Although it was disappointing to see the bearish price action yesterday, the end of day rally indicated the bulls are still in control as price supports proved strong. Of course earnings will play a big role this morning; the majority of the attention of the market will likely turn to the big economic reports to find inspiration. We have had a very event-driven but with more than 1600 companies expected to report next week there will no time to take a break. Plan your risk into the weekend accordingly.

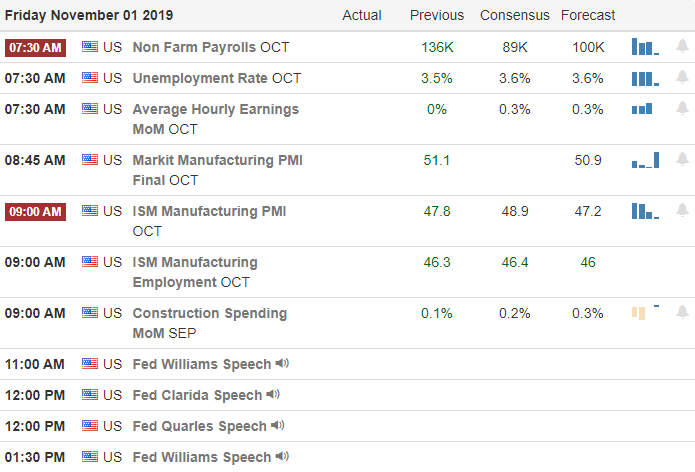

During the night, Asian markets close their trading week mixed but mostly higher after their government expressed long-term trade concerns. However, European markets see modest gains across the board this morning. US Futures are also showing bullishness this morning, pointing to a modest gap up ahead of the Employment Situation number and earnings results. Keep a close eye on the ISM Mfg. number at 10 AM Eastern as it may prove to be the biggest market-moving report of the day.

On the Calendar

We get a little break on the Friday Earnings Calendar with just over 100 companies reporting. Notable reports include ABBV, BABA, LNG, CVX, D, XOM, LYB, NWL, STX, X, and WPC.

Action Plan

Yesterday’s price action was disappointing after China’s unfavorable comments regarding trade. However, a late-day rally saved the index charts from technical damage, and the bulls remain in control. Although we have a significant day of earnings, the major focus will be in the Employment Situation report and the ISM MFG number that may prove to be the biggest market-moving numbers of the day.

As we head into the uncertainty of another weekend, remember to take some profits. Although we seem to have kicked the Phase 1 trade deal and Brexit down the road and have the FOMC behind us, we can’t become complacent in this very news-driven market. With all the major indexes holding support and well above their 50-day averages, I remain bullish though somewhat cautious as prices work to prove support. Remember, we have a very big week of earnings, with more than 1600 companies expected to report, so rest up this weekend the coming week will require us to be at our best.

Trade Wisely,

Doug

Comments are closed.