The disappointing retail number energized the bears just enough to fill Monday’s vaccine news-driven gap. However, the bulls quickly went back to work as the push for the 30,000 Dow target resumes. We’re not going to allow the details of a suffering economy, unemployment, or a new record daily pandemic death rate deter the bulls from this mission. With the holiday shutdown just around the corner, they will have to work quickly; as volume begins to decline and trading floors start to clear.

Asian markets closed the day mixed but mostly higher as Japan’s autos slip and the dollar weakens. European markets trade with modest gains across the board this morning, extending the vaccine rally. The U.S. futures point to a bullish open ahead of earnings and a possible market-moving housing starts number.

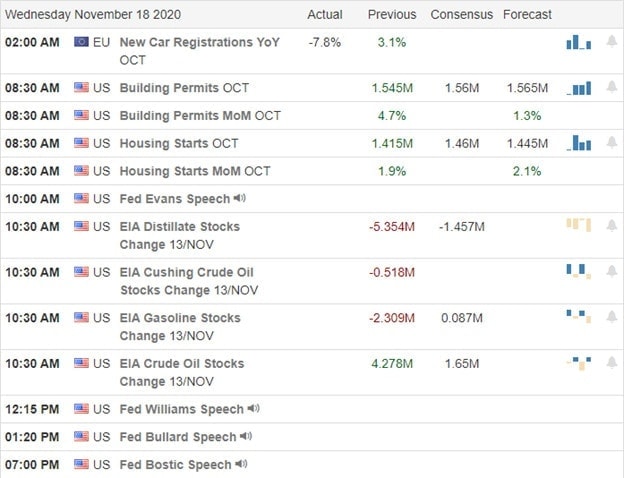

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have over 30 companies reporting quarterly results. Notable reports include BILI, CPRT, JACK, LB, LOW, NUAN, NVDA, SCVL, TGT, TJX, & ZTO.

News & Technical’s

It would appear that the surge in pandemic infections has already started to affect retail sales rising just .3% last month vs. the 1.6% gain last month. However, after a sharp but brief selloff to fill the Monday gap, bulls went back to work defending the lows trying to get back on track toward a 30,000 Dow. According to Johns Hopkins numbers, the U.S. set a new national record daily for pandemic deaths toping 1700. Emergency approval of the first home-based Covid test costing $50 will now be made available, a good sign considering the new public restrictions states have begun to enforce. You may soon see the Boeing 737 Max that has been grounded for nearly 2-years back in the sky with the expected approval by the FAA later today. ON the earings retail front, LOW earnings fall short of expectations, and the stock is indicated to decline more than 7% at the open. On the other have TGT topped expectations surging nearly 2.5% in premarket trading.

Filling the Monday gap and seeing the bulls work hard to defend its price support is a sign institutions will continue to push for the 30,000 Dow target. I suspect we will see this target reached before we take a break for Thanksgiving, even though indicators continue to suggest an extreme short-term overbought condition. Pandemic numbers don’t seem to matter, and disappointing retail results won’t stand in the way. Remember to consider your risk as we quickly approach the holiday when volume typically declines sharply.

Trade Wisely,

Doug

Comments are closed.