BA Inspires the Bulls

News from BA that the 737 may be back in the sky by January inspired the bulls to shake off the trade fears that began the day to close the DIA at a new record high close. Relentlessly the bulls have pushed past bad news to move up and if that bad news eventually finds resolution the surges even higher. This morning there is speculation the President will delay European tariffs by 6-months on Wednesday, lifting futures off of overnight lows. Expect news-driven price action to continue with he Powell speech on Wednesday and the Impeachment hearing also scheduled to begin.

Asian markets recovered from early lows closing in the green despite trade concerns and Hong Kong unrest. European are also green across the board this morning on hope of an auto tariff delay. US Futures continue to fluctuate this morning with more than 300 earnings reports to digest. That said, I expect a modest gap up at the open with the bulls still in control.

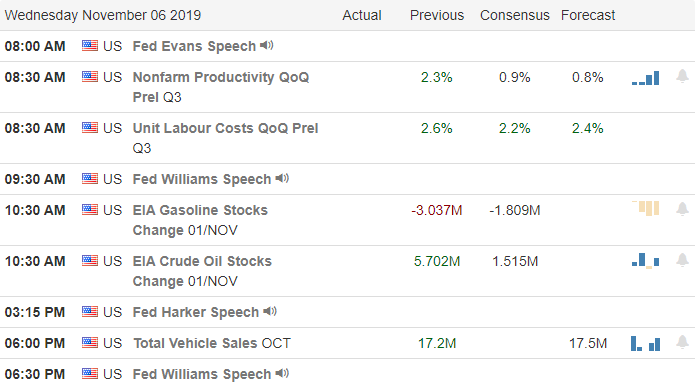

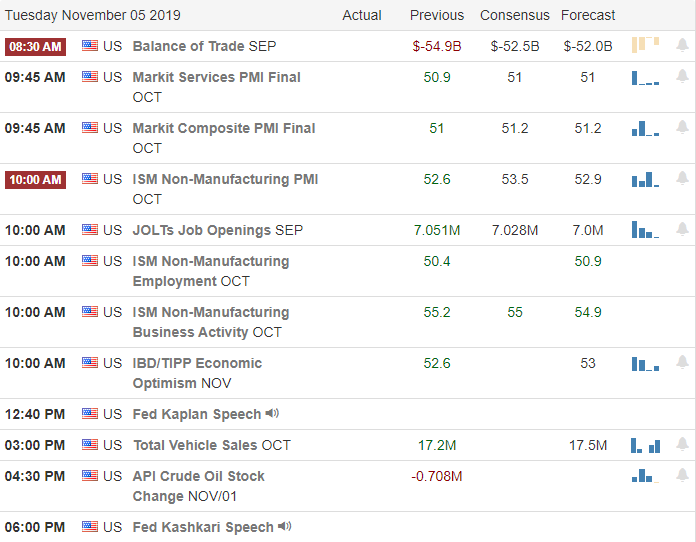

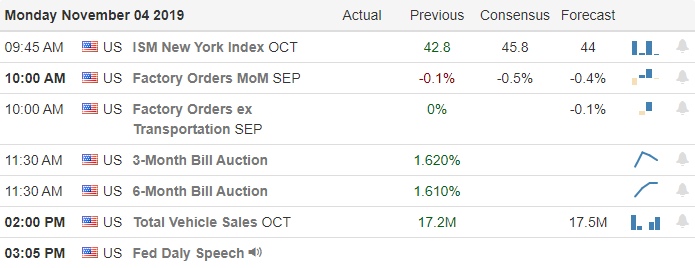

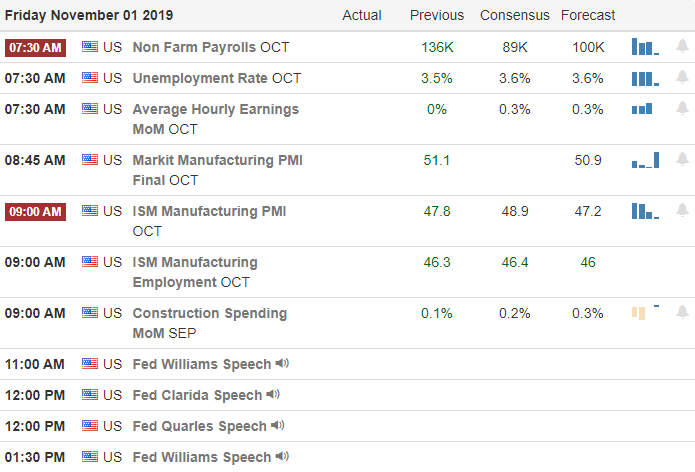

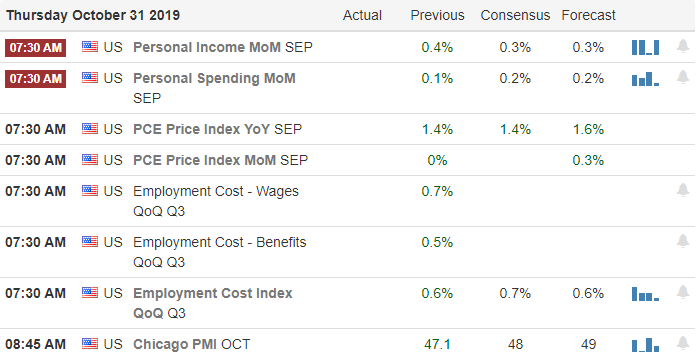

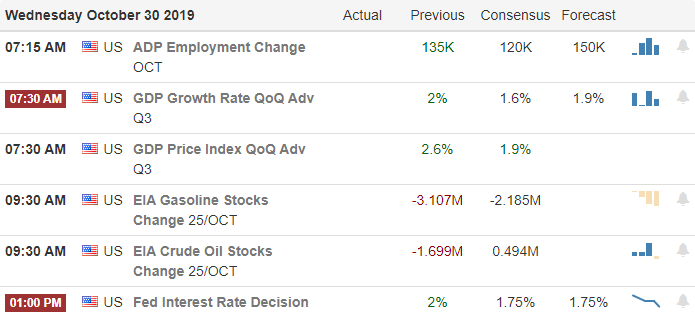

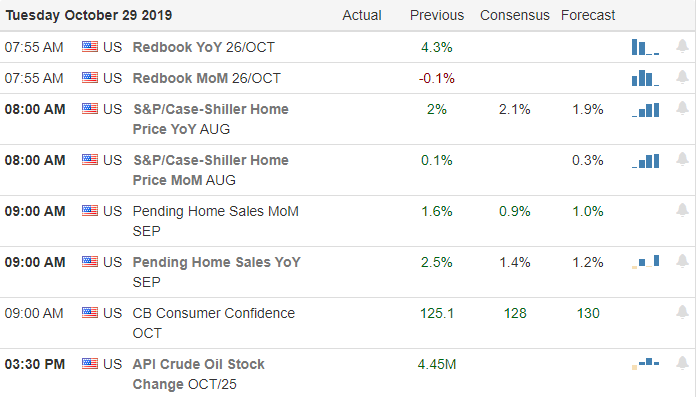

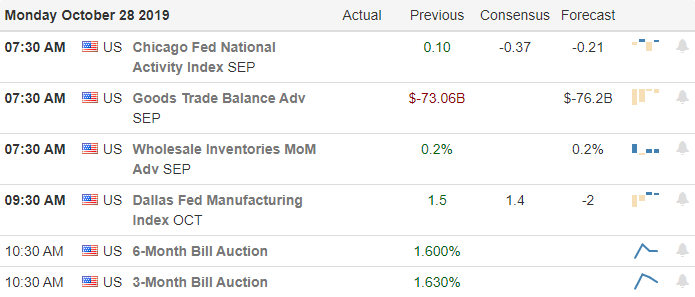

