The vaccine news-driven rally pushed the DJ-30 to a new record high and finished the day within striking distance of 30,000. As the bulls try to price in a pandemic recovery, 22 states have added restrictions that could have significant business impacts ahead, as infection rates continue to surge throughout the country. While I believe the institutions will not miss out on achieving a Dow 30,000 headline, the path may be challenging in this very news-driven extended market environment. Plan carefully.

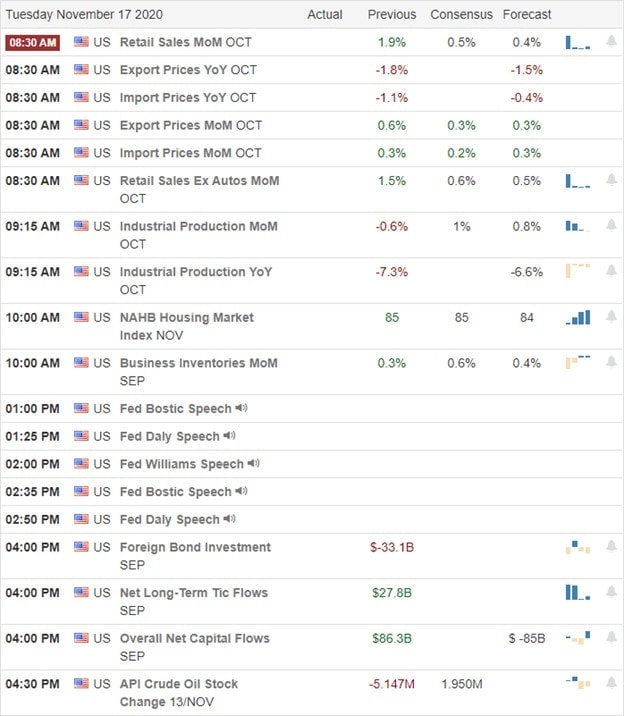

Asian markets closed overnight with modest gains after an initial jump higher in reaction to vaccine news. European markets are currently edging lower this morning, and the U.S futures point to a lower open ahead of several potentially market-moving economic reports. The wild price volatility is likely to continue as investors grapple with holiday restrictions and shutdowns.

Economic Calendar

Earnings Calendar

We have more than 30 companies stepping up to report quarterly results this Tuesday. Notable reports include NIO, HD, WMT, KSS, LZB & SE.

News & Technicals’

The Dow hit new record highs yesterday, rallying 470 points hopeful vaccine news closing the day just 50 points below 30,000. Unfortunately, at the same time, the pandemic surge has inspired 22 to add new restrictions likely to impact the overall economy. While the bulls try to price the market for the hopeful better days ahead, the short-term impacts could be challenging to grapple with, keeping the price action volatile. Tesla shares jump in aftermarket trading after its addition to the S&P 500 average. Shared of Home Depot are dipping this morning despite a strong earnings report. Amason Pharmacy has launched, allowing its customers to order prescriptions online. Shares of AMZN are modestly higher on the news. Futures currently indicate a lower open ahead of several potential market-moving economic reports. With the Dow so close to 30,000, it hard to imagine the institutions will miss the opportunity to claim that headline. I’m guessing the hats are already on the floor of the exchanges, just waiting for the photo opportunity. Of course, pandemic, political, and economic news could make it a challenging and choppy process.

Technically speaking, there really is not much to say except the bulls are in control, and the indexes appear extremely extended in the short-term. While I believe the institutions will not miss the opportunity to test 30,000 the path, there may not be a straight one. Odds of fast intraday whipsaw and full overnight reversals remain high in this very emotionally charged market. Plan your risk carefully and guard yourself against chasing into already extended stocks.

Trade Wisely,

Doug

Comments are closed.