Bulls Held Strong

Though the Dow continued to pull back yesterday, the bulls held strong defending recent lows and prevented a lower low’s technical damage. Though the S&P is now suggesting that Evergrande is likely to default is suspect we will ignore the possible U.S. impacts in favor of new record highs in the Nasdaq and SP-500. However, this push higher seems to be struggling with momentum, so make sure you have a plan if the tide starts to go out.

Overnight Asian markets were mostly lower, led by tech shares and developer concerns, as Hong Kong fell 1.29%. European markets trade flat and mixed, worrying about the implications of the slipping consumer sentiment due to inflation impacts. However, U.S. futures don’t appear to have any concerns pointing to a bullish open and possible new record high.

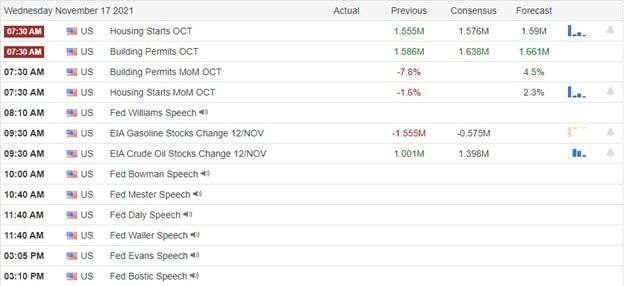

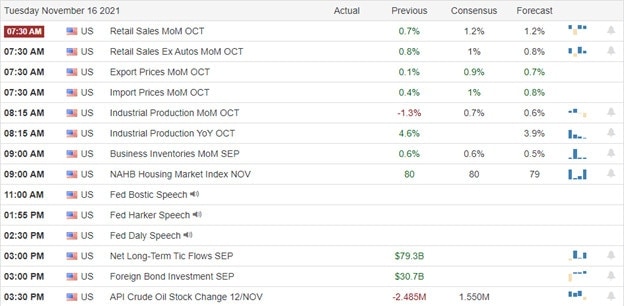

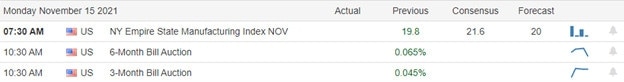

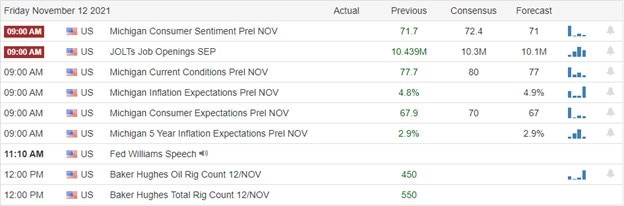

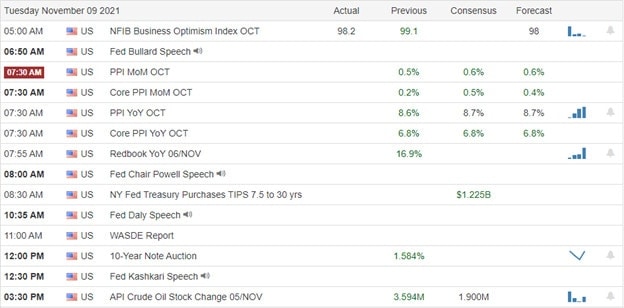

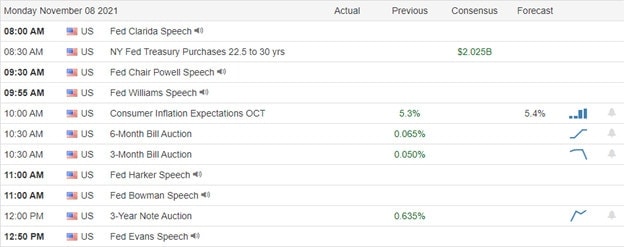

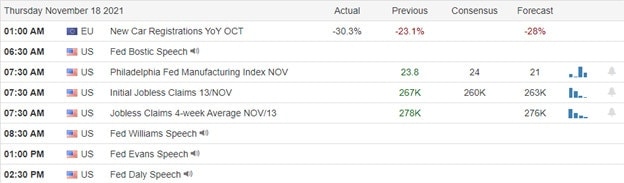

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 35 companies listed with a few unconfirmed. Notable reports include BABA, AMAT, ATKR, AHM, BECN, BRBR, BJ, CAL, CSIQ, FTCH, HP, INTU, JD, KSS, M, NUAN, PANW, WOOF, POST, ROST, VIPS, WWD, & WDAY.

News & Technicals’

Saule Omarova, President Joe Biden’s choice to lead one of the nation’s top bank regulators, is set for a fiery nomination hearing. While Republicans have warned against recommending a candidate whose academic work calls to “end banking as we know it,” skepticism has also come from a Democrat, Sen. Jon Tester. Just one Democratic defection on a committee vote to recommend her to the broader Senate would likely end her nomination to head the Office of the Comptroller of the Currency. “I know that difference between the job of an academic … and the job of a regulator, which is very circumscribed,” Omarova said in an interview Tuesday. N26′s American customers will no longer be able to use its app from Jan. 11, 2022. The Berlin-based fintech said the move aimed at shifting focus to its core European business. It’s a reminder of how difficult it has been for European fintech to expand its services in the U.S. Evergrande default is highly likely, according to the S&P. “We still believe an Evergrande default is highly likely,” S&P Global Rating analysts said in a report Thursday. The firm has lost the capacity to sell new homes, which means its main business model is effectively defunct,” the report said. Treasury Yields pulled back slightly yesterday and continued to relax in early Thursday trading. The 10-year declined to 1.5838%, and the 30-year fell to 1.9713%.

Though we pulled back in Dow, creating lower high patterns, the bulls held strong preventing a lower low from occurring and avoiding technical damage. Unfortunately, the Russell was not so lucky with the price creating a lower low while holding substantial price support and the bullish trend. Though there may be some reason for uncertainty in the industrials, the tech sector continues to surge within striking distance of a new record high and lifting the SP-500 as well. That said, overall market momentum is slowing as inflation impacts curtail consumer activities. With jobless claims and manufacturing data on the horizon, the bulls are back on the job in the premarket.

Trade Wisely,

Doug