Yesterday’s pop and drop price action left behind some bearish candle patterns but fell short of creating technical damage in the index charts. While that’s true, the damage to trading accounts being chopped up in the politically created volatility was likely substantial. Unfortunately, as we wait on stimulus negotiations, more whipsaws and reversals are likely. If you love to gamble on a political outcome, then this market is a dream come true. Place your bets the marble is rolling, and in the next 24 hours, we will find out if the outcome is red or black.

Overnight Asian markets were mixed as China keep lending rates unchanged. European markets trade mixed this morning as well, as they monitor the growing virus concerns and stimulus hopes. US futures, on the other hand, once again point to a significant gap up open ahead of earnings, economic data, and the quickly approaching Pelosi deadline for stimulus.

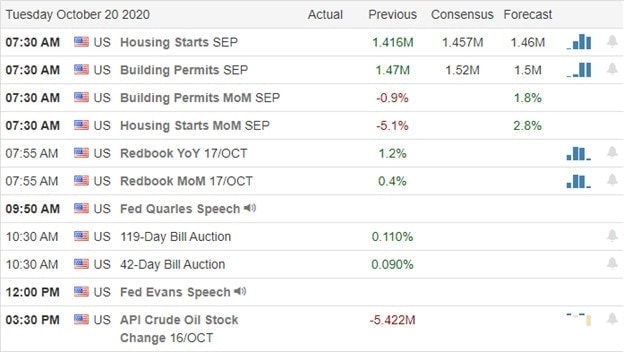

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 44 verified companies fessing up to quarterly results. Notable reports include PG, NFLX, ACI, AMX, CNI, CP, CIT, CMA, DOV, IBKR, IQV, IRBT, LOGI, MAN, NAVI, PNR, PM, PLC, RF, SNAP SYF, THC, TXN, TRV, & USB.

News and Technicals’

Yesterday’s nasty pop and drop reversal left behind some concerning candle patterns, but with news, progress on the stimulus, futures point to a bounce. In other words, more of the same news-driven political spin volatility for a very uncertain market. The Pelosi imposed deadline to get a bill passed before the election is upon us. The result of the negotiations is likely to have dramatic market consequences over the next 24 hours. If the news occurs during the market day, quick traders may be able to take advantage of the move. However, should the story come out after the close, expect a significant gap in either direction. Guess right, and you could be a big winner! Guess wrong, and money could quickly disappear from your accounts. No available trading edge; place your bets on the roulette wheel and hope your gamble pays off. I can’t speak for you, but I didn’t become a technical analyst to gamble on a coin flip. Rapidly rising virus cases also weigh heavily on investors’ minds, with 37 states reporting increased hospitalizations that seem likely to accelerate in the coming weeks. The economic impacts continue to mount as some states ramp up restrictions in response.

On the technical front, the indexes printed bearish candle patterns yesterday, confirming lower highs and adding some overhead resistance. That said, there was no significant technical damage created, and we all know another reversal is possible depending on the political news. What happens next is anyone’s guess, but once again, I will caution you about the dangers of chaising a morning gap with so much uncertainty ahead. Get ready; this wild ride is far from over.

Trade Wisely,

Doug

Comments are closed.