1st Quarter Earnings

All through the bears made a quick visit last Friday, the bullish trends remain, and according to the futures, the bulls are rested and ready to get back to work this morning. With the inauguration just around the corner and the ramp-up of 1st quarter earnings, traders should expect an extra dose of price volatility in the days ahead. Although the market is very hopeful about the next round of stimulus, make sure you check earnings dates before making trading decisions. With so many stocks looking elevated, a disappointing earnings report could create painful selloffs. Plan carefully.

Asian markets traded mixed but mostly higher overnight, with the HIS surging 2.70% higher. European markets trade cautiously this morning, chopping around the flat-line. However, the bulls seem to be on a mission this morning, pointing to a gap up open ahead of earnings results. It would be wise to expect an extra dose of volatility as earnings ramp up.

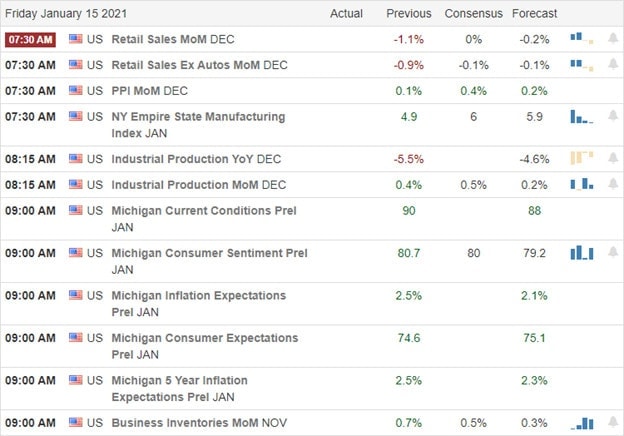

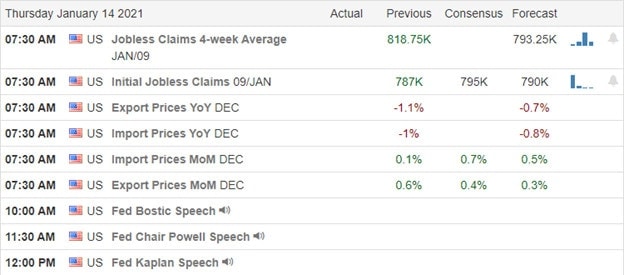

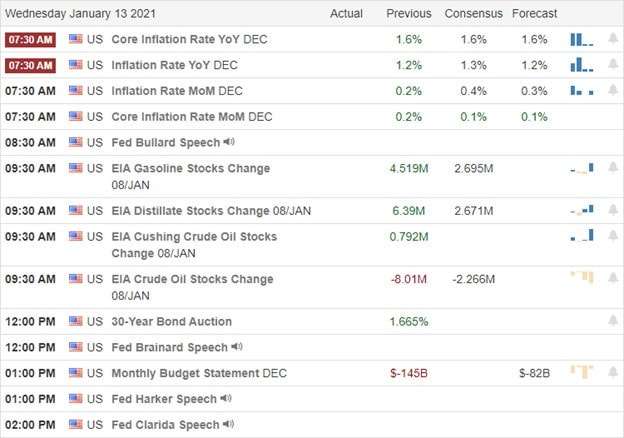

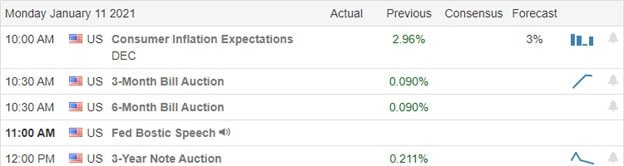

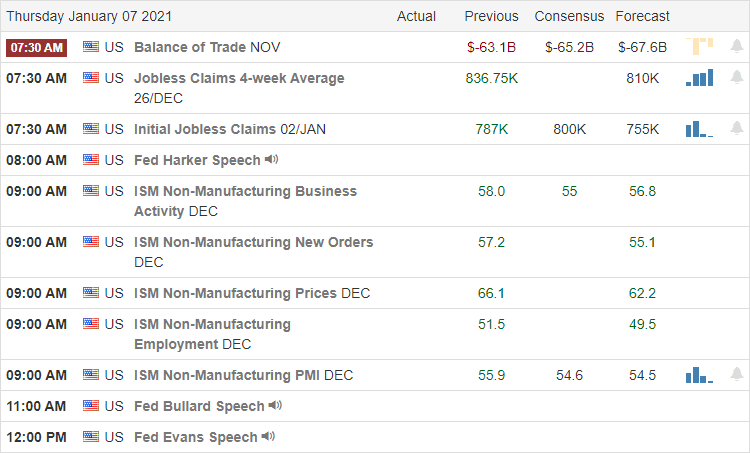

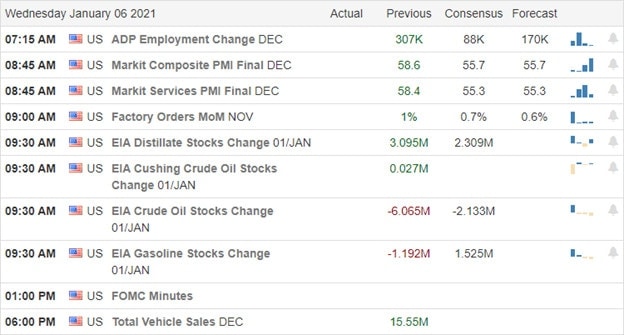

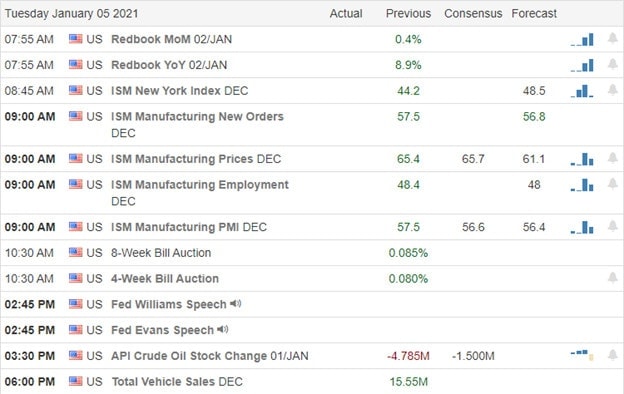

Economic Calendar

Earnings Calendar

We begin to ramp up the 1st quarter earnings calendar with 20 companies reporting results. Notable reports include IBKR, NFLX, BAC, SCHW, CMA, GS, HAL, JBHT, LOGI, PETS, STT, & ZION.

New & Technicals’

Last Friday, big bank earnings beat estimates, but they all found a few sellers. Today we ramp earnings, but futures are currently staging a rally ahead of GS, and BAC reports this morning, with the first big tech report this afternoon coming from NFLX. With the change in power at the White House just around the corner, it’s possible we could experience a bit of price volatility with lower than usual volumes as the world watches. Although energy prices have seen a sharp rally recently, the IEA cut their oil demand outlook due to pandemic lockdown restrictions. Germany has discovered a new virus variant among 35 hospital patients. Though the outgoing Trump administration wants to lift travel ban restrictions, the Biden administration says they will keep Europe and Brasil restrictions in force.

Although we experienced a little bearish activity last Friday, overall uptrends held as support. This morning as we return to work after the MLK holiday, the bulls seem ready to resume their march higher, with the Dow futures suggesting a gap up of more than 150 points at that time of writing this report. BAC beat top-line estimates but fell short of revenue expectations, yet the stock is holding up in premarket trading. Higher unemployment, weak retail sales have not dampened the spirit of the bulls with the hope of more stimulus on the way, so perhaps earnings can be added to the list of things that don’t matter all that much in this environment. Keep an eye out for price volatility due to earnings and the transition of power in the Whitehouse.

Trade Wisely,

Doug