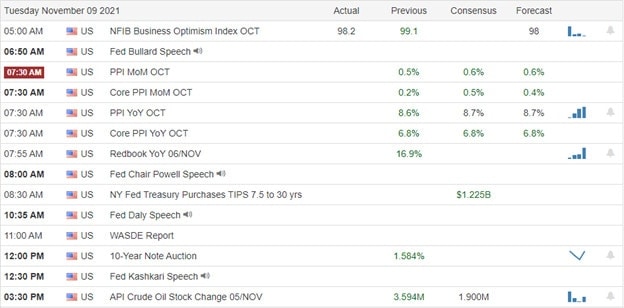

Though we experienced modest pop and drop patterns in the index charts, we still managed closing records across the board. The daily records in the Dow hit its 8th straight day not seen since 1997 even has the VIX rallied. Today we will get a reading on inflation with the Produce Price Index, and consensus is looking for a slight month over month increase. If it were to come in hot, will it wake up the bears, or will it just keep ignoring the impacts on the economy? Stay tuned; we will find out soon.

Overnight Asian markets traded mixed as the real estate price declines are beginning to raise some contagion concerns from the Fed. European markets trade mostly higher, but gains are modest as they keep an eye on the pending inflation data. Finally, with a big day of earnings, PPI, and more Fed speak, U.S. futures suggest a flat open except for the continued push in the Nasdaq.

Economic Calendar

Earnings Calendar

We have a big day on the Tuesday earnings calendar with 250 companies listed, but many of them are small-cap. Notable reports include COIN, ADT, ACB, AXON, BAYRY, BNTX, APRN, ELY, CAH, CCEP, DHI, DASH, EGRX, EBIX, FTEK, GLNG, HAIN, TWNK, IIVI, INO, IGT, JBI, JAZZ, NDUT, MNKD, MCFE, MLCO, NIO, PLTR, PAAS, PRTY, POSH, PUBM, RNG, SGMS, STWD, SYY, U, UPST, WES, WRK, WKHS, & WYNN.

News & Technicals’

The White House on Monday said businesses should move forward with the requirements despite the court-ordered pause. The U.S. Court of Appeals for the 5th Circuit considered one of the most conservative appellate courts in the country, halted the requirements Saturday pending review. In addition, Republican attorneys general in at least 26 states has challenged President Joe Biden’s vaccine and testing requirements in five different U.S. appeals courts. The Biden administration asked the court to lift the pause Monday evening, claiming it could cost dozens or hundreds of lives per day. “Stresses in China’s real estate sector could strain the Chinese financial system, with possible spillovers to the United States,” the Federal Reserve said Monday in its financial stability report, released twice a year. “The nexus of the Fed’s concern is that China’s real estate activity is slowing, but the developers have large debts [and] some of them (like Evergrande) are diversified into other areas of the economy,” said Paul Christopher, U.S.-based head of global market strategy at Wells Fargo Investment Institute. The bulk of the report discussed domestic U.S. financial conditions, and analysts downplayed the significance of the Fed’s comments on China real estate. Treasury yields dipped early this morning, with the 10-year dipping slightly to 1.488% and the 30-year falling to 1.8835%.

Closing records across the board in all for indexes with the Dow hitting its 8th straight daily record in a row which has not been seen since 1997. At the same time, the VIX rallied for the 3rd day while the price action in the indexes largely chopped sideways. The T2122 indicator continues to ring the bell that the indexes trade in a short-term overbought condition, but bulls are having none of it as they continue to push higher. Technically speaking, the odds of consolidation or pullback continue to grow. That said, the relentless buying is unwise to fight, so stay with the trend but have a plan in place because the tumble from these hights would likely be very painful. Today we will get a reading on inflation with the PPI. However, even if the number comes in hot, we may ignore it and keep plowing in new records but ready if it wakes up the bears.

Trade Wisely,

Doug

Comments are closed.