Today the market faces a literal deluge of events. Nearly 380 companies report earnings, including big tech market-movers like AAPL & FB after the bell today. At 8:30 AM Eastern, we get the latest reading on the GDP that the consensus estimate suggests will come in below 2 percent. Then at 2:00 PM, the FOMC rate decision that may excite or disappoint the market, creating significant price volatility. Swing and position traders will have tough decisions to make while quick and experienced day traders will likely have the upper hand. Anything is possible, so think carefully about how you approach the day.

Asian markets, with the uncertainty of the Fed rate decision, looming closed the day down across the board. European markets trade cautiously mixed but mostly lower this morning ahead of the big data dump. US Futures that were down most the night are now hovering near the flat line ahead of the deluge of events. There could be some excitement during the morning rush but don’t be surprised if the market action becomes light and choppy waiting on the FOMC decision. After that, it’s anyone guess!

On the Calendar

Today we have the biggest round of earnings reports so far this season with nearly 380 companies fessing up to their results. Notable earnings include AAPL, FB, AKS, AWK, APA, ARCC, ADP, BKR, EAT, BG, CME, CTCH, CROX, DIN, ETR, EWIX, ETSY, GRMN, GE, HCP, HES, H, LM, TREE, LYFT, MANT, MCK, MET, MGM, TAP, MYL, RCL, SPG, SNE, SO, S, SFM, STAG, SBUX, SU, SPWR, SKT, TDOC, TUP, TWLO, VIAV, WDC, WMB, WING, YUM, & ZNGA.

Action Plan

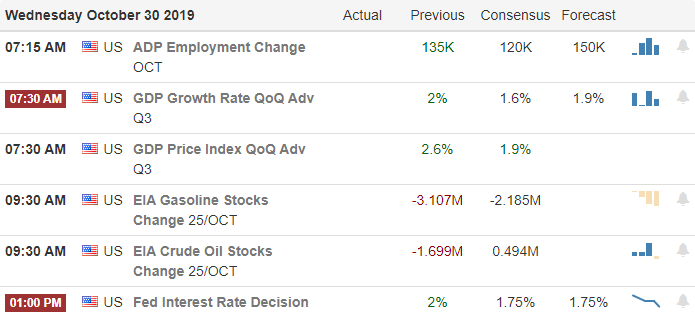

It’s always tough to know with to do on a day so chalked full of potentially market-moving events. First, we have our biggest day of earnings reports so far this quarter with just short of 380 reports. Both AAPL and FB report after the bell today, which means anything is possible Thursday morning, making it a difficult decision on the risk held overnight. Secondly, with a very big day on the economic calendar beginning with ADP numbers, the GDP report, Petroleum Status report, and then at 2:00 PM Eastern the FOMC decision on interest rates followed directly by the Chairman’s press conference.

Fed fund futures suggest a very high likelihood of a rate cut today, which of course, the market always loves. The big question to be answered is will the FOMC hint of more possible cuts in the future or disappoint the market, suggesting they finished. If so, might the market react negatively? It’s anybody’s guess! I would expect some volatility early in the morning session, but would not be at all surprised to see the market become very slow and choppy as we wait for the interest rate decision. Futures were slightly bearish overnight but have recovered to suggest a flat open at the time of writing this report. However, with so much data for the market to digest before the open, anything is possible, and we will have to stay on our toes and remain flexible.

Trade Wisely,

Doug

Comments are closed.