Netflix disappointed investors

The substantial point decline yesterday added insult to injury after the bell as Netflix disappointed investors with the substantial decline in subscriber growth. However, consumer staples, utilities, and packaged food-related stocks surged as investors moved to more defensive positions. Technically the QQQ suffered the most damage falling below the price support of the February high. With the sharp NFLX decline, the NASDAQ is vulnerable to more selling as the index seeks price support.

Asian markets had a rough night, with Japan declining another 2%, with Hong Kong not far behind, falling 1.76%. Despite that, the European indexes see green across the board this morning with modest gains. With a big day of earnings and a petroleum number later this morning, U.S. futures have recovered from overnight lows, currently pointing to a flat to a slightly positive open. Prepare for more price volatility as the market reacts to earnings data.

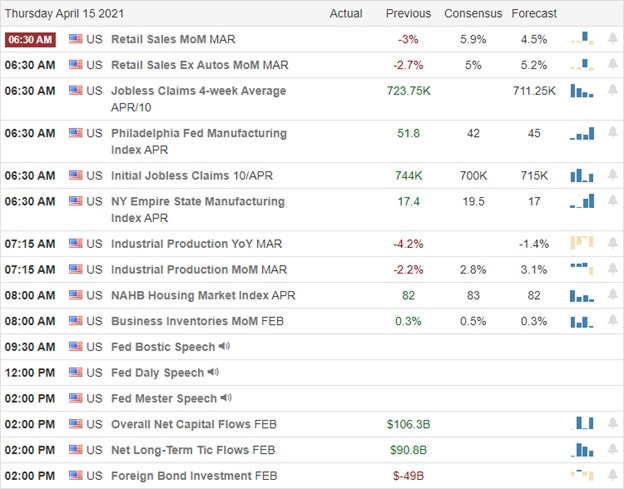

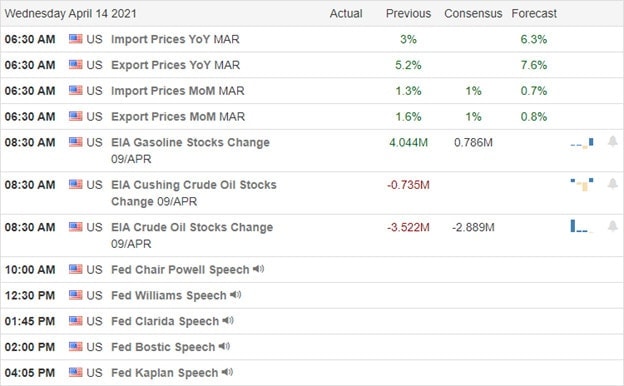

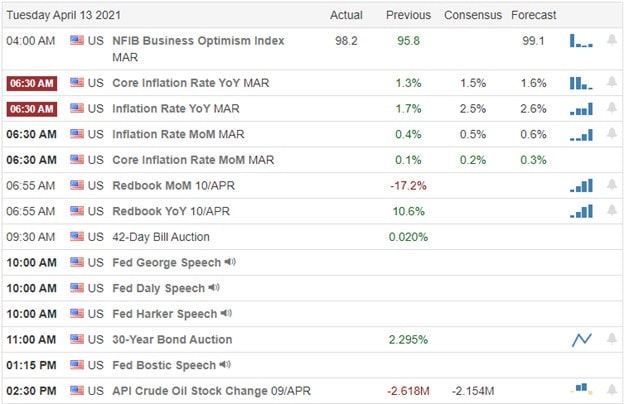

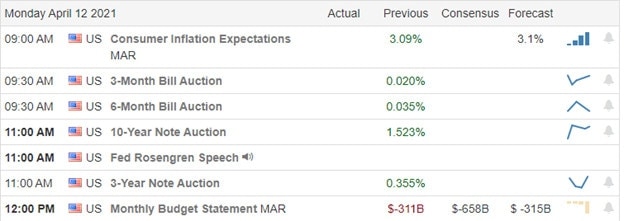

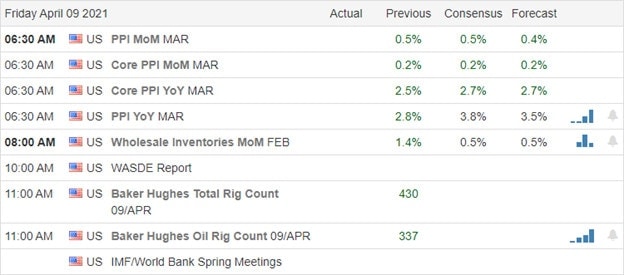

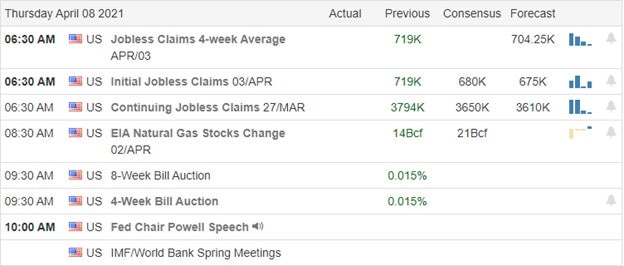

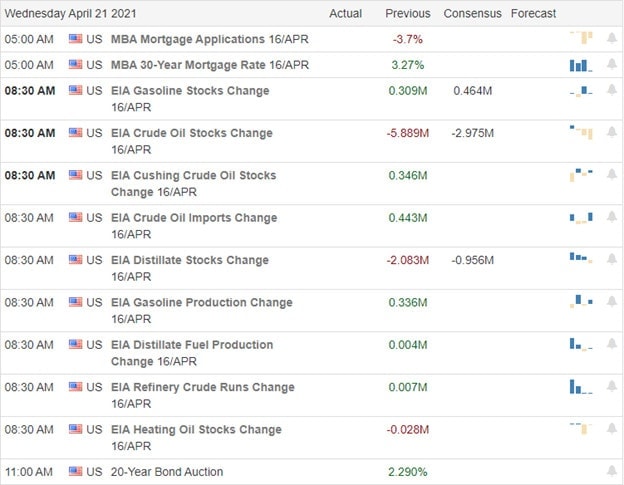

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have 66 companies listed to report, but many are unconfirmed. Notable reports include CMG, ANTM, BKR, CP, CHDN, DFS, EFX, GL, HAL, KMI, LRCX, LVS, LAD, NDAQ, NEE, NEP, RHI, RCI, SNBR, VZ, & WHR.

News & Technicals’

After the bell yesterday, Netflix disappointed investors as subscriber growth declined sharply, and adding insult to injury, the company projects that next quarter the trend is likely to continue. A challenging beginning to the big tech reports. After a record of 109 SPAC (Special Purpose Acquisition Company) deals in March, the SEC shut off the pipeline with new accounting guidance. SPAC’s warrants will now receive the classification of liabilities instead of equity instruments. Amazon plans to connect your credit card to a palm print scan payment system in their Whole Foods stores. According to the company, they have already signed up thousands of users to the new technology. The debut of new Apple tech upgrades unimpressed investors yesterday, leaving behind a bearish engulfing pattern on the chart.

Although yesterday’s selling looks relatively benign on the index charts, I suspect it was painful for those not prepared for the substantial point decline. However, as we head into another big day of earnings data, the premarket futures try to put on a brave face recovering from overnight lows despite the big NFLX disappointment. Energy and financial sectors continued to show weakness yesterday as consumer staple and utilities sector stocks surged higher. Also, keep an eye on packaged food and farm-related commodities as California drought concerns and inflation worries push the stocks upward. With only petroleum numbers later this morning on the economic calendar, be prepared for the typically wild earnings price volatility as the market reacts.

Trade Wisely,

Doug