Transition Begins

The transition begins, and the U.S futures celebrate the decision surging higher this morning even as states add a blizzard of new restrictions to battle the pandemic. With a holiday shutdown just around the corner, it may be wise to consider the big gap up this morning as a gift and opportunity to profit and reduce heading into the holiday. Remember, volume typically begins to decline as traders head out for vacation plans.

Asian markets were mostly bullish overnight, with the NIKKEI surging a whopping 2.5% amid vaccine hopes. European indexes trade decidedly bullish this morning, and the U.S. futures point to a substantial gap up with a Dow 30,000 target within striking distance. Please keep in mind volume typically declines quickly, heading onto a holiday. That said, it may be challenging to maintain the bullish momentum.

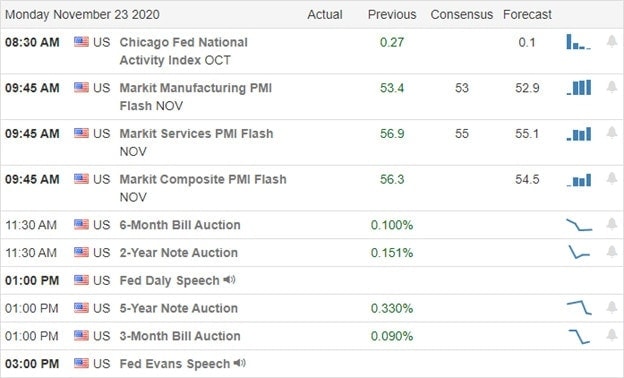

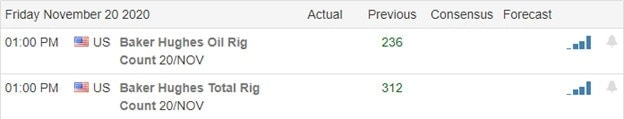

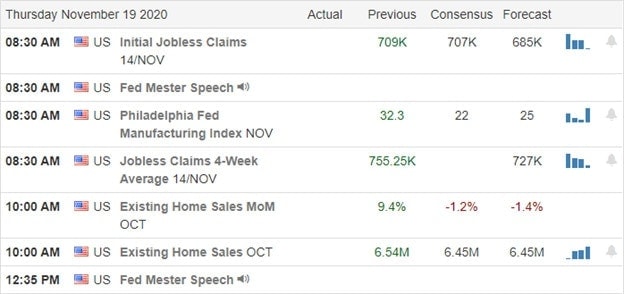

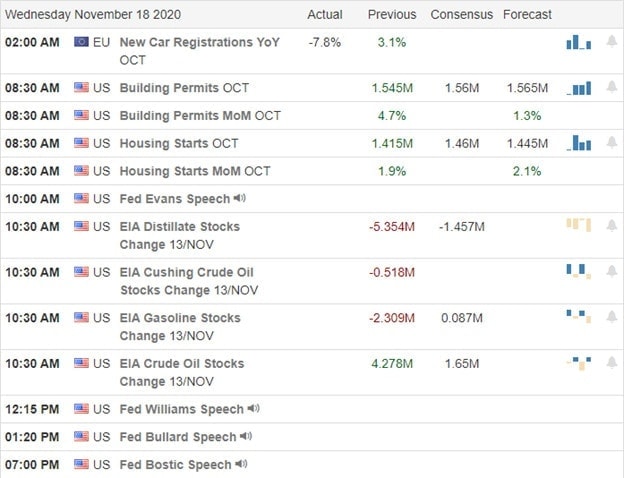

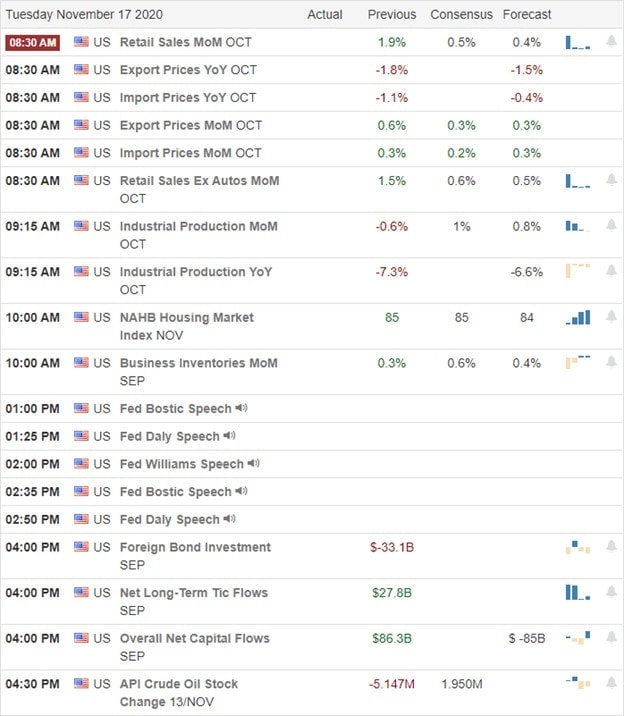

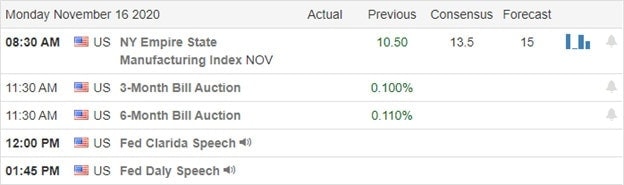

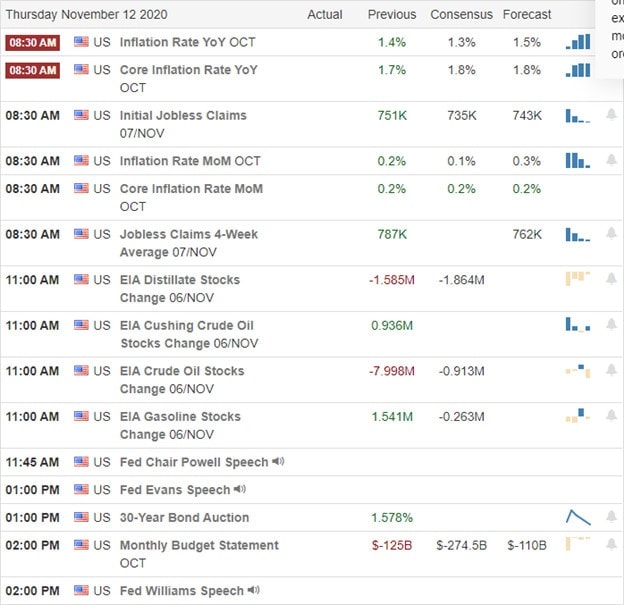

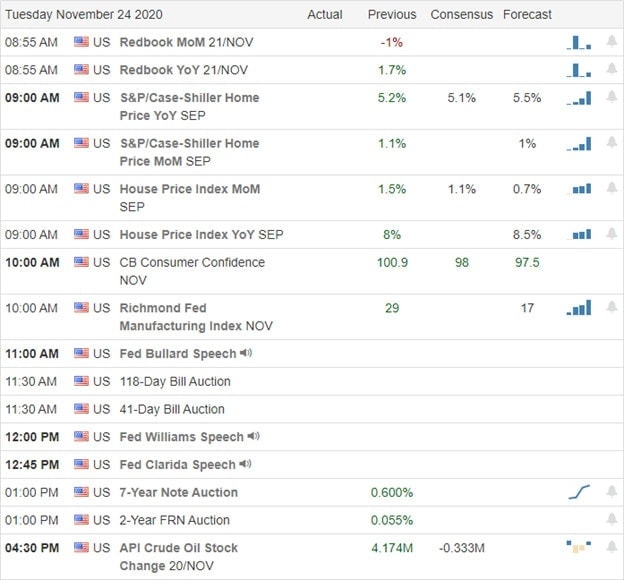

Economic Calendar

Earnings Calendar

We have a busy day on the earnings calendar, with retail reports a significant focus on Tuesday. The notable reports include ANF, BBY, DKS, GPS, DLTR, JWM, AEO, ADI, ADSK, BURL, EV, HRL, HPQ, SJM, J, MDT, MOV, TIF, & VMW.

News & Technicals’

