Mixed Bag

With a mixed bag of earnings results, the overall market continues to struggle with the overhead resistance of all-time highs. After receiving another late-day rally yesterday, the bulls have the upper hand but lack the inspiration to push forward with confidence. With a lighter Friday earnings calendar and the big disappointment report by AMZN, the bulls and bears seem equally matched as we head into the weekend.

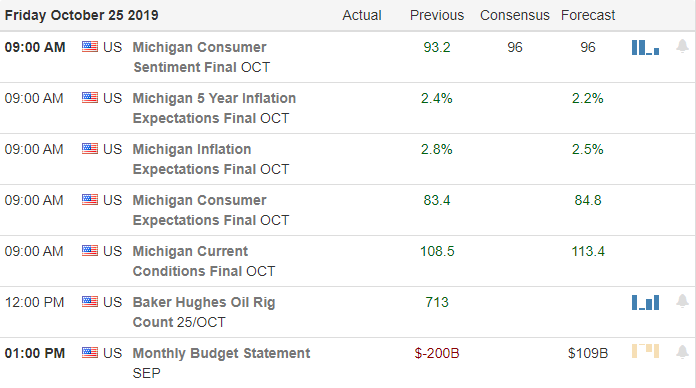

Asian markets closed mixed with the uncertainties of trade and Brexit still hanging overhead. European markets also trade mixed this morning due to the mixed bag of earnings results and a possible Brexit vote ahead. US Futures currently appear to lack in energy this morning, dancing around the flat line ahead of fresh reports and a Consumer Sentiment report at 10 AM Eastern.

