Better than expected jobs numbers, solid earnings, strong consumer spending, and an accommodative FOMC continues to melt-up the indexes this morning. Tariffs and trade seem to no longer be of concern as the bulls continue to stretch the indexes higher breaking records along the way. However, I want to offer up a word of caution as we gap to new highs this morning. The SPY and QQQ are stretched a long way from their 50-day averages and remember that sometimes gap up opens produce pop and drop patterns. Be careful not to chase, keeping in mind gap up opens is a great time to take some profits.

Overnight Asian markets closed mixed but mostly higher on optimism of a huge Asian Pacific trade deal expected in 2020. European markets are bullish across the board this morning on renewed trade optimism, and the US Futures are in full-on beast mode ahead of earnings and economic reports. Currently the Dow is expected to gap more than 125 points breaking above price resistance to make a new record high at the open.

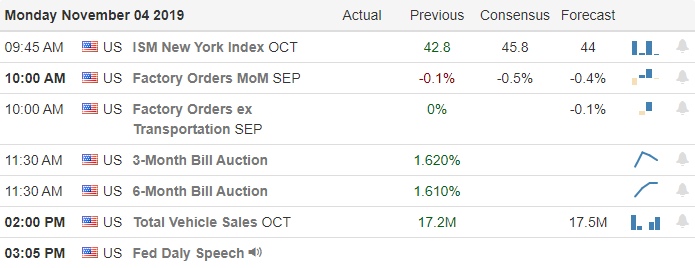

On the Calendar

We have a massive week of earnings reports this week, with more than 1600 companies reporting. We get started with more than 200 reports today. Notable reports include UBER, AAN, AWR, APLE, WTR, BHC, CC, CDE, ED, RACE, FE, FRPT, GCI, GRPN, HTZ, MAR, MOS, PXD, PBPB, PRU, O, SHAK, S, SYY, & UAA.

Action Plan

The bulls are in beast mode this morning, and the DIA is likely to join its compadres the SPY and QQQ with a new record breakout as long as it doesn’t stumble before the open. As always I will be watching the open closely, but I will not chase the move with the fear of missing out. Instead, I will focus on the price action making sure buyers will show up to support the gap. Big gap up opens can often produce the dreaded pop and drop pattern, so waiting a few minutes won’t hurt anything and may, in fact, provide an opportunity to take some profits. Gaps are gifts!

Friday’s big rally pushed the T2122 indicator near the bearish reversal zone, and this morning’s gap could stretch the indexes right to the top. One thing that gives me a little pause this morning is that BA is looking to gap up even-through weekend news suggests there could be further delays getting the 737 Max back in the air. However, if earning’s continue to roll in strong and the Factory Orders number is good, we could rip higher squeezing out any remaining short-hands. We have had much better earnings than the market expected with strong consumer buying, and an accommodative FOMC the melt-up could easily continue to stretch the indexes higher.

Trade Wisely,

Doug

Comments are closed.