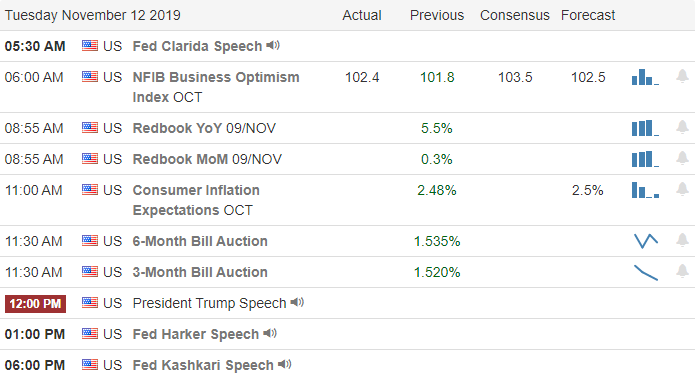

On the Calendar

On the Earnings Calendar, we have over 300 companies reporting today. Notable reports include DHI, TWOU, ADT, AAP, ACM, CBS, BREW, DF, OSTK, ROK, SWKS, TLRY, TSN, and YY.

Action Plan

The bullishness of this market has been truly remarkable. As issues continue to swirl around trade and Hong Kong, the bulls relentlessly surge forward. Although yesterday’s rally was not broad-based, a new record high closing high in the DIA was inked mostly on the back of BA news. With an upcoming speech by the President on Wednesday with speculation that he is going to dealy European tariffs for 6-months markets this morning a once again surging higher. Jerome Powell is also scheduled to speak on Wednesday.

All the while, the Presidential impeachment hearings will begin, and we can count on a barge of political rhetoric and spin to captivate the public and potentially move the market. News-driven price action can be challenging to trade, but it could also turn out to be a non-event if the bulls remain as relentless as they have been over the last month of trading. No matter what happens, as traders, it’s our job to focus on the price action and follow the clues they present without bias or prediction.

Trade Wisely,

Doug