Though considerably overextended in the short-term, the vaccine news and hopes of recovery continued to encourage the bulls as the tech sector bounced off support. Sadly, news of 144,000 new infections and possible business restrictions or lockdowns weigh heavy on this morning market. Facing a big day of data, the gap down in the Dow will challenge the support of Monday’s massive rally. Buckle up for another day of new-driven volatility.

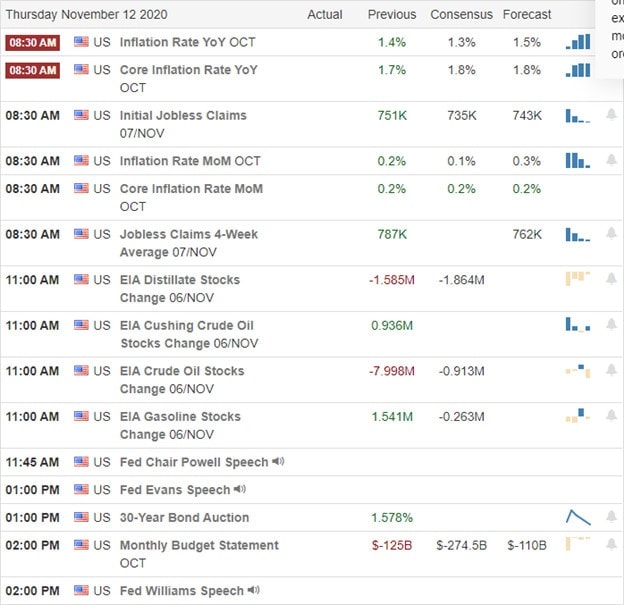

Asian markets closed mixed but mostly lower in a relatively muted day of trading. European markets have a bearish attitude this morning, with the DAX and CAC trading more than 1% lower at the time of this report. As we wait on Jobless Claims, GDP, a Powell speech, and a big round of earnings reports, futures currently point to bearish open. Of course, the news events could quickly improve or worsen the current sentiment. Stay focused.

Economic Calendar

Earnings Calendar

We have our most important day of earnings this week, with more than 150 companies fessing up to quarterly results. Notable reports include DIS, AQN, AMAT, BZH, CSCO, DGLY, DLB, ENR, FTCH, GLOB, DGRX, HIMX, JAMF, MFG, PLTR, PDD, SBH, TK, TDG, U, & WIX.

News & Technicals’

A tech bounce led the market yesterday, with the SPY and IWM struggling to find direction, while the DIA ran into a little profit-taking. As the Presidential election saga drags on, the U.S. experienced another new record in COVID infections topping 144,000. That is the 9th straight day of more than 100k new infections, Ugg. Yew York has imposed a curfew on restaurants, bars, gyms and limited home gatherings to ten. The Biden Covid advisor is suggesting a lockdown of 4 to 6 weeks to control the surging pandemic. It looks like we’re in for a long winter and a tough holiday season. President Trump continues to allege fraudulent election activity, filing multiple lawsuits and appeals even as Biden moves forward with the transition appointing his close friend as Chief of Staff. The Republican state AG says it’s highly unlikely that Trump will win in Arizona, citing no fraud evidence. Georgia will do a hand recount of election ballots, but the Biden lead continues to grow, according to reports.

Though the T2122 indicator continues to warn of an overbought condition, the tenacious bulls hold firm fending off any attempt by the bears. Unfortunately, worry over pandemic numbers, and the threat of more lockdowns have the futures pointing to a gap down open this morning will test the support of Monday’s massive rally. With a big day of earnings and economic reports, price volatility could be high, and news-driven whipsaws and reversals are possible. Stay focused, and flexible.

Trade Wisley,

Doug

Comments are closed.