Though the indexes have inked new records, the price action indicates the bull may be a bit winded after such a big bullish run. A little consolidation or slight pullback to test new supports and allowing time for the key averages to catch up could be just what it needs to set up the next leg higher. There may be some concern as well; the Phase 1 trade deal is already priced into the market before we even know what it does or does not include. Between Wednesday and Friday, we have more than 1000 earnings reports for the market to digest as well, so traders should remain flexible and focused on price action clues.

Asian markets traded cautiously as they closely watch the Phase 1 trade developments. European markets are also timid this morning trading flat to slightly bullish this morning. US Futures were flat to slightly bearish most are again getting the morning pump up ahead of a big round of earnings that are now pointing to a modest gap up open. Let’s hope today we can see some follow-through rather than the sideways chop after the institutional gap we’ve experienced in the last 2-days.

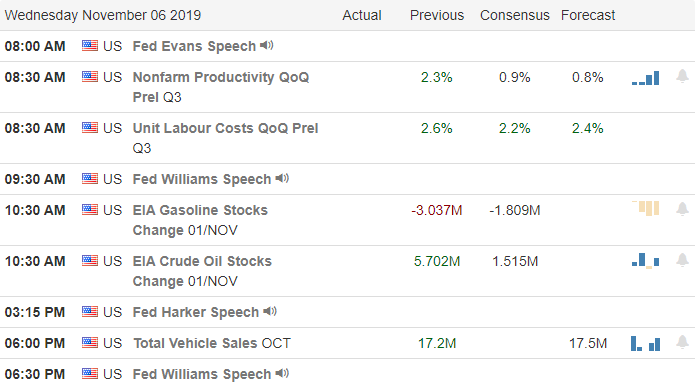

On the Calendar

On the hump day earnings calendar, we have over 430 companies’ results. Notable reports include UPWK, ALB, UHAL, ANGI, BIDU, GOLD, BLMN, CRCM, CARS, CVNA, FUN, CTL, COTY, CVS, ELF, ET, EOG, EXPE, STAY, FISV, FIT, FLO, FOSL, GLUU, GDDY, TWNK, HUM, IAC, IQ, KGC, LL, MRO, NYT, ODP, PAAS, PZZA, PRGO, QCOM, RCII, SMG, SQ, TRIP, VVV, VER, WEN, & WLH.

Action Plan

Ahead of a very big day of earnings, futures are taking a wait and see approach. Most of the evening, they were flat to slightly lower have been slowly creeping up as we wait for results. After inking new record highs in the Dow yesterday, perhaps the futures are indicating we need a rest to confirm new levels of support and allow the key averages time to close the distance with the price. Pensiveness could also be due to the Phase 1 trade deal and concerns that it’s already completely priced into the market.

Technically speaking, the bulls remain in control, but the averages do appear to be a little too far ahead of their 50-day averages. Should a slight pullback or consolidation occur, I think that could be very bullish for the market as long as the new support levels prove strong enough to hold. With more than 1000 earnings reports between today and the end of the week, anything is possible, but so far this earnings session, the results favor the bulls.

Trade Wisely,

Doug

Comments are closed.