Futures point to a bullish open shrugging off 20-straight days of more than 100,000 pandemic infections, focused on the latest vaccine news and hopes of more deficit spending. The big round number of a 30,000 Dow just around the corner will have the institutions working hard to get that headline. The only thing that stands in their way is pandemic news and some emerging evidence of a slowing economy as a result. Volume typically begins to decline sharply, heading into the Thanksgiving shutdown as traders head out for travel plans. This year could be very different with considerable sensitivity to news events.

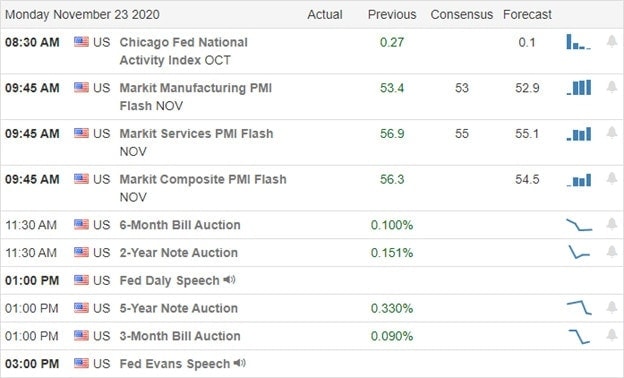

Asian markets traded mostly higher overnight, with airline shares declining sharply due to virus concerns. European markets point to modest gains this morning on hopes of that vaccines will soon become available. U.S. Futures once again point to a bullish open ahead of earnings and the PMI Composite at 9:45 eastern time. Buckle up it could be a wild week.

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have under 25 companies reporting quarterly results. Notable reports include A, AMBA, DQ, KFY, NTNX, URBN, & WMG.

News & Technicals’

After 20 straight days of more than 100,000 pandemic infections, U.S futures are once again in rally mode this morning, focused on new vaccine news and hopeful stimulus deal by the end of the year. President Trump’s flurry of lawsuits appears to have not been effective in turning over evidence of fraud. However, he has yet to concede as Biden moves forward to announce some Cabinet selections as early as this week. With mounting economic restrictions, evidence of a slowing economy, and a holiday shutdown, anything is possible this week. I fully expect the institutions to continue their push for a Dow 30,000 headline, but with pandemics weighing on investors’ minds, it could be a choppy process with whipsaws and large morning gaps. We usually see a sharp decline in volume beginning Tuesday afternoon as traders head out for holiday destinations. However, nothing about this year is normal, so stay focused and flexible.

Though we saw a little bearish activity toward the end of last week, the index trends remain bullish. We may still need more consolidation to digest the colossal vaccine move, but as long key price supports hold, the bulls have the upper hand. Expect price volatility to continue and news-driven sensitivity as we slide toward the holiday. Remember there will be a lot of focus on Black Friday and Cyber Monday shopping, so it’s possible we could see low volume choppy price action for a few days, so plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.