500,000 American Deaths

A sad new world record was made yesterday as the U.S. topped 500,000 American Deaths due to the pandemic. However, the infection rates are declining, and there may be a light at the end of this very long and grim tunnel. Facebook struck a deal with Australia to restore service, but the tech sector remains a bit of concern after breaking the bullish trend. Jerome Powell will testify today, and it seems to have the market a bit on edge this morning, so it may be wise to keep an eye on price action as he speaks today.

Asian markets closed mixed but mostly higher overnight as HSBC topped earnings estimates. However, European markets are in decline this morning, lead by the DAX trading down over 1% this morning. The U.S. fluctuated dramatically overnight, but the premarket pump is trying to put on a brave face, currently suggesting a flat open ahead of earnings and the Powell testimony.

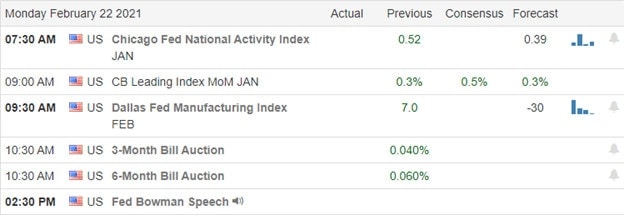

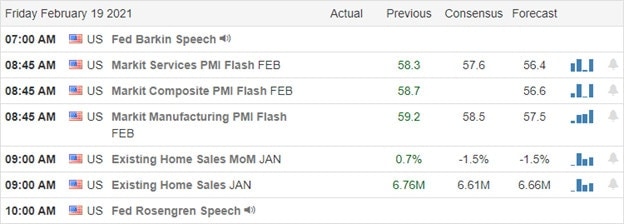

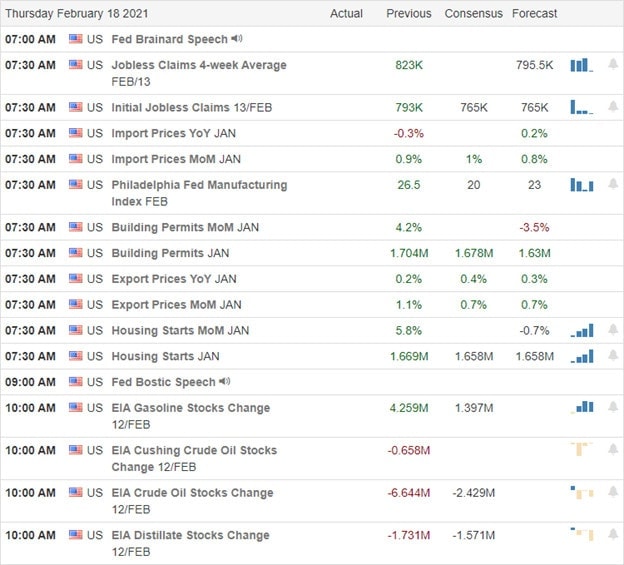

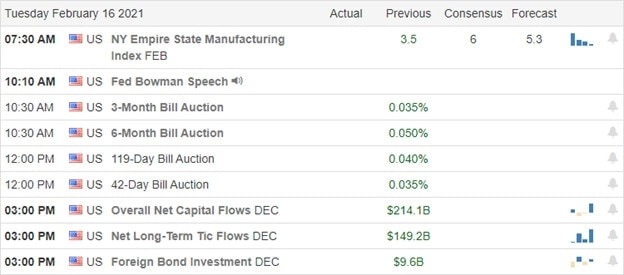

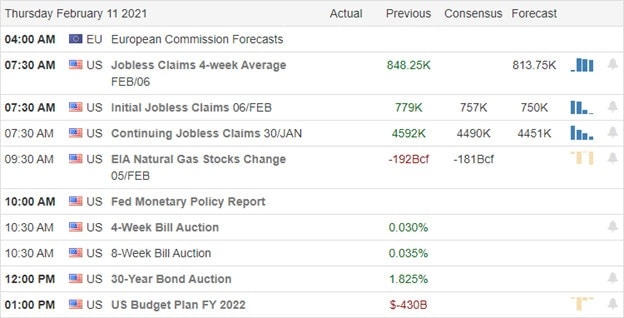

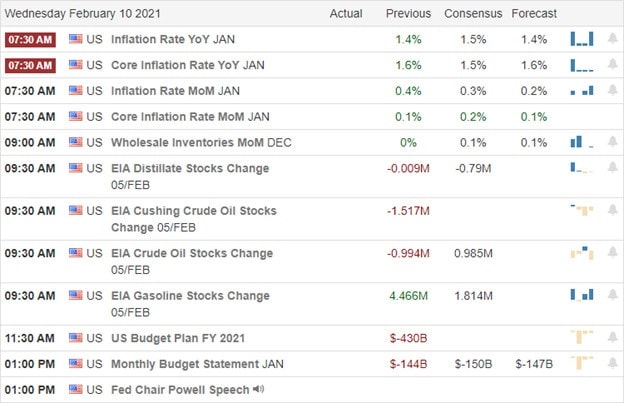

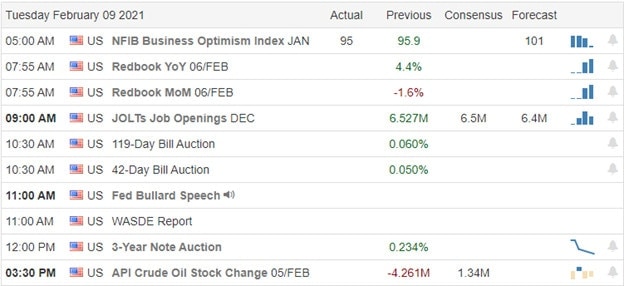

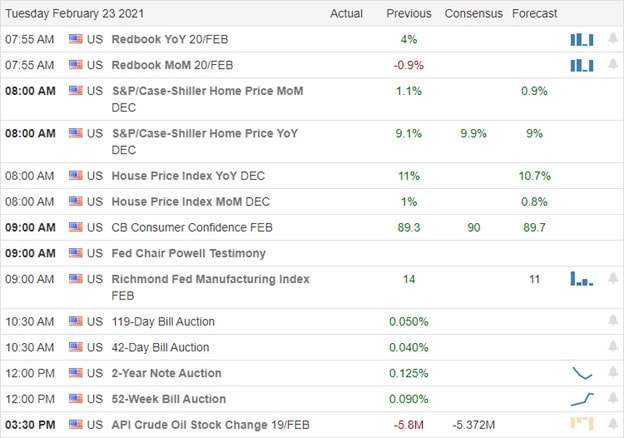

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 60 companies reporting quarterly results. Notable reports include AAN, APLE, ARNC, AGR, BMO, BNS, BCO, COG, CHE, CLVS, CSGP, CBRL, DK, FLS, FI, HEI, HD, INTU, JAZZ, LDOS, M, MCFE, MDT, NXST, PXD, RRD, SPT, SQ, TRI, TOL, & UPWK.

News and Technicals’

