The tug-of-war continues between the bulls hoping for a spring recovery and the bear’s concerns of the business impacts getting through a severe pandemic winter. Infection rates hit a new record yesterday, and at the same time, the Treasury has decided to end some programs in the CARES act by the end of the year, drawing criticism from the FED. Treasury yields are falling this morning in reaction. As the weekend and a short trading week due to the holiday, traders will have some tough decisions to make as they plan their risk forward.

Asian markets closed on Friday mixed but with The SHANGHAI and HIS modest posting gains. European markets are trying to shake off virus concerns this morning, showing modest gains across the board. The U.S. trade mixed but are well off the overnight lows as they try to look past the Treasury decision, infection numbers, and more state restrictions ahead of the holiday. Expect the news-driven sensitivity to continue.

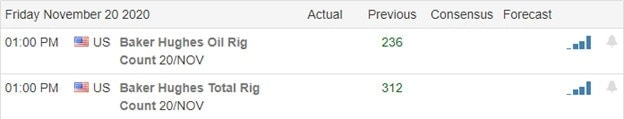

Economic Calendar

Earnings Calendar

We have a lighter day this Friday with less than 20 companies fessing up to quarterly results. Notable reports include BKE, DXLG, FL, HP, HIBB, & JKS.

News & Technicals’

The Treasury Dept. is looking to extend a handful of the Federal Reserve programs used to get the markets through the pandemic’s early days. However, they have also decided to end several other programs that expire at the end of the year. The action has drawn some negative feedback from the Fed, which believes the programs should continue. A decision coming on the same day that the U.S set a new record infection rate of more than 185,000 new cases reported. Treasury yields are falling this morning in reaction. Another disagreement is raising eyebrows in treating the infection as the WHO urges doctors not to use Gilead’s remdesivir, breaking ranks with the FDA, stating “no evidence” it improves survival rates. In other news, both Pfizer and BioNTech have requested emergency authorization from the FDA for their vaccines. I suspect the tug-of-war will continue between the bulls hoping for a spring recovery and the bears looking at the impacts of rough winter.

Yesterday’s early selloff found enough bulls to defend the morning lows but fell a bit short of inspiring confidence. The bullish index trends still exist, as does the short-term extended appearance of the charts. With a very light day on the economic calendar and just a handful of notable earnings reports, we can expect the market to be highly sensitive to the news cycle today. As this tug-of-war continues, plan your risk carefully as we slide into the weekend ahead of the Thanksgiving shutdown.

Trade Wisely,

Doug

Comments are closed.