The question of a new record high received an affirmative answer yesterday as both the SPY and QQQ finally broke through the stubborn resistance level. However, before we can officially claim victory and sound the all-clear signal, they must now prove they can hold this new level as support. Earnings disappointments after the bell yesterday have the US Futures looking a bit pensive this morning as we face more than 250 new reports today. The bulls are clearly in control but stay flexible and focused on price action because sentiment can change with such a barrage of data.

Overnight, Asian markets closed mixed but mostly lower, and the European markets this morning currently are flat to mostly lower as they monitor earnings and the pending UK Brexit related election. US Futures trade mixed this morning with Dow pointing to bearish open that seems to be getting heavier as the morning progress, but that could quickly change though out the morning depending on earning results.

On the Calendar

Tuesday’s Economic Calendar indicates more than 250 companies will report results today. Notable reports include AMD, ALL, AMGN, AOS, AN, BIDU, SAM, BP, CAKE, CB, COP, GLW, CMI, DENN, DLR, ECL, EA, EPR, EXR, FEYE, GM, GRUB, HCA, HLF, IR, K, KKR, LDOS, MA, MAT, MRK, MDLZ, PAYC, PFE, PSA, SPGI, SHOP, SYK, WH, XRX, YUMC, & EXN.

Action Plan

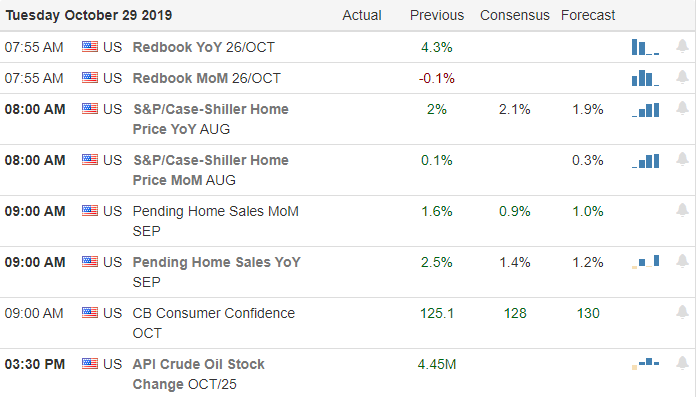

Yesterday the SPY and QQQ finally found the inspiration to break out while the DIA continues to struggle with price resistance. Breaking out is only one step in the equation; now, they must prove it can hold the new lofty prices as support. As we wait for the FOMC interest rate decision, we have another big day of earnings reports to digest as well as the Case-Shiller Report, Consumer Confidence, and Pending Home Sales. Price volatility is likely during the early session, but it could significantly slow after the morning rush as we wait on the FOMC.

Technically Speaking, the Bulls are in control with all four of the major indexes holding above their 50-day averages. However, with earnings misses after the bell such as GOOGL, the Futures seem a bit pensive this morning ahead of a fresh round of reports. As I am writing this report the Futures are mixed with the Dow suggesting a slightly lower open. That, of course, can quickly change for the better or worse as the morning earning reports roll out in quick succession. T2122 suggests there is still room to move higher, although beginning to look a bit extended as the VIX tests a 12 handle.

Trade Wisely,

Doug

Comments are closed.