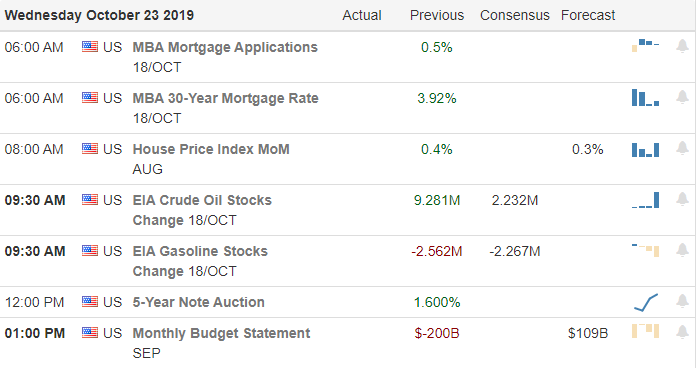

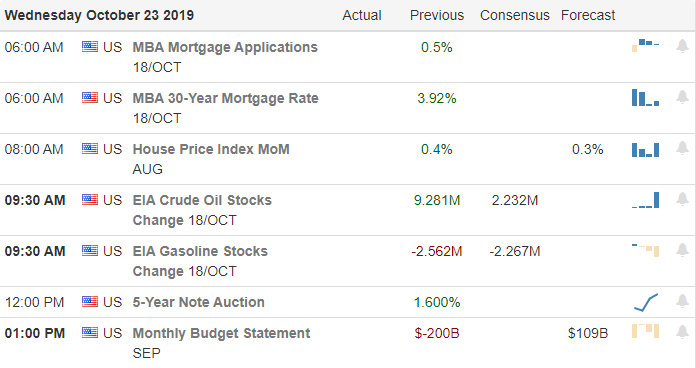

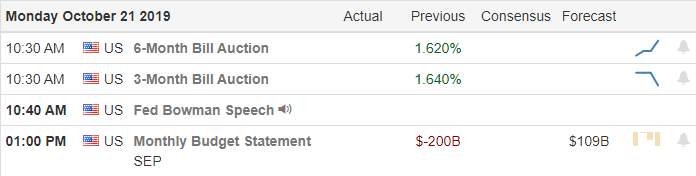

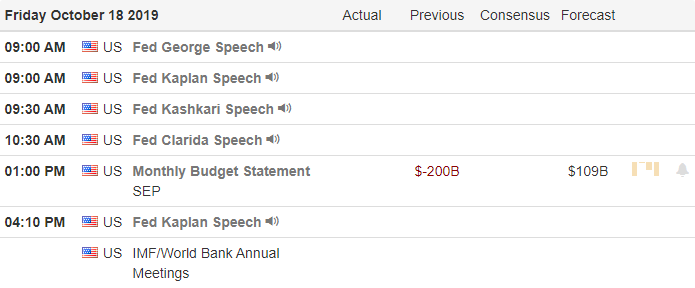

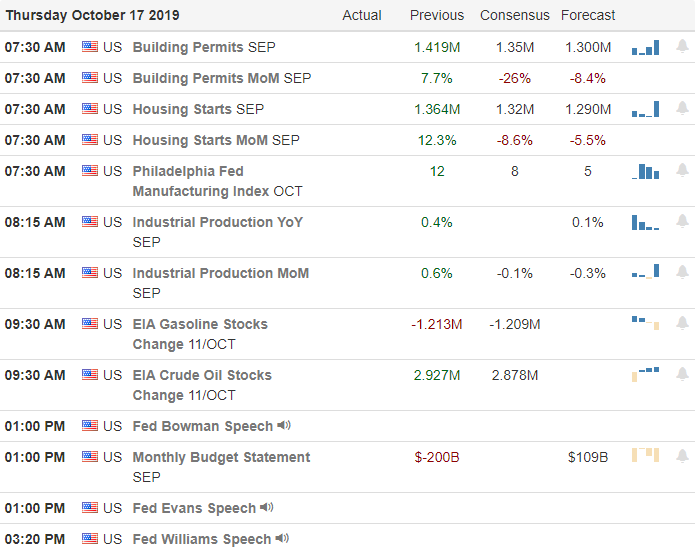

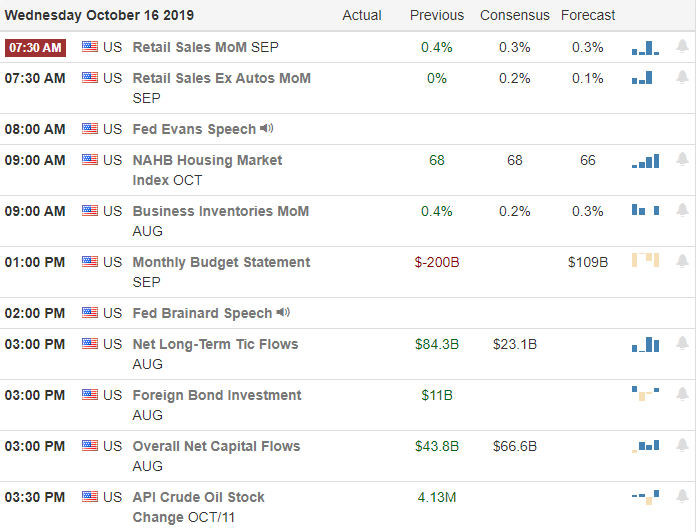

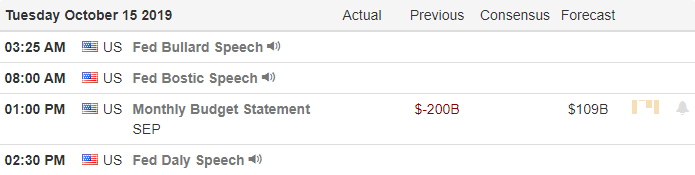

On the Calendar

We have a lighter day on the Earnings Calendar this Friday, with just over 63 companies expected to report. Notable reports include BUD, CHTR, GT, ITW, LEA, PSX, PSXP, VFC, VTR, VZ, WY, WETF, AND YNDX.

Action Plan

US markets struggled yesterday with the DIA under pressure ending the day with mixed results. This morning US Futures this morning recovered from some overnight losses but also seem a bit confused hovering around the flat line. Vice President Pence delivered an address with harsh words directed at China on trade and human rights practices. He also delivered some scathing criticism of the actions of NKE and the NBA organization regarding the Hong Kong protesters. Trade negotiators are scheduled to speak by phone next Friday.

With another late-day rally yesterday, the bull continues to hold a stronger hand and continues to focus on the all-time high resistance levels above that have proven to very challenging to breach. While companies such as INTC and JNPR produced better than expected earnings results, AMZN delivered a big disappointment. As we head into the weekend with such a mixed bag of earnings results, Friday trading has the potential to produce another choppy day of price action.

Trade Wisely,

Doug