A busy economic calendar and about 900 companies reporting earnings will give the market a fire hose of data to digest this week. Wednesday afternoon, the FOMC is expected to cut the interest rate for the 3rd time this year, and we’ll cap the week with the Employment Situation and ISM reports. Indeed a very busy week as the market knocks on the door of record highs.

Asian markets closed the day green across the board on US-China trade optimism. European markets are mixed but mostly higher this morning as the EU grants an extension to January 31 for Brexit. US Futures are bullish this morning and may create new record highs in SPY, and the QQQ at the open assuming earnings reports and the International Trade in Goods report don’t change the current sentiment. Buckle up; it could be a wild ride this week!

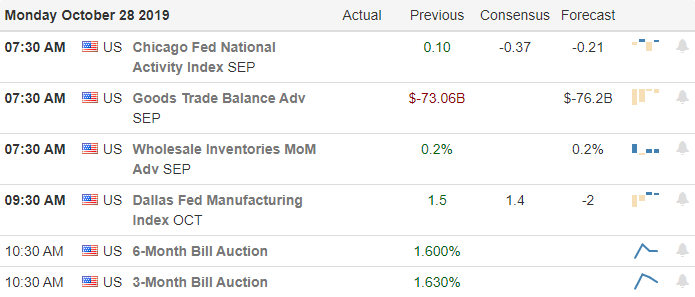

On the Calendar

The Monday Earnings Calendar had just short of 140 companies reporting quarterly results. Notable reports include AKAM. GOOGL, T, AVB, BYND, CTB, EPD, LEG, L, NXPI, ON, QSR, SPOT, TXRH, TMUS, RIG, VNO, WBA, and WELL.

Action Plan

We had a nice weekend where there were no additional uncertainties, and in fact had a few resolutions. First, according to reports, some provisions of the Phase 1 trade agreement are coming together. The report was very thin on details but enough to move the market substantially toward record highs. The Yield curve that shook the market a few months ago is improving, and the FOMC is expected to lower the interest rate for the 3rd time on Wednesday afternoon. GM reached an agreement with striking workers, and the ISIS leader Baghdadi met his end this weekend improving the US relationship with Syria.

US Futures, suggest a bullish open that may print all-time highs in the SPY at the QQQ, at the time of writing this report. Although the DIA is lagging behind, the bullish engulfing candle popping out of a consolidation rage on Friday suggests a break of the current downtrend is possible with the futures suggesting a gap up of about 70 points at the open. Of course with a big round of earnings reports, this morning and the International Trade in Goods report at 8:30 AM Eastern anything is possible. We have a very big week of economic data, so keep in mind price action could become very light and choppy as we wait.

Trade Wisely,

Doug

Comments are closed.