Drinking from a fire-hose of data.

Take a deep breath and be prepared for volatility this week as the market is forced to drink for a fire-hose of data. With more than 1300 companies reporting and an economic calendar full of potential market-moving reports including the FOMC Announcement on Wednesday and the Employment Situation number on Friday. Then to keep in interesting let’s raise the hope of a US/China in the news first thing Monday morning.

With so much fo the market to try and digest traders should be prepared for volatile price action particularly on Wednesday afternoon if the FOMC decides to become a bit more hawkish in light of the stronger than expected US economic numbers. The DIA, SPY and QQQ continue to maintain strong uptrends but ahead of all this data it’s impossible to know how the market will react. Plan your risk carefully and be prepared for the possibility of challenging price action as the market gulps down this fire-hose of data.

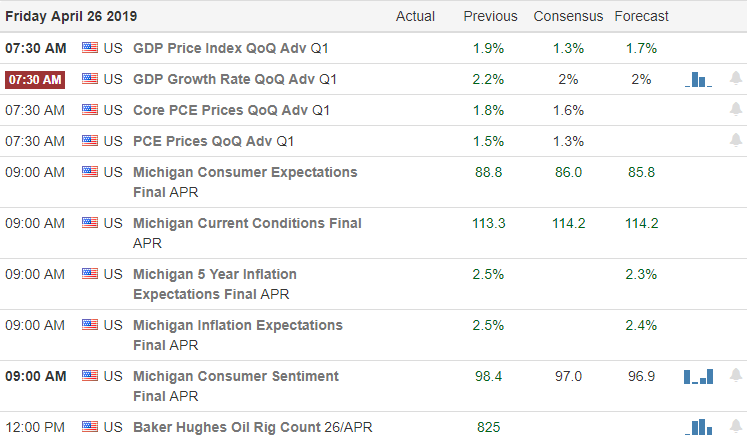

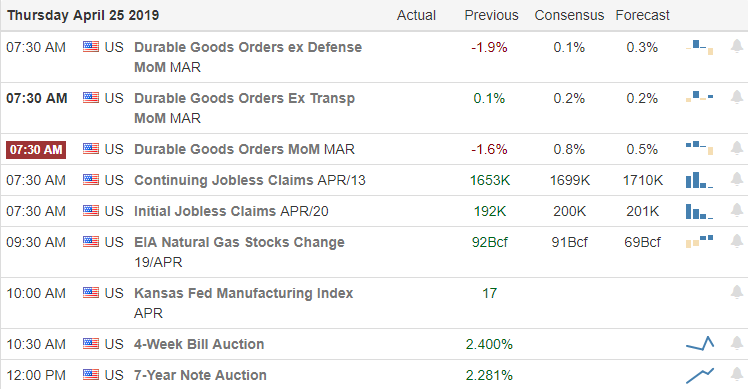

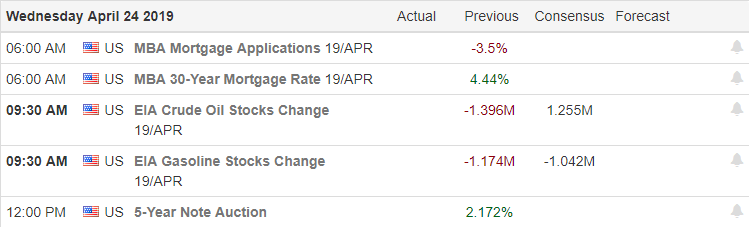

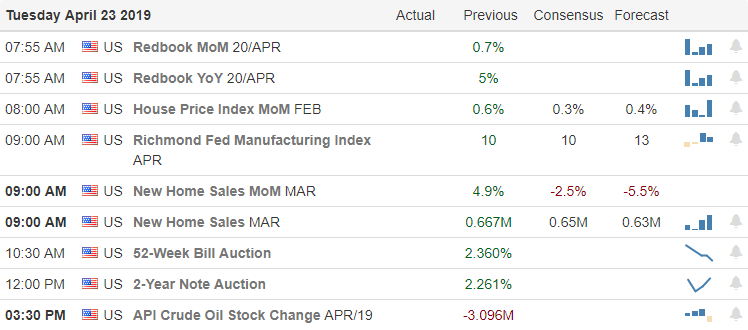

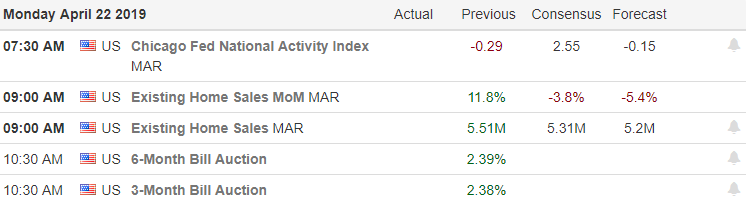

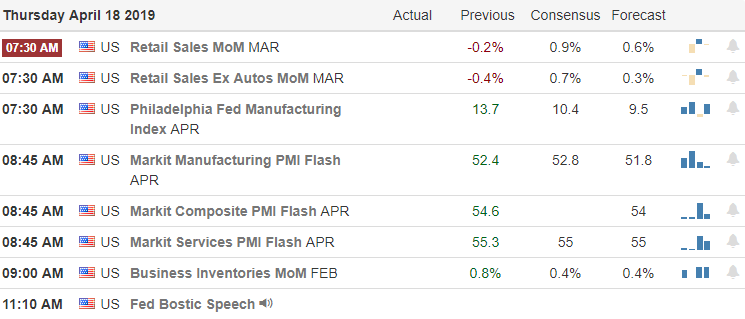

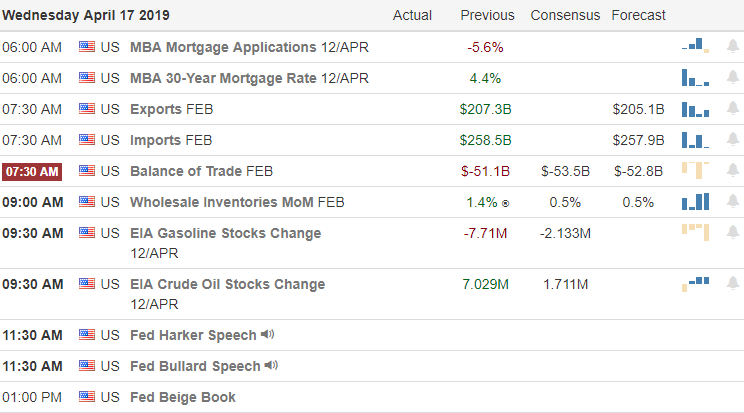

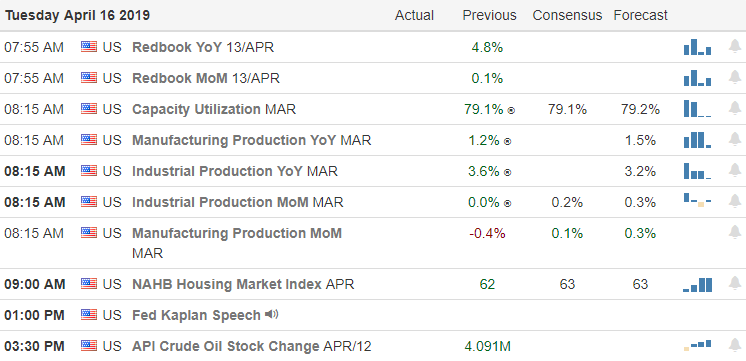

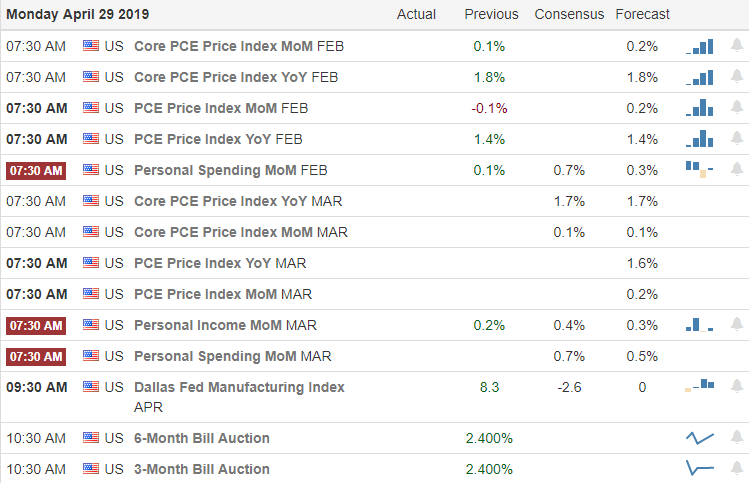

On the Calendar

We kick off a big week of earings with nearly 160 companies reporting today. Some of the notables today, AKS, AMX CYOU, SNP, CHA, CTB, EPR, LEG, GOOGL, L, MGM, NUSA, NPXI, PTR, THC, RIG, WDC & YUMC.

Action Plan

If you were planning a set of market conditions to create potential volatility and make it very very challenging to trade you would be hard-pressed to top the conditions set before us this week! Not only do we have a massive week of earnings reports we also have an earnings calendar heavy laden with market-moving reports. Toss in the FOMC where the strong economic numbers that could have the Fed speaking a bit more hawkish and for good measure raise the hopefulness of US/China trade deal in the news.

Asian markets closed mostly lower overnight with Japan closed for a 10-day holiday. European markets are slightly lower across the board this morning as it reacts to weak euro-zone data once again raising fears of a slowing global economy. As I write this US Futures are mixed and mostly lower as we wait for fresh earnings reports and the Personal Income and Outlay report at 8:30 AM Eastern. The trends in the DIA, SPT and QQQ remain strong but be prepared for considerable volatility this week with the possibility of large morning gaps and intra-day reversals as the market drinks from a fire-hose of data.

Trade Wisely,

Doug