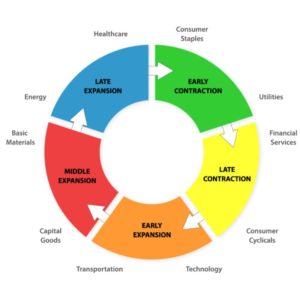

A rotation out of the high-flying tech sector into value and dividend-paying stocks seems to underway as we wait for the courts to weigh in the election. The pandemic numbers once again surged to new record hospitalizations and infection rates, raising concerns about possible negative economic impacts. With the indexes so extended from critical averages, traders have to take a considerable risk when entering new positions. Plan your risk carefully in be careful chasing with the fear of missing out.

Asian markets closed mixed but mostly lower, and concerns over new regulations push tech shares down 10%. European markets are edging higher again today, riding the wave of vaccine-related recovery hope. U.S. future point higher with yet another Dow gap even as pandemic numbers surge.

Economic Calendar

Earnings Calendar

We have just over 50 companies stepping up to report quarterly results on this hump day. Notable reports include APD, ATO, FOSL, LMND, REYN, SB, SPTN, SLGG, TTEK, VRM, & YPF.

News & Technicals’

Another day and more new records set on the pandemic, with national hospitalizations topping more than 61,000 and over 131,000 new infections. However, market futures continue to rise even as new rolls out of new city lockdowns going into place. The Supreme Court asked to weigh in on Obamacare yesterday and, according to reports, appears willing to leave the act in place. A decision from the high court is not scheduled until June of 2021. Although the election has yet to be certified, Joe Biden is calling for an expansion of Obamacare. Alibaba’s Singles Day event shattered records with sales topping $56 billion, but tech shares in China plunged 10% as new regulatory concerns mount. Here in the U.S., the tech sector is also showing some weakness as investors seem to be rotating toward value plays and dividend-paying stocks. Perhaps concerns over potential Covid impacts have traders seeking safety due to the likely difficult winter ahead.

Technically speaking, the DIA, SPY, and IWM remain quite extended from their 50-day averages. The fear of missing out is driving traders to take a considerable risk as they rush to buy stocks so far from key support levels. They may be right to do so, but this is not for the faint of heart. With such a new-driven market, the possibility of a sharp pullback remains high, or we could see a very choppy consolidation while we wait for the key averages to catch up. It’s easy to overtrade in this kind of environment, so make sure you follow your rules and carefully understand each position’s risk. The T2122 indicator remains in a short-term overbought condition, and the VIX above 24 handles as the indexes reach out to new records is extremely abnormal when compared to historical price action.

Trade Wisely,

Doug

Comments are closed.