi and the White House finally agree, there is still the uncertainty if the Senate has the votes to pass a spending plan over 2 Trillion. That said, news of a deal expect the bulls to celebrate. A failure to reach an agreement and expect a market temper tantrum, creating technical damage in the index charts. Hold on for another uncertain day as we wait.

Asian markets closed mixed but mostly higher overnight, but European markets trade in the red across the board this morning. US Futures point to flat open as we wait on stimulus news, earnings, and economic data. Expect volatility and remain focused and flexible as anything is possible.

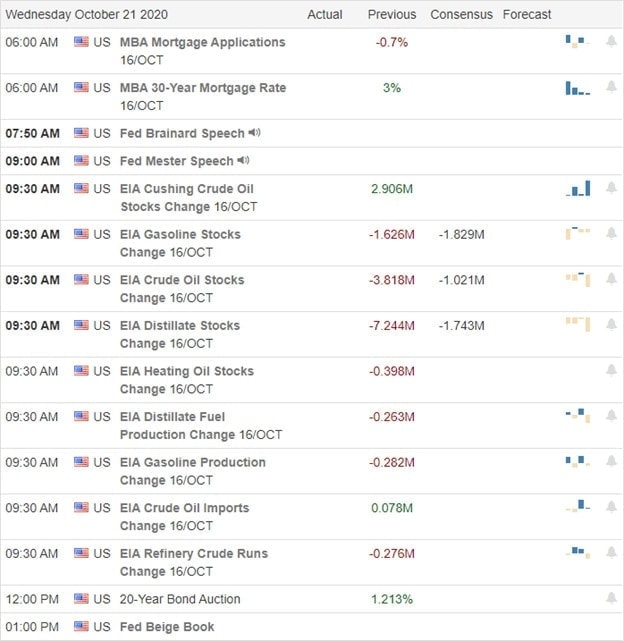

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have 35 verified companies stepping up to report quarterly results. Notable reports include TSLA, ABT, AN, BKR, BIIB, CMG, CCI, CSX, DFS, EW, DFX, GL, KEY, KMI, LRCX, LVS, LAD, MANU, NDAQ, NEE, SUI, TMO, VX, WHR, & WGO.

News & Technicals’

Apparently, the Pelosi imposed deadline has passed and was nothing more than a negotiation tactic as talks continue today. Yesterdays’ price action reflected the high market emotion chopping rather violently as hope rose and fell throughout the day. The good news is we do not have to deal with a considerable gap this morning but, we will have to prepare for another day of uncertainty with high volatility on a deal or no deal news event. After the bell, NFLX disappointed investors by missing earnings estimates. Shares of the streaming behemoth indicate more than a 25 dollar per share drop at today open. According to reports, next week’s GDP report will likely show record-breaking economic growth if estimates are correct. Across the pond, the top Brexit negotiator says that a trade deal is now in reach, boosting the British pound overnight. That could have ripple effects in the currency markets today, lowering the US Dollar and proving the energy for Gold to break above price resistance.

Technically speaking, the bulls have defended critical price supports in the index charts, but the palpable uncertainty has them teetering on the edge. A lot is riding on the stimulus deal’s outcome, and traders should prepare for a substantial and volatile price move as news spin on the subject tugs on market emotion. The bulls will likely celebrate with a strong rally should they hammer out a deal, but we should also prepare for a market temper tantrum and a bear attack should they fail. Keep an eye on the news and stay focused on price action as we wait.

Trade Wisely,

Doug

Comments are closed.