The bulls worked hard to defend the 50-day average of the QQQ yesterday, even as the bears added technical damage to the DIA and SPY charts yesterday. I think there was a significant hopefulness that MSFT would produce an earnings report to support this effort, but with the company offering up weak revenue guidance, hope quickly faded. Factor in more stimulus delay’s rising infection rates as well as political uncertainty, and it’s no surprise that the bears are gaining ground.

Asian markets closed mixed but mostly lower overnight as concerns of economic impacts continue to grow with rising infection rates. European markets grappling with all the uncertainties trade sharply lower this morning. U.S. Futures ahead of a big day of earnings and economic data point to a punishing gap down, adding significant technical damage to the index charts. Hang on; it could be a very volatile day!

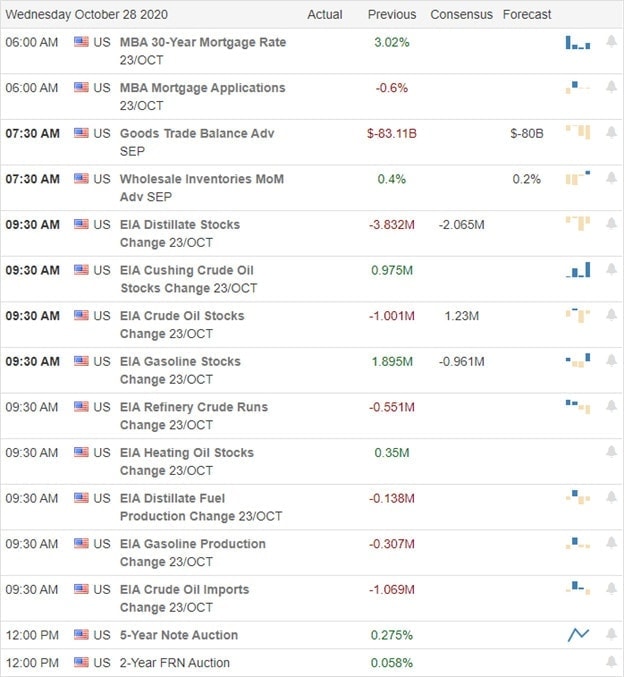

Economic Calendar

Earnings Calendar

The earnings reports ramp up this Wednesday with more than 100 verified companies stepping up to quarterly results. Notable reports include AEM, AMGN, NLY, ANTM, BX, BA, BOOT, BSX, EAT, CHDN, DB, DRE, EBAY, EPD, EQIX, ESS, ETSY, FSLY, FCAU, F, GRMN, GD, GE, GILD, GSK, GRUB, HES, LVGO, MAS, MA, NDLS, NSC, ORLY, PINS, R, SIX, RGR, SPWR, TDOC, TUP, UPS, V, WELL, WDC, WH, & TUMC.

News & Technicals’

Uncertainty settled the market into a choppy trading range most of yesterday, with bears ultimately gaining the edge by the close of the day. After the bell, MSFT reported better than expected but guided revenue lower, adding some selling pressure in aftermarket trading. It could be a rough day for some tech giants as FB, GOOG, and TWTR CEOs get grilled by a Senate committee. They hope to convince the Senate not to change liability laws that currently allow social media site protections that mainstream media outlets don’t enjoy. Should the laws change, it could forever change the social media industry. The delays continue to pile up on the stimulus front, with some now suggesting a deal may not happen until early 2021. Combine that with another big day of reported infections and rising deaths, and markets worldwide feel the pressure this morning.

Yesterday’s bearish follow-through day of selling added significant technical damage to the DIA and SPY charts. The QQQ managed a weak bounce off its 50-day average but with the market pointing to a nasty overnight reversal that will drop the index below this critical technical level. Facing a big round of earnings reports, International Trade and Petroleum numbers volatility will remain high, and I suspect that will continue through the election and possibly beyond. One possible bright spot is that with this morning’s gap down, the T2122 will show a short-term oversold condition. That said, it may be difficult for bulls to find inspiration amid all the economic and political uncertainty.

Trade Wisely,

Doug

Comments are closed.