With the uncertainty of retail sales numbers out this morning, the market struggled to find direction yesterday. The pop and drop pattern left behind would raise the possibility of a lower high at resistance if the bears were to happen to find some inspiration. However, with analysts suggesting a solid retail sales number is likely yesterday may prove only to be a rest before stretching to new highs. That said, anything is possible, and with earnings, inspiration to fuel the bulls market momentum could suffer.

Asian markets traded mixed during the night as the investors reacted to Biden-Xi talks with China selling slightly and Hong Kong surged higher. Across the pond, European markets sport modest gains across the board. U.S. futures began the morning in the red, but the bulls went to work pumping the premarket, which has become all too typical of late. Of course, anything is possible with the dollar showing strength, so buckle up the ride is about to begin.

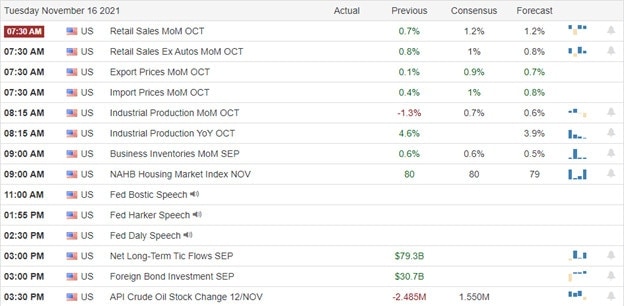

Economic Calendar

Earnings Calendar

We have a much lighter day on the earnings calendar with just 44 companies listed, and several are unconfirmed. Notable reports include HD, ARMK, DLB, DAVA, AQUA, JMIA, LZB, NTES, SE, SBLK, STNE, TDG, VREX, WMT, ZENV, ZEPP.

News & Technicals’

October retail sales are expected to increase by 1.5%, boosted by early holiday shopping and higher gasoline prices. Economists say the report will be essential to examine whether consumers are willing to spend, even as sentiment has weakened. In addition, the report should show that the effects of the Covid delta variant are fading, as parts of the economy are rebounding. Home Depot topped Wall Street’s estimates for its third-quarter earnings and revenue. Consumers were spending more when they visited, raising the average ticket by 12.9% to $82.38. President Joe Biden signed the more than $1 trillion bipartisan infrastructure plan into law Monday. The plan will put $550 billion in new money into transportation, broadband, and utilities. In addition, Biden made a case for Democrats’ $1.75 trillion proposals to invest in the social safety net and climate policy. Finally, Tesla CEO Elon Musk faces a potential tax bill of more than $10 billion on stock options granted in 2012. Musk started exercising the options Monday, exercising $2.5 billion in shares and selling $1.1 billion of those exercised options to pay the taxes. But he continued to sell the additional stock, and it’s likely those sales were unrelated to the stock option exercises he must complete by August. This means future stock sales are likely. Treasury yield fell in early Tuesday trading, with the 10-year slipping to 1.6094% and the 30 pulling back to 1.9790%.

The indexes struggled for direction yesterday, challenged by overhead resistance and facing the uncertainty of retail sales figures coming out before the bell this morning. We will also hear from HD and WMT before the bell, the only likely market-moving earnings reports today. Yesterday’s pop and drop in all four indexes set up possible lower highs, but with economists suggesting a solid retail sales number, it could be nothing more than a rest before reaching out for more new records. However, with the decline in earnings inspiration and seeing a rising dollar, there is a concern of fading momentum and a possible risk-off scenario forming. As a result, a noticeable shift of energy into traditional defensive sector stocks, hinting at a possible rotation toward safety. Stay with the overall trend but never forget how elevated this market has become. A longer-term consolidation or a pullback is not out of the question, so have a plan to protect your capital because it can begin with breakneck speed!

Trade Wisley,

Doug

Comments are closed.