I must admit this wild bullishness continues to surprise me even as more restrictions go into place around the country trying to curb the pandemic. That said, I also have to say I am enjoying the profits the relentless push toward higher. The moral of the story, read the price action, follow the trends, and most importantly, gratefully take the gains the market provides in time like this. Futures are pointing to a gap up open, apparently celebrating that President Trump has begun the process to ensure a smooth transition. Though he vows to continue the legal challenges, the market seems to have voted this was the right thing to do. Biden’s choice, Janet Yellen, to lead the Treasury also boosted the market higher yesterday afternoon, supporting the decision. Though all the warm and fuzzy bullish is fantastic, let’s forget we have a holiday shutdown just around the corner and blizzard pandemic restrictions likely to impact businesses. As a result, it may be wise to take advantage of the morning gap by taking profits and reducing risk heading into the holiday. Remember, gaps are gifts, but the money is not yours until you take the gain and tuck it safely away in your account.

On the technical front, the indexes remain in bullish trends but keep in mind the current rally will have to deal with the price resistance created in the last three weeks. Only the IWM has thus far been able to enjoy the blue sky breakout, so watch closely for the possibility of profit-taking near resistance on the DIA, SPY, and QQQ. The T2122 indicator will show an extreme short-term overbought condition at the open as well. Don’t let greed prevent you from making a profit!

Trade Wisely,

Doug