Lower rates and strong earnings reports inspire the bulls to reach out to new record highs in the SPY. Not only that, but both the SPY and QQQ successfully tested and held the support level of the recent breakout. Well done, bulls! Unfortunately, trade war uncertainty once again raised its ugly head during the night, tempering the bullish sentiment as we head toward today’s open that chalked full of enough earnings and economic calendar events to keep everyone guessing, what comes next?

Asian markets closed mixed but mostly higher after reporting their 6th straight manufacturing decline. European markets see only red this morning with rising doubts about the trade war deal. US Futures have slightly improved this morning from overnight lows but continue to point to a modestly bearish open due to trade war concerns. With the Employment Situation and ISM number on Friday, we should not be surprised to see a choppy day of price action as we wait.

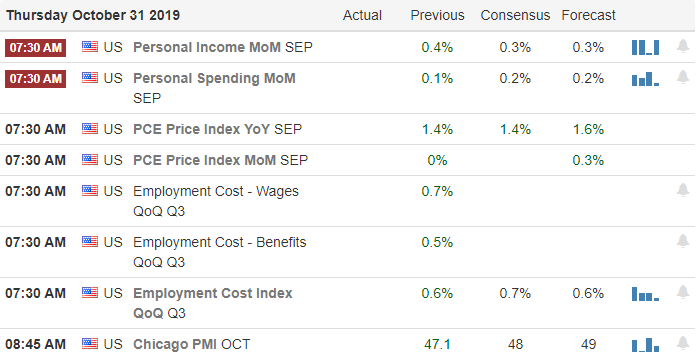

On the Calendar

The Thursday earnings calendar is a busy one, with nearly 340 companies expected to report results. Notable reports include MO, AMCX, AMT, ADM, CAR, AVP, BLL, APRN, BMY, CHD, CI, CLX, COR, DNKN, DD, EL, EXC, FCAU, FTNT, GLPI, HFC, IP, IRM, KHC, MELI, NNN, RMAX, SNY, SIRI, STOR, TRI, W, WU, WWE, XYL, and YETI.

Action Plan

We have and interesting set of circumstances facing the market this morning. A rate cut that the market wanted, good earnings reports yesterday, and another big day of them today, but the futures are reacting negatively to downbeat comments on trade from China. China was in the news for a second time last night, stating their manufacturing activity shrank for the 6th straight month due to trade war pressures. Congress is expected to vote today on the rules they will follow in the impeachment process, which is likely to be a distracting and firey side show of political gamesmanship.

Technically speaking, yesterdays price action turned out to be very bullish with the SPY and QQQ testing and proving to hold breakout support. Although the DIA still has a lot of work to do before it reaches new record highs, the bulls showed strength holding the downtrend breakout as support after a quick test. Trade war worries add another wrinkle in an already busy day full of earnings events and possible market-moving economic reports. If that’s not enough to keep the market guessing, remember, we still have the Employment Situation, and the ISM reports on Friday morning. Waiting on those could produce some choppy price action after the morning rush as we wait.

Trade Wisley,

Doug

Comments are closed.