Yesterday the U.S. hit a grim world record with more than 500,000 American deaths due to pandemic. The silver lining is that the rate of infections is declining, and vaccine availability is growing around the country. Facebook struck a deal with Australian news creators and will begin restoring the services it banded just last week. Apparently, the trending #deletefacebook struck a chord with the company leadership. Treasury Security Yellen sounded a warning yesterday about the ‘extremely inefficient way to conduct monetary transactions with bitcoin. She went on to say there remain important questions about the legitimacy and stability of the blockchain and cited dangers that it poses to investors. Home Depot tops earnings estimates this morning, reporting a 25% surge in sales. However, the stock is not seeing much price benefit from the report in the premarket.

Tech had a rough day yesterday, even as the DIA managed to squeak out a modest gain on the day. During the night, futures have fluctuated substantially between gains and losses, with the premarket pump once again lifting price off of overnight lows. We have a busy day earnings and some Jerome Powell testimony that seems to have the market a little on edge this morning. The House plans to pass the Biden Covid relief bill this week without a single bi-partisan vote in other political news setting up an interesting test for the newly formed Senate. Expect the Washington spin machine to shift into high gear in the days ahead. Technically speaking, the SPY and QQQ are beginning to raise some concerns after the selling yesterday. Stay focused and prepared for anything.

Trade Wisely,

Doug