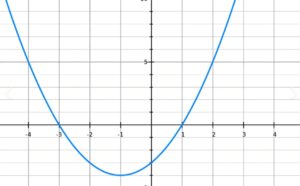

As traders rush to buy tech, it’s hard to ignore that the QQQ chart is going parabolic as we look for another gap up in the QQQ this morning. Analysts expect today’s employment situation number to come in very bullish, so maybe the buying party continues into the weekend. However, carefully plan your risk and remember to take some profits noting that the economic situation in China continues to worsen. Odds of a pullback continue to grow, so don’t be the last the last dollar in the door chasing extended stocks.

Overnight Asian markets mostly sold off with the news of another developer default as their real estate crunch continues. However, European markets show modest gains across the board after the BOE maintained rates but began tapering easy money policies. Ahead of the employment situation report and a lighter day of earnings, the Dow and Sp-500 futures trade muted with the Nasdaq suggesting a gap to new another new record.

Economic Calendar

Earnings Calendar

We get a little break from the breakneck pace of earings this week with just 105 companies listed and a good number of them unconfirmed. Notable reports include AMCX, CGC, D, DKNG, ELAN, FLR, GCI, GT, GRPN, HMC, JCI, DOC, & PNW.

News & Technicals’

Analysts expect the economy to have added 450,000 jobs in October, according to estimates from Dow Jones. That’s up sharply from 194,000 in September. In addition, they see hourly wages rising by 4.9% on a year-over-year basis. That will be a significant number since the market sees inflation and whether it will continue to run hotter than expected. The jobs report is back in focus as a critical input for the Fed, which announced plans to start tapering back its bond purchases this month. That opens the door to potential interest rate hikes next year, economists say. Asad Rehman, a spokesperson for the COP26 coalition, a U.K.-based civil society representing indigenous communities, frontline activists, and grassroots campaigns from the global south, told CNBC that he had been struck by the comparisons between the meeting in Glasgow and previous talks in Copenhagen. The 2009 summit in Denmark’s capital city is widely regarded as a failure, with a deal many countries criticized for falling short of the action needed to tackle the climate crisis. The summit continues after pledging $18 billion to end the use of coal.

The Nasdaq’s surge continues to set records, the chart now going parabolic and looking to gap higher ahead of the employment situation report. However, plan your risk carefully and prepare as we continue to extend because simple logic would suggest the odds of a substantial pullback growing with every tick higher the indexes extend. At some point, we will hit a point of exhaustion, and when that last dollar is in, look a sideways move at a minimum and more likely a strong profit-taking selloff.

Trade Wisely,

Doug

Comments are closed.