Although the index charts have gone parabolic, there is no stopping the bulls from setting records daily. Logic would suggest that the odds of a substantial pullback are growing, so watch carefully for the classic pop and drop possibility as the futures point to a gap up open. That said, it’s also not wise to fight a relentless bull because there is no telling how long it can push higher. However, avoid extended stocks with the fear of missing out and plan your risk carefully because when the bears do show themselves, the move lower could be swift and painful.

Asian markets began the week trading mostly lower, and as energy prices and rapidly declining real estate prices worry traders. European markets trade mixed but mostly lower this morning with muted gains and losses. However, with earnings fanning the fire, U.S. futures show nothing but green, with the Dow pushing for another record open.

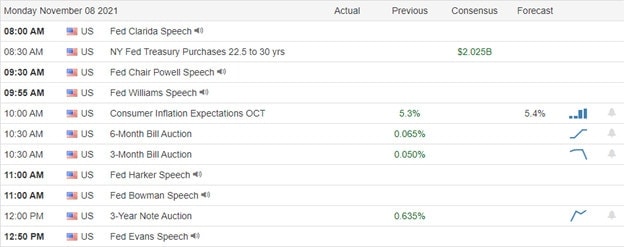

Economic Calendar

Earnings Calendar

To kick off a new trading week, we have 200 companies listed on the earnings calendar. Notable reports include PYPL, DDD, ACAD, CBT, CXW, COTY, FWRG, FTK, FRPT, NVTA, LMND, OCN, PSTL, APTS, RBLX, SDC, TME, TSEM, TTD, TRIP, SPCE, WOW, & ZNGA.

News & Technicals’

Since August, Walmart and Silicon Valley start-up Gatik said that they’d operated two autonomous box trucks, without a safety driver, on a 7-mile loop daily for 12 hours. “Taking the driver out is the holy grail of this technology.” Gatik CEO Gautam Narang, who founded the company in 2017, told CNBC. In a Twitter poll launched Saturday, Musk said: “Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock. Do you support this?” The billionaire gave people the option to vote “Yes” or “No” and pledged to abide by the poll results, whichever way it went. Some 3,519,252 people responded, and 57.9% of them voted for “Yes.” The U.S. on Monday will lift a pandemic travel ban on international visitors from more than 30 countries after 19 months. New rules will replace the ban, requiring international visitors to show proof of vaccination and a recent negative Covid test. Exceptions include travelers under age 18 and those traveling from countries with low vaccine availability. Treasury yields begin the week slightly higher, with the 10-trading up to 1.474% and the 30-year rising to 1.8999% early this morning.

Though the SP-500 current P/E ratio is 99% above the historical average, there is no stopping the bulls at this point. During the 1999 tech bubble, the same ratio hit 132%, and I guess this record-setting market may also want to take that record. The T2122 indicator also indicates a short-term overbought condition, so with the futures gapping to new records, be on guard for the possibility of a pop and drop pattern. That said, avoid fighting a relentless market because there is no way to know when it might finally stop. However, stay focused because, with this extension, the reversal down could be very punishing. Remember, market internals indicate the economy is slowing due to the crushing impacts of inflation. Nationally gas prices are up $1.32 per gallon in just the last 11 months, and I suspect they only go higher as we head into winter. That adds cost to everything we do or buy, robbing consumers of disposable income every day it’s allowed to continue.

Trade Wisely,

Doug

Comments are closed.