Technical Damage

Though the index charts have taken some technical damage, the DIA and SPY finding the energy to hold at their respective 50-day averages provide hope that a relief rally may soon follow. However, the damage in the QQQ and IWM is much more significant and will require substantial effort by the bulls to reverse the current downtrends and overhead price resistance levels. The elevated VIX suggests we should expect challenging price volatility as the bulls and bears battle for control. Inexperienced traders will likely find this environment very costly due to the speed and range of the point moves, overnight reversals, and whipsaws that are likely to occur.

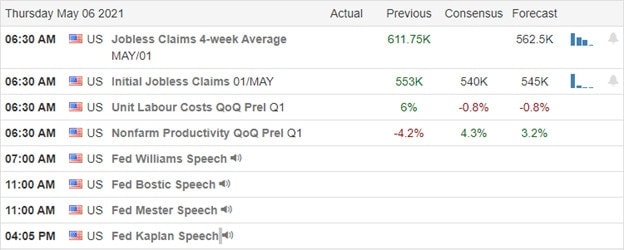

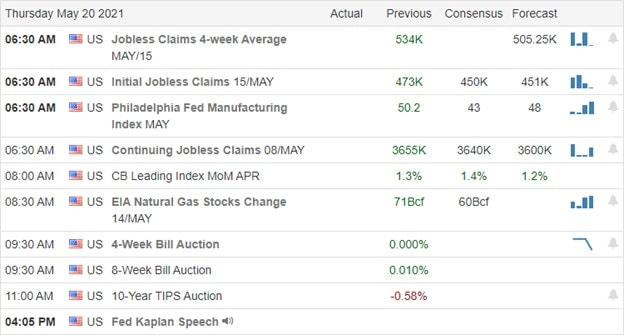

Asin markets traded mixed but mostly lower overnight though Japan’s exports surged in April. European markets are currently green across the board this morning after the Fed talks of tapering. On the other hand, U.S. futures point to a bearish open though will off the overnight lows ahead of Jobless Claims and the Philly Fed numbers.

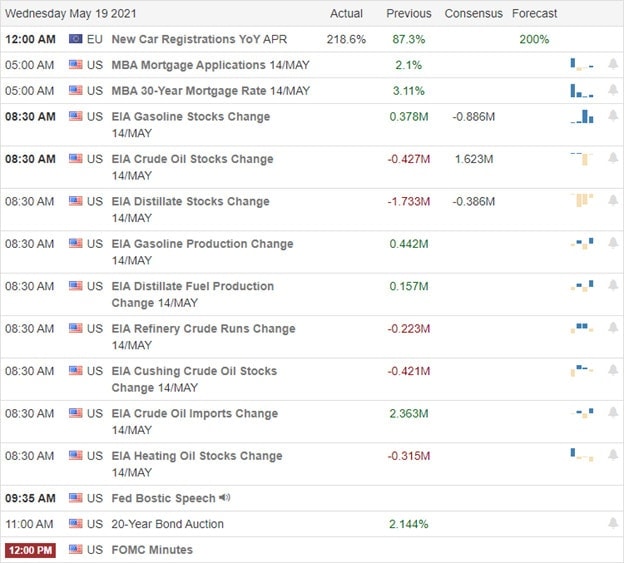

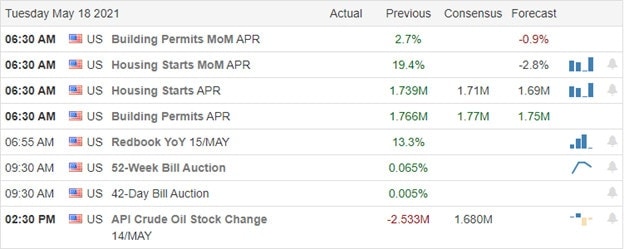

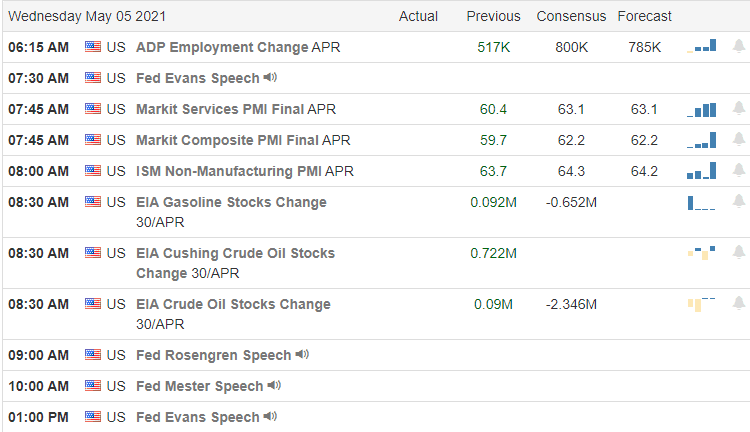

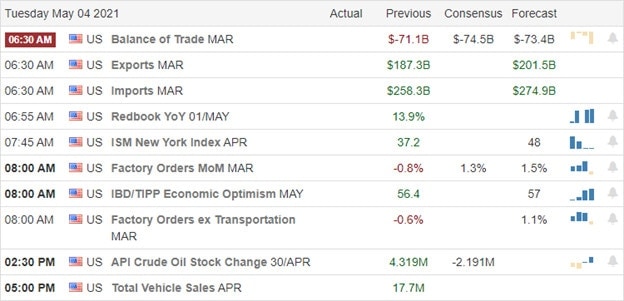

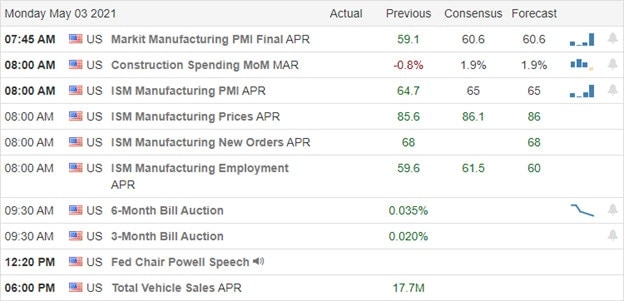

Economic Calendar

Earnings Calendar

Today we have just 39 companies listed on the calendar, but several of them have not confirmed their reports. Notable reports include AMAT, BJ, CSIQ, DECK, HRL, KSS, RL, PANW, & ROST.

News & Technicals’

Facebook is facing some court challenges that could lead to a ban on its EU-U.S. data transfers. Blocking their transatlantic data flow will have profound implications for other U.S. tech giants. Bitcoin plunges 30% and at one point touched 30,000 yesterday, which constitutes a 50% haircut from recent highs. Hamas says it sees a cease-fire possible in the coming days, but this fight has gone on for decades and is unlikely to find a resolution anytime soon. The 10-year Treasury yield dipped this morning to 1.663%, and the 30-year fell to 2.371% after investors digested the FOMC minutes, where there were hints that the committee might begin pulling back on debit purchases.

Yesterday’s sell-off created some technical damage in the index charts, but there was also a few rays of hope, with the DIA and SPY finding at least some temporary support at their 50-day moving averages. Unfortunately, the QQQ and IWM are under this critical psychological level but managed to hold the price supports of last week’s selling. Recovery, however, could be challenging with both technical and price action resistance levels overhead blocking the potential relief rallies. The VIX closed well below its high of the day but remained quite elevated above a 22 handle so expect considerable price action volatility to continue. Experienced day-traders will likely have the upper hand in this environment, while swing traders may find the quick whipsaws and complete overnight reversals very challenging.

Trade Wisely,